Latest News

- Ascent Solar’s quarterly revenue grows, from $0 to $16k

- Sidus Space 2025 1Q shows Lizziesat revenue not as advertised

- AAC Clyde 2-quarter hot streak ends in 2025 Q1

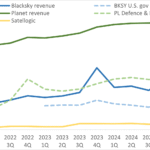

- NRO budget cut and possible impact on Blacksky, Planet Labs, and Satellogic

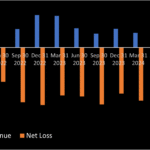

- Satellogic 1Q 2025 – no revenue growth (again), satellite constellation still shrinking

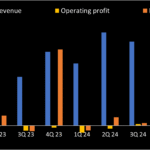

- Intuitive Machines 1Q results: OMES III lag pulls down revenue; new projects presented

- Satrec 2025 first quarter financial performance

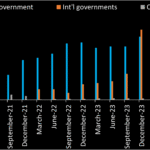

- Blacksky 2025 Q1 revenue flat, U.S. and Israel government sales drop, India saves the quarter

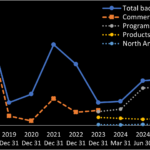

- GOMSpace Q1 profitable on record Q1 revenue; North American growth lags

- iQPS revenue drops on faulty satellites; ups cost of replacements

This site

When the space SPAC frenzy happened in real time, many saw the financial targets pushed onto investors by newly minted public companies as a “space case,” not base case. Here an insignificant employee working in the space industry in Japan offers research, analysis, and perspective. This is a hobby. Please ignore everything.

Approximately 40 public space companies trade on nine exchanges on three continents. Space stocks categorized by sector and listed here. Pages are presently up and tracking news for all public earth observation companies Planet, Blacksky, Satrec, Satellogic, ISI, iQPS and Synspective. Moving towards satellite manufactures (Terran Orbital may they RIP and MDA), but GomSpace and AAC Clyde already up. For satellite service companies, Sidus Space is live, to be followed later by Spire. Space solar panel provider Ascent Solar, optical link manufacture Mynaric and antenna ASIC manufacturer SatixFy are up. And so is lunar service company turned oribtal transfer provider Intuitive Machines.

As has been well-reported, most space SPACs failed to deliver on initial financial projections post-IPO. Keeping track of projections hit and missed by each company and grading companies here.

And finally also tracking CEO performance in terms of shareholder value created, and lost. This list will grow to include all public space CEOs. And a RIP list to follow later for prior space CEOs who were fired, stepped aside, retired, or went private.

Some will make money from investing in space stocks (i.e. ASTS). However there have been many more losers than winners. If you ever browse Stocktwits or Reddit, you have seen posts of people who already incurred some substantial losses. More will loose again in the future. If you invest in any stock, especially in the commercial space industry, be careful. Make decisions after consultation with an investment professional. And disregard everything posted on this site.

Upcoming additions and planned changes

- Fix chron to make stock API data automatically update (who knows how to do this??)

- Make the tables sortable (need to learn to code that)

- Update SAR information on Earth Observation page

- Pages with supporting data forming the basis for CEO value created

- Make RIP page for failed public space companies (Astra, Terran Orbital, NewSat, Sky & Space) and successful exits (Maxar)

- Add “Avio” (and about nine other companies) to the list of space stock companies

- Maybe eventually a comments/discussion for each stock if anyone actually visits this site

Please note this

My background is physics and engineering, not finance. I work for company with decades of space heritage and through participation at industry conferences have seen all sorts of new companies pitching their business. Many new companies don’t seem to last. If you plan to invest stocks or any other financial product, don’t make investments based on random sites on the internet. Do your own research and seek advice from a financial advisor.