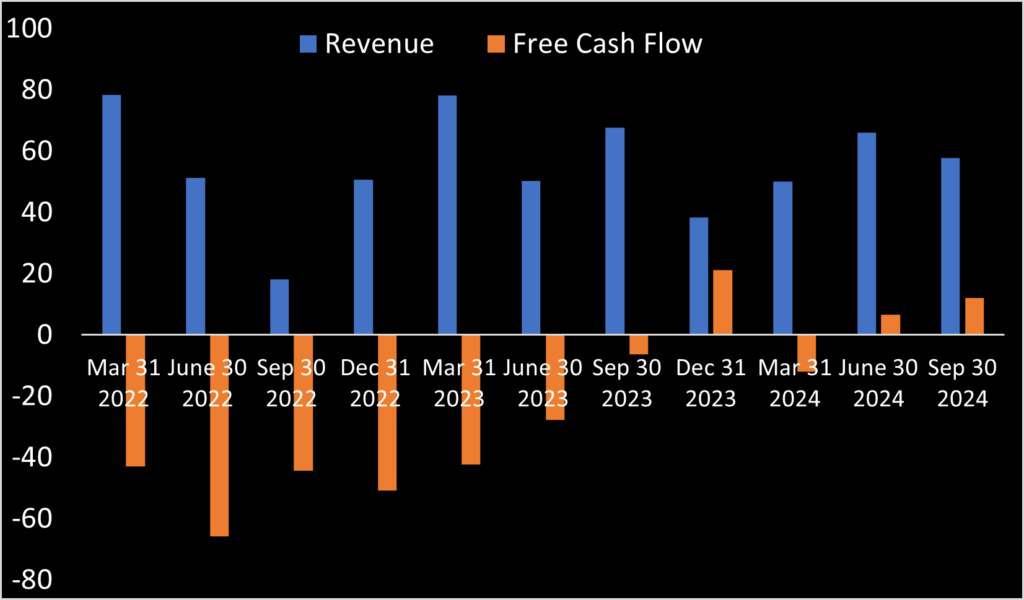

GOMSpace’s just released 2024 third quarter financial results indicate CEO Carsten Drachmann’s business turnaround strategy is on track. Over the past three years, quarterly revenue remains relatively flat, but free cashflow has continuously, although slightly irregularly, tracked upward. This suggests Drachmann’s focus on dumping unprofitable projects is seeding positive free cashflow. (What a surprise, right?) GOMspace has long forecasted reach positive free cashflow in 2024 2H. Now GOMspace apparently also specifically forecasts that 4Q will additional be a quarter with positive free cashflow. Specifically, GOMspace published, “we expect to receive specific new orders, which will contribute to the positive cash flow in the fourth quarter.”

Investors want GOMspace increasing sales to North American (i.e. USA). GOMspace saw 3.6 MSEK (~$340k) revenue from North America in Q3. This is down from 10.9 MSEK (~$1.0m) collected over Q1 and Q2. Order intake also dropped from 9.0 MSEK (~$850k) in 1H 2024 to 2.4 MSEK (~$225k) in Q3. The U.S. remains the largest satellite market and GOMspace’s difficulty finding traction there causes concern as to why. Still, upside remains for GOMX stock should GOMspace management figure it out.

Most important for the stock, GOMspace’s Indonesia contract status remains unchanged. The anticipated closing of this contract is supporting GOMX’s current stock price. If the project falls through, so likely will GOMX’s share price. But CEO Drachmann wrote to investors in the 3Q statement, “I expect that the Indonesian government will execute on this in due time.”

GOMX stock presently trades near its lowest value since the December 2023 jump after announcement of the Indonesia contract.