AAC Clyde Space (STO: AAC) reported third quarter results which certainly pleased its active shareholder base. AAC Clyde in Q2 reported supply chain issues had hampered revenue. At the time CEO Luis Gomes stated orders did not cancel but instead pushed to the right. And push to the right they did. AAC Clyde in Q3 achieved record sales, delivering SEK 84.8m of revenue, YoY increase of a 51.1% . Operating cashflow and, for the first time, EBIT also was positive. AAC Clyde stock jumped +31% in the two trading days following Q3 announcement. The main negative was backlog slightly shrunk, suggesting AAC Clyde is fulfilling orders faster that its sales team closes new ones. Here we break it down.

AAC’s license deal with its unnamed customer (who we think is York Space Systems) contributed SEK 19.5m towards 3Q revenue. So without this licensing income, 3Q EBITDA would have flipped from +SEK 17.5m to SEK -2.0m. The positive case for AAC Clyde stock articulated on this site bases on York Space continuing to win SDA satellite contracts and AAC Clyde continuing licensing its power systems to York for those satellites. To this regard, CEO Gomes wrote to shareholders in his Q3 note that licensing is “a model of business that we see as a potential additional revenue stream for the future.” Licensing revenue is essentially zero overhead. Thus future license payments, if and when received, should contribute extremely favorably to AAC Clyde reaching profitability.

Year-to-date revenue now stands at SEK 209.8m. CEO Gomes in his 3Q note to shareholders reiterated prior guidance: 2024 yearly revenue between SEK 350m and SEK 400m. Thus investors should ready themselves for a potentially blowout forth quarter. To meet revenue projections, AAC Clyde must post >140m SEK in 4Q revenue. Such record-breaking quarterly revenue may certainly push the stock even higher, especially if positive cashflow continues. However as cautioned above, such large revenue will eat into backlog, pressuring AAC’s sales team to keep closing more orders.

AAC Clyde retroactively recategorizes segment costs and backlog, but not revenue (?!)

Two points of sketchiness from AAC Clyde’s third quarter report cannot go without highlighting. First, AAC Clyde readjusted costs allocated to two of its market segment in Q1 and Q2. This resulted in Data-as-a-Service (DaaS) segment margins cumulatively decreasing across Q1 and Q1. AAC conversely adjusted Products segment margins cumulatively upward. AAC Clyde has long represented DaaS margins offer highest margins. However with this adjustment (restatement?), DaaS margins are now lower. AAC Clyde management used high DaaS margins as a selling point for the recent rights option raise capital for its xSPANCION project. Even more concerning is AAC Clyde provided no explanation why they retroactively reallocated costs to different segments, causing restatement of segment margins.

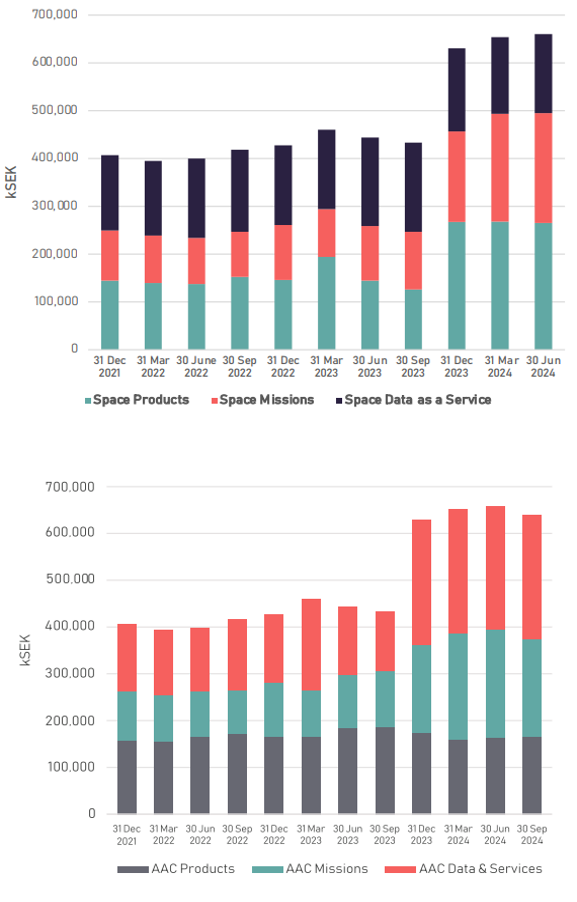

Second and even more concerning, AAC Clyde retroactively changed the composition of its historical backlog. AAC Clyde apparently did this without mention or note to shareholders drawing this fact out. Close observation shows that starting largely in 1Q 2023, backlog that was previously categorized in the AAC Products segment AAC Clyde now retroactively recategorized into the Data & Services segment (previously called Data-as-a -Service). The magnitude of this retroactive backlog recategorization becomes more substantial in 4Q 2023 to 2Q 2024. However, top level, total backlog appears unchanged.

The implication of AAC Clyde changing the value of its segmented backlog relates to investors ability to identify AAC’s growth in high-margin segments. Previously investors hoped AAC Clyde could drive towards DaaS segment growth since it presents the highest margins. Space Products (now called “AAC Products”) had lowed margins. But now it appears backlog AAC Clyde previously categorized in low-margin Space Products is now categorized in Data & Services (formerly DaaS). Does this mean investors should anticipate lower margins in the Data & Services segment, since Products segment backlog has moved into it? It seems that way.

Finally, the retroactive adjustment of backlog by segment appears to go back as far as 2Q 2022. If the backlog composition is now being restated as of 2Q 2022, one would expect the revenue by segment posted after Q2 2022 to also require updating/restating. But AAC Clyde only restated reporting for segment costs in Q1 and Q2 2024. Revenue by segment remained same. This is fishy.🚩 AAC Clyde retroactively adjusting historical backlog by segment without retroactively adjusting segmented revenue suggests something is off. Hopefully someone can get to the bottom of this.

New investor relations (IR) head

And, as already announced, AAC Clyde Space hired of a new head of investor relations – Hakan Tribell. Whereas CEO Gomes is fantastic at engaging AAC Clyde’s shareholders regularly and candidly, AAC’s IR has been wanting. Prior IR staff (as we reported here) have blown off and ignored investor questions, and even apparently been oblivions of CEO Gomes’s prior public statements. We will watch if Tribell can offer improvement. He could start by communicating to investors why AAC Clyde retroactively adjusted segment EBITDA and backlog numbers.