Five satellite earth observation companies trade publicly: Planet Labs (NYSE: PL), Blacksky (NYSE: BKSY), Satellogic (NASDAQ: SATL), Satrec (KOSDAQ: 099320), and ImageSat (TLV: ISI). Yes, Maxar, the biggest player in this sector, operates privately. And Airbus, albeit loosing two satellites at launch last year, is Europe’s biggest company in this sector and is part of a conglomerate. However we set both aside and compare arguably five of the seven biggest companies in the sector.

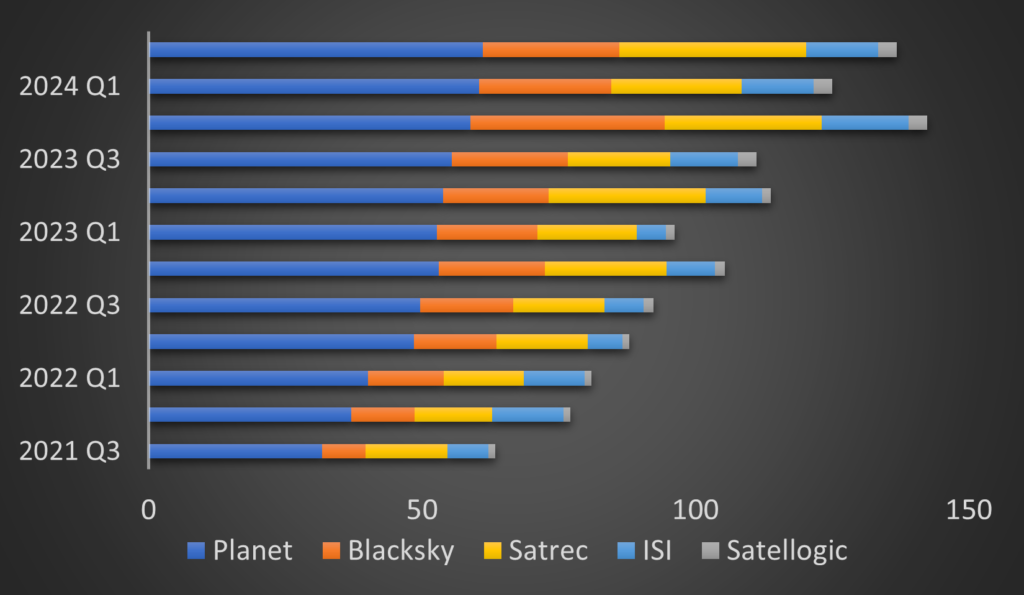

We compile and compare revenue for each public company by quarter over the past three years. Note just three points: First, Planet’s fiscal calendar is one month shifted – their first quarter ends April 30th, as a opposed to March 31nd. Second, Satellogic presents sales semiannually. We divide semiannual sales in half attributing half to each composite quarter. Finally third, ISI Q2 revenue is not posted on its website yet, so Q1 revenue was re-used as placeholder.

First, whereas each company competes in the satellite earth imagery sector, each employs different strategies. Planet and Blacksky operate satellites and sell imagery along with data and analytics. Blacksky also now sells satellites to customers directly who seek to autonomously run their own constellation. Satellogic operates satellites and predominately sells raw imagery and, like Blacksky, also sells satellites to India. Satrec and ISI, the Old Space players, predominately sell higher spec satellites to government customers. However each Satrec and ISI operate their own satellites from which they sell imagery and analytics.

Plotting each company’s revenue shows the five-public-company earth imagery market has grown significantly over the past three years. In 3Q 2021, these five company’s revenue totaled $63.4m. This grew to $136.8m in 2Q of this year.

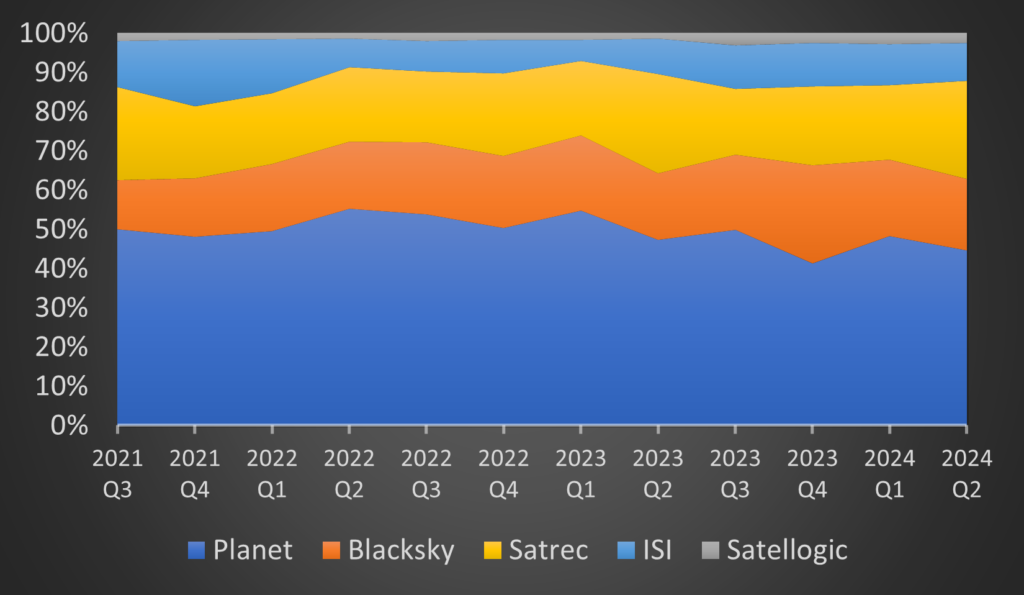

However, as may be of interest to investors, some companies are growing faster than others. According to the data, Blacksky comparatively is growing fastest. Averaging Q3 and Q4 of 2021 and comparing with the average of Q1 and Q2 2024 shows Planet’s market share shrunk from 49% to 46%. ImageSat also shrunk from 14% market share in 2021 to 10% now. Satellogic went from 2% to 3% and Satrec went from 21% to 22%. But the data shows Blacksky is the real winner capturing the most new business. Blacksky held 14% of market share during the second half of 2021. But outpaced growth led Blacksky to holding 19% in the 1st half of 2024.

Blacksky’s sales strategies over the past three years have clearly been working better than its public-company peers. Blacksky shareholders has endured severe losses after Blacksky drained its IPO proceeds while failing to hit its IPO business plan. If Blacksky can leverage its best-in-sector growth into profitability, the future will undoubtably be much brighter. However, to-date Blacksky’s financials still are yet to suggest future profitability (or even positive cashflow) is on the way.