Blacksky (NYSE: BKSY) reported 2024 Q4 and full year financial results. Highlights include:

- 2024 revenue totaled $102.1 million, just meeting the absolute lowest of management’s prior guidance range ($102 to $118 million);

- Operating loss shrunk mildly from -$56.0 million to -$44.2 million;

- Debt grew to $107.6 million, approaching Blacksky’s all time high;

- 2024 revenue grew just 8%, but management now forecasts 22%-39% growth in 2025; and

- Adjusted 2024 EBITDA grew from -$1m in 2023 to $11.6m for 2024, suggesting Blacksky may be on track to operate profitably.

But ultimately low revenue in 4Q disappointed. Blacksky stock dropped 24% as a result.

Blacksky has not released its full 2024 annual report, but examination of the information reported so far reveals some insights about revenue. First, Blacksky again changed its segmented revenue categories. For reasons unclear, Imagery and Software Analytical Services which used to be separate segments, are now one. Similarly Blacksky now combined Professional and Engineering as one segment. If there’s a trend, Professional & Engineering revenue is growing faster than Imagery and Software Analytics revenue. In other words, Blacksky’s revenue from core business is not leading growth.

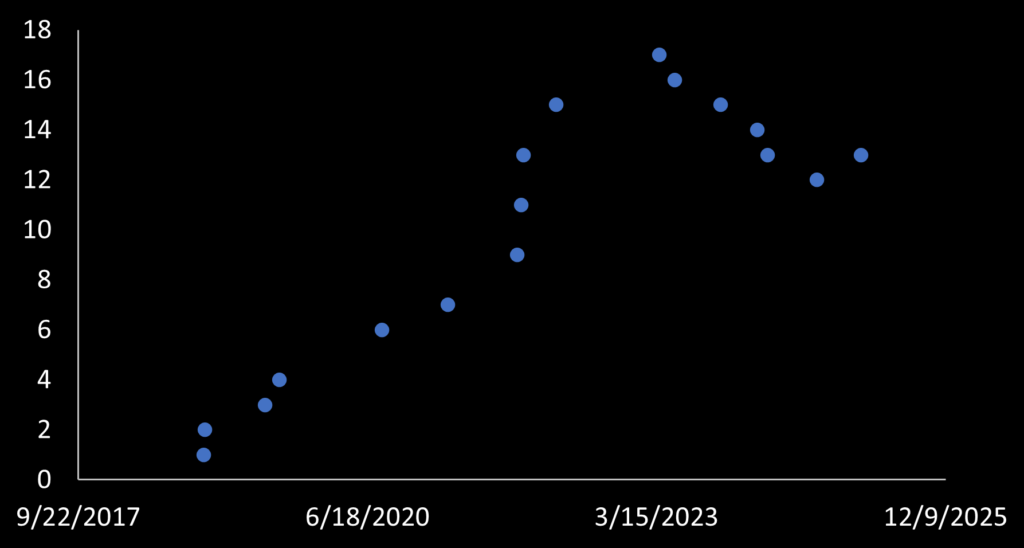

Although not mentioned in the report, Blacksky’s satellite constellation is aging. Their satellites have a three year design life. A year ago, three of Blacksky’s then 14 satellites were more than three years old. Presently nine of Blacksky’s 13 satellites exceed the three year design life. Blacksky is well attune to this. Their 2024 financial releases notes $60-$70 million in planned 2025 capital expenditures, primary related to Gen-3 satellite production and launches. However, any delays likely could risk Imagery & Software Analytical Services revenue decreasing.

On Blacksky’s February 6th management conference call, CEO Brian O’Toole projected Blacksky will launch six Gen-3 satellites in 2025. Thus the majority of aging satellites should be replaced this year.

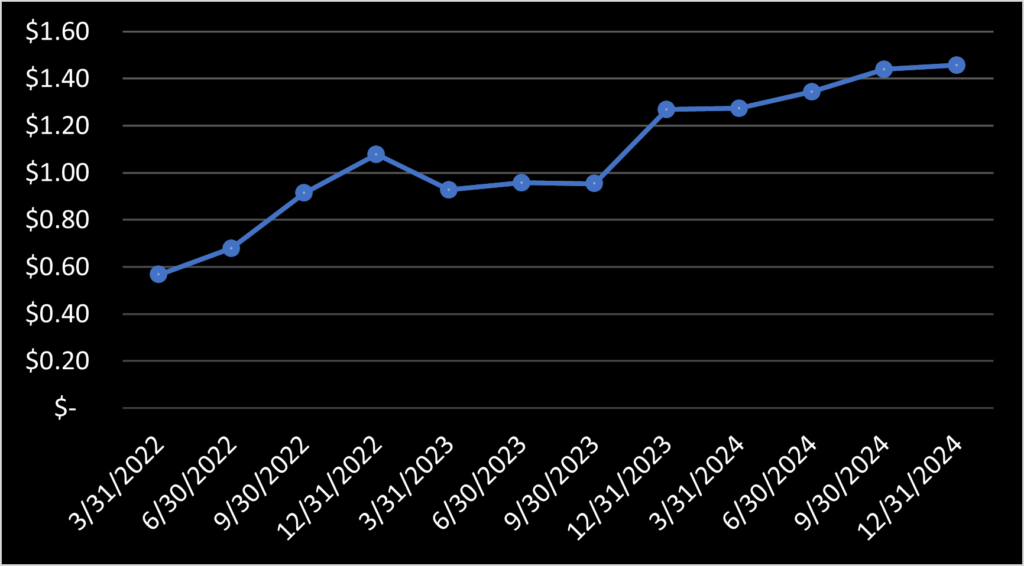

The ratio of Imagery and Software Analytical Services revenue to Blacksky’s quarter-ending constellation size provides a rough value of revenue-per-satellite. Plotting by quarter shows Blacksky’s revenue per satellite has more than doubled over the 2.5 years. Whether upgraded Gen-3 satellites with better resolution increase this metric further will be something we look for in the future.

CEO O’Toole’s positive response to a question concerning whether Gen-3 is generated “price lift or lift in overall contract size,” seemed to suggest an expectation of higher revenues from Gen-3. Although O’Toole could have been more clear with his response.

Finally, CFO Henry Dubois stated, “we believe we have sufficient cash and liquidity to deploy a baseline constellation of 12 Gen-3 satellites and drive to positive free cash flow.” If this is true, it would be huge. However, this is the same Henry Dubois who stated on August 8, 2024, “we believe we have sufficient liquidity for the foreseeable future.” No sooner than the next month Blacksky announced a public offering of common stock to raise more money. So some caution may be warranted taking Henry Dubois at his word.