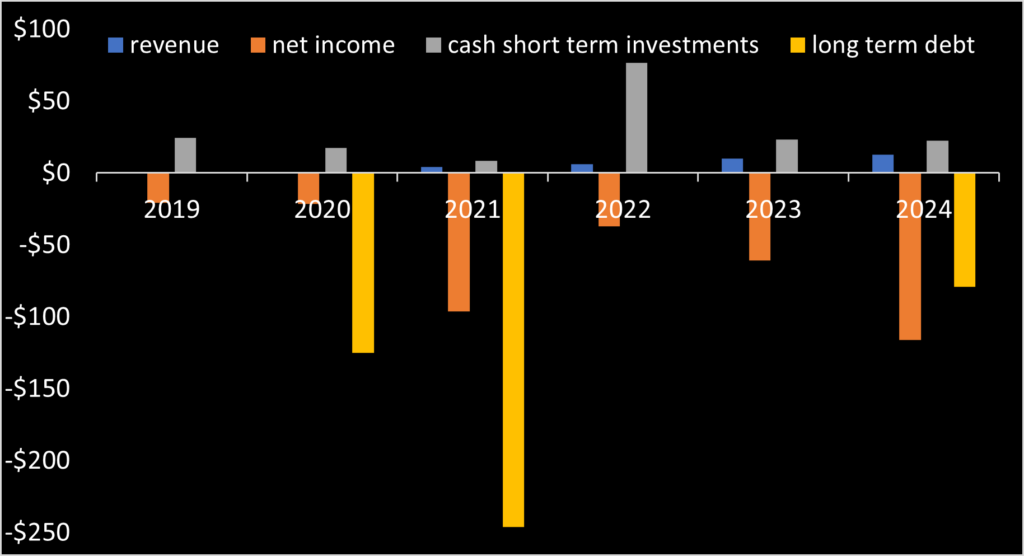

Satellogic’s (NASDAQ: SATL) 2024 annual financials shows no breakout. Revenue grew modestly from from $10.7 to $12.6 million. Net loss was $116 million, highest on record. Satellogic stock traded around $1.00 per share pre-election. Like other (U.S. listed) space stocks, Satellogic stock rose dramatically post President Trump’s election win. The stock rose as high as $4.74, but as time of writing, trades back in the $3.00 range. With a $320 million market cap, Satellogic is worth more than Blacksky ($230 million) with similar debt, almost 1/10th the revenue, and no significant U.S. government contracts.

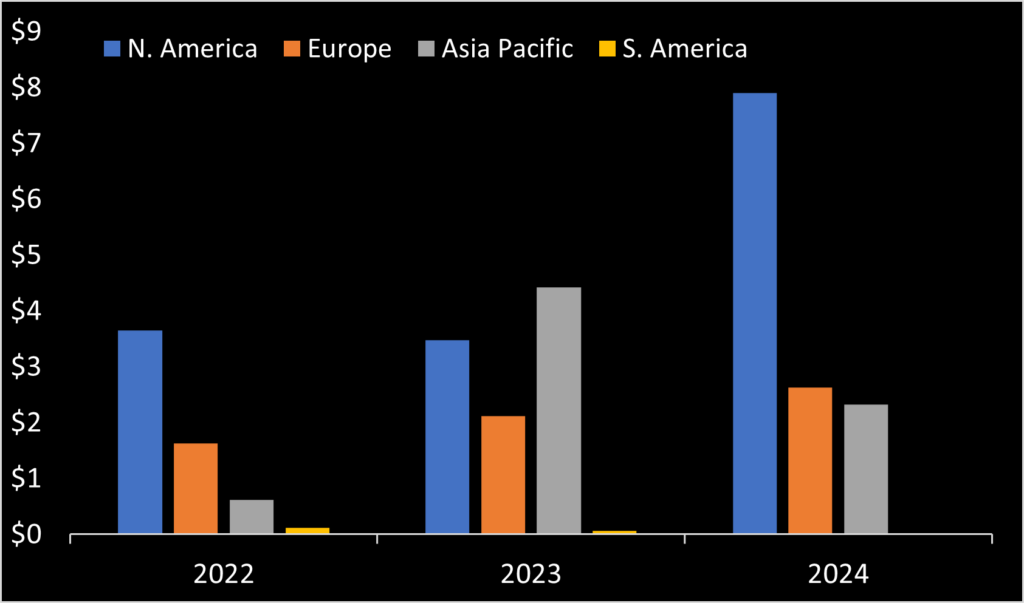

Revenue growth stemmed from increased North American sales. Satellogic relocated its HQs to and re-registered in the United States in bid to qualify for U.S. government NRO sales. This completed in March 2025. Whether this leads to a contract/order from from the NRO remains to be seen.

Satellogic has sought to capitalize on the rise in its stock value. On December 10th Satellogic filed a registration statement with the SEC governing the sale of up to $150 million in new stock. On December 20th, they disclosed engaging Cantor Fitzgerald & Co. as sales agent for $50 million of new stock. The terms are not outrageous (like other space companies experienced, i.e. Sidus Space): 3% commission plus other fees. As of March 26th, Satellogic reported so far selling shares totaling $1,178,592 via this at the market sales offering.

In 2024, Satellogic’s cash outflow totaled $40.9 million. Their plan to sell $50 million worth of stock this year could allow them to continue operating through 2025 without incurring additional debt. Furthermore, as long as Satellogic’s stock price stays within the $3-$4 range, raising $50 million will require the sale of fewer shares, thus minimizing shareholder dilution.

As of December 31st, the publicly disclosed entities holding Satellogic stock valued at over $1 million were long-standing investors Liberty Capital, Cantor, and Softbank. This suggests that the recent surge in Satellogic’s stock price following the election has likely been primarily driven by retail investor activity.