Synspective (TYO: 290A)’s annual report provides details about the company’s future operational plans, which appear to include issuing more shares to raise capital. Additionally, Synspective warns of a high risk that venture capital firms holding its stock may soon begin unloading their shares.

Revenue growth

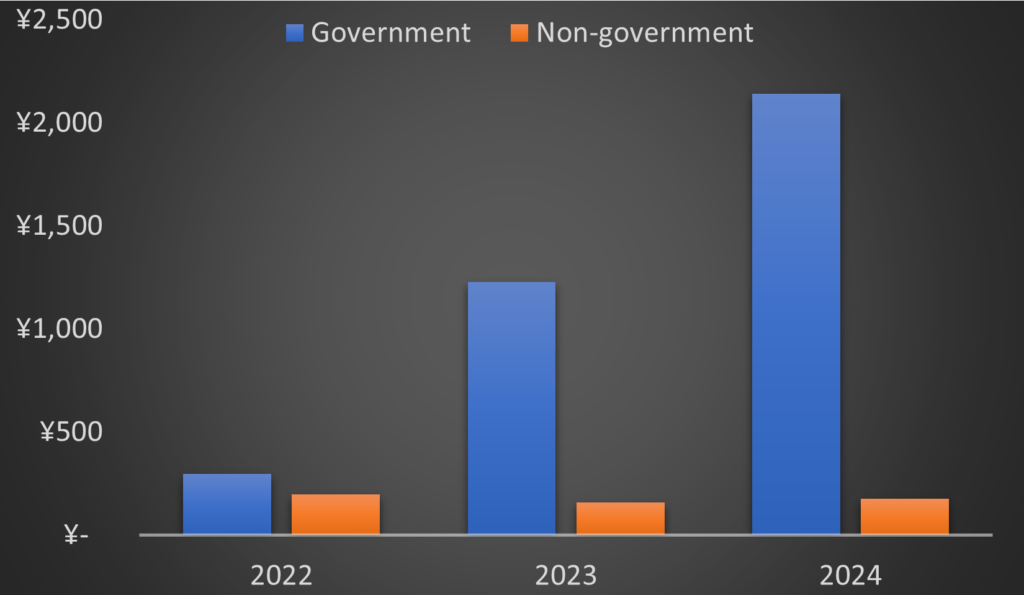

Revenue growth in 2024 was almost entirely attributable to government sales. This marks a significant shift from 2022, when commercial revenue constituted 40% of the total. By 2024, this figure had dropped to a mere 8%. Furthermore, of Synspective’s ¥2.1 billion in government-sourced revenue for 2024, ¥1.3 billion came in form of a Japanese government subsidy.

Business plan not fully funded

As of March 2025, Synspective had placed six satellites into orbit. Two of these have completed their missions, leaving four in commercial operation. Synspective projects reaching profitability once its constellation reaches ten satellites, requiring a minimum of six additional satellites (and potentially more if existing satellites deorbit or complete mission in the interim). Synspective’s IPO paperwork disclosed ¥2.5 billion projected cost per satellite, including launch. Therefore, deploying six more satellites would require ¥15 billion yen, excluding overhead costs. Selling, general, and administrative costs in 2024 totaled ¥3.3 billion (an increase of ¥600 million from 2023). At the end of 2024, Synspective reported holding ¥14.2 billion. While Synspective has already incurred some costs for its upcoming satellites, these figures suggest Synspective lacks sufficient cash to fully fund its path to profitability.

Synspective has acknowledged that its business plan is not fully funded. On page 22 of its 2024 annual report, the company disclosed the need to raise additional funds post-IPO, stating plans to secure this capital through loans and capital increases. Investors should factor in future dilution when calculating Synspective’s future valuation.

Venture capital share lock-up ending

Synspective’s report also indicates that 48.4% of Synspective’s stock is held by venture capital firms. These firms are subject to a post-IPO lock-up period, preventing them from selling their shares until June 16, 2025. Synspective explicitly disclosed a “high” risk that these firms may sell some or all of their holdings once the lock-up period expires.

Previous analysis has explored the potential profitability and future valuation of Synspective stock. These venture capital firms, and likely Synspective itself, have undoubtedly conducted similar calculations. Synspective’s warning of a high risk that these professional investors sell their shares starting June 16th is telling. For any early investors subject to the lock up period, the current valuation might appear attractive for selling with immediacy. Synspective cautions that such sales could impact the stock price. Close monitoring is advised after June 16th.