| Market Cap: ¥36.5B TTM revenue: ¥1.7B YOY return: +134.62% |

CEO: Shunsuke Onishi Cumulative pay: ¥50M (est) Shareholder value created: ¥18.8B |

Forecast effort: B Forecast accuracy: B |

|

iQPS was for a short time the golden child of Japanese new-space. The first Synthetic-aperture radar (SAR) satellite imagery company to go public, iQPS stock once traded over 11x its its IPO price. (How many U.S. space SPACs can say that?) iQPS enjoys lower operating costs, specifically lower labor and cheaper commercial rent than western counterparts. iQPS reported net profit one quarter post IPO and its stock skyrocketed. Still expanding its revenue-generating SAR constellation, iQPS aims to post slim losses as they ramp up launch of more satellites. Challenges arose after two of its first commercial satellites failed mid-mission in 2024. The stock lost over three-quarters its value since post-IPO highs. iQPS still is forecasting year-on-year EBITDA growth through 2026. Can investors expect iQPS to solve engineering issues and deliver the growth pitched during its IPO?

2 Minute Version

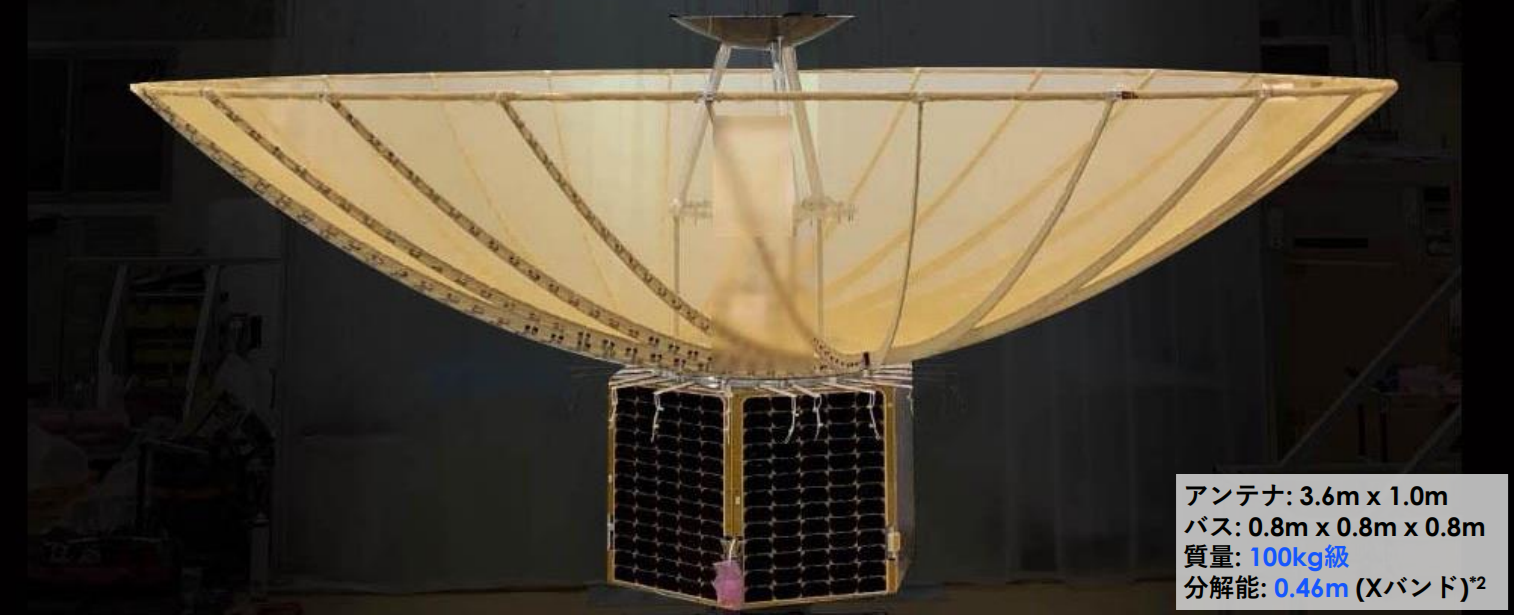

- iQPS manufactures and operates six SAR imagery satellites. The most recent of which are 46cm resolution revenue-generating models with ISLs offering near-real time image acquisition. The goal is a constellation of 24 satellites by 2028.

- iQPS quickly found trouble, and two satellites placed in orbit malfunctioned (see here and here) in 2024.

- Compared to Planet Labs and Blacksky, iQPS went public early in its revenue cycle but already posted two profitable quarters.

- iQPS’s stock rose as much as +1070% (🫧?) after its IPO but since lost most of this value.

- Domestic sales, inexpensive Japanese labor, and a commercial lease less than a single-family New York apartment drive iQPS’s profitability.

- iQPS planned to use IPO proceeds and commercial loans to fund 11 more satellites and satellite factory construction in Fukuoka. However, approximately a year after IPO, iQPS announced sale of more stock to raise more capital.

- Current revenue appears entirely sourced from Japanese government contracts. Success of this company appears dependent on iQPS securing international revenue which has yet to to be demonstrated.

- iQPS claims to have identified overseas distributors to target U.S. government sales. So far nothing else announced.

- iQPS disclosed revenue-per-satellite and satellite operating cost metrics. Extrapolation allows calculation of potential profits of its planned fully built out 36 satellite constellation. Thus iQPS’s max stock value may be calculated (assuming launch and sales metrics are met, and iQPS expands into no other business segments).

- iQPS offers a case study of how space sector companies benefit from manufacturing and developing software in Asia where land and skilled labor costs are inexpensive.

Examining Financial Disclosures

SAR imagery until now cost roughly $5,000 per image. iQPS through low-cost in-house satellite manufacturing offers a profitable business model based high resolution imagery priced at $2,550. But the 1990s are over and Japan’s capital markets aren’t what they once were. Resultantly, iQPS raised just ¥3.48 billion ($23.7 million) from its IPO. Compare to US-listed imagery SPACs which raised massive amounts with profitability still doubtful two years post-IPO: Planet Labs (raised $590M), Blacksky ($283), and Satellogic ($274). With any of these amounts, iQPS could launch its entire constellation and build its new factory. iQPS still aimed for the same using its slim IPO proceeds and a combination of commercial loans and profits(!). Profitability is still just a dream for Planet, Blacksky, and of course Satellogic. However, this did not work out too well for iQPS, or its investors.

iQPS’s business plan requires short-term commercial loans to fund satellites, to be quickly repaid from operating profits. Sumitomo Mitsui Banking Corporation arranges loans from smaller lending instructions to provide 5-year funding. iQPS claimed five years is more time needed to launch and recuperate build/launch costs, repay debt, and earn profit. So far two its first revenue-generating satellites have failed in orbit, hampering shareholder’s ability to accurately judge the profitability of iQPS’s business plan.

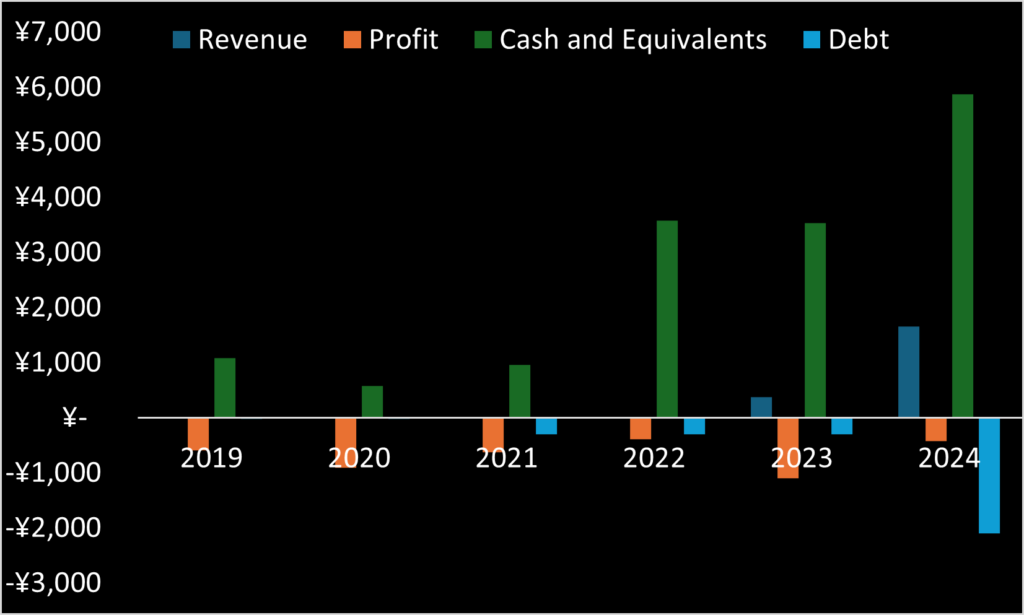

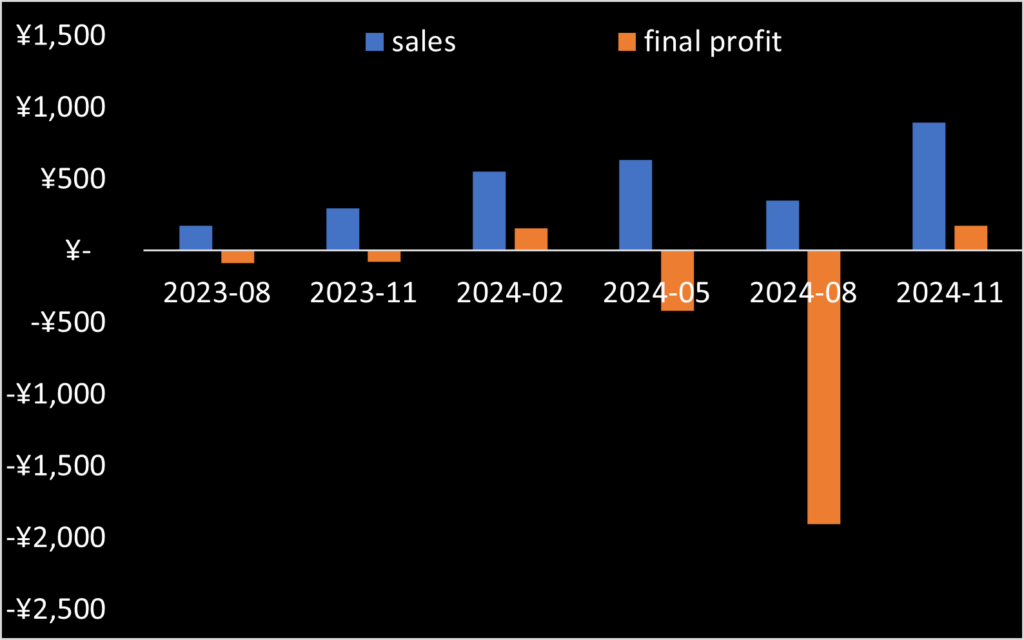

Revenue started in FY 2022 (ending May 31, 2022) with a nominal ¥4M (~$25,000), but quickly grew to ¥372M (~$2.37M) in FY23 and then to ¥1,653M in FY24 (~$11.5M). This is miniscule compared to Planet, Blacksky and Satrec and even SAR competitor Capella Space (private company with 2023 revenue reported as $74M). Management plans ¥3160M revenue (~$21.9M) in FY25 and positive EBITDA of ¥730 (~$5M).

iQPS boasts ¥13.4 billion ($85.4M) in Japanese government contracts. Contracts range up to six years in term. The majority of funds (75.8%) appear for research and satellite development work. Thus iQPS currently subsidizes considerable costs from Japanese government funding. iQPS does not report “backlog” like U.S. and Korean counterparts, so the portion of contracts already drawn down is unclear. Clearer reporting from iQPS is needed.

iQPS reports 60 employees, an average age of 41.9 years, and a company-wide average salary of ¥6.53 million ($41,600). Yes, satellite electrical engineers, software developers, manufacturing, executive management, everyone – average pay of $41,600. The current rent for its Fukuoka factory and offices is ¥8,094,000 per year – about $4,300/month. These two metrics drive iQPS’s business competitiveness. If iQPS executive leadership executes and finds sales outside of Japan, iQPS could be a worldwide SAR leader. iQPS plans to increase headcount expanding to 76employees by end of this fiscal year. iQPS benefits from drawing graduates from Kyutech and Kyushu University – two nearby universities with established small sat education programs.

iQPS has overcome huge setbacks not generally experienced by other space startups. iQPS fell victim to Epsilon-6 and Virgin Orbit’s bankruptcy. When Epsilon-6 failed in 2022 two iQPS satellites onboard were destroyed. These were to be iQPS’s first 46 cm resolution revenue generating satellites. (Prior satellites were lower resolution test satellites.) iQPS insured both satellites at 96% of value, so this Epsilon-6’s failure did not deal a financial body blow to iQPS. But the rocket failure delayed iQPS’s first and second 46 cm SAR satellites over a year until July and December 2023 when iQPS relaunched using Falcon-9 and Electron. To add more pain to suffering, iQPS also pre-paid ¥715M ($5.2M at the time) to Virgin Orbit for the launch of its fifth SAR satellite. Virgin Orbit never launched the satellite, ceased operations, and never returned the money. iQPS later rescheduled this launch with Rocket Lab and wrote investors that it is doubtful to recover these funds from Virgin Orbit.

iQPS reported the cost to develop, build, launch, and insure one satellite is approximately ¥1B ($6.4M). iQPS assumes 5 years operational life and claims ¥350M ($2.2M) yearly cost to operate each satellite. iQPS launches into both sun-synchronous orbit (SSO) and inclined orbits. SSO satellites pass over the polar regions – areas where customers generally have little interest in buying imagery. Inclined orbiting satellites straddle the equator orbiting over populated areas ignoring the poles. SSO orbiting satellites overtime cover the earth’s entire surface, while inclined orbits offer only limited global service depending on the degree of inclination. iQPS estimates its SSO orbiting satellites can take 16.8 revenue-generating imagery sets per day versus 19.5 for inclined orbiting satellites.

iQPS reported its SAR imagery is priced at ¥400,000 per set ($2,550). This is roughly half the cost of SAR imagery pricing prior iQPS and its newspace competitors entering the market. iQPS exceeded this metric for 2024 sales, but did not discloses by exactly how much it was exceeded. Using iQPS’s satellite development, launch, insurance, and yearly operating costs with its disclosed selling price, you may calculate iQPS’s potential future operating profit. Assuming 85% satellite operational time (same metric iQPS uses) and iQPS sells only half its operational capacity, potential yearly operating profit is presented below.

| Satellites | Daily imagery sets sold |

Sales (M) | Operating cost and satellite depreciation (M) |

Operating profit (M) |

|---|---|---|---|---|

| 1 | 7.5 | $6.99 | $3.48 | $3.51 |

| 8 | 60 | $55.88 | $18.88 | $37.00 |

| 24 | 180 | $167.65 | $54.08 | $113.57 |

| 36 | 270 | $251.47 | $80.48 | $170.99 |

A few immediate points:

- iQPS currently has about a $380M market cap. Assuming the 15 P/E average ratio historically exhibited for Japanese stocks, the current market cap presumes future yearly profit of $28 million. Accounting for financing costs, iQPS’s current stock price already builds-in profit obtained from successfully launching and selling half the imaging capacity of 9-12 revenue-producing satellites.

- Operating costs are likely to come down with more launched satellites due to fixed costs – something iQPS also itself hints to in investor briefings. This will drive profitability higher.

- Launch costs should also come down as iQPS transitions to SpaceX Falcon-9 “Bandwagon” rideshares launches for inclined orbits (cheaper than using Rocket Lab Electron for a dedicated launch). iQPS is wise to this, manifesting one SAR satellite on SpaceX’s inaugural April 2024 Bandwagon launch. However, launch cost savings should provide iQPS little overall competitive benefit. Competitors Iceye, Capella Space, and Umbra all launch with SpaceX. Synspective launches with Rocket Lab.

- Selling prices may also face downward pressure as iQPS and others launch more SAR satellites and compete for business.

- Additionally it is concerning that small SAR-market Japan is overcrowded with two SAR imagery providers – iQPS and Synspective. Thus iQPS’s future prominence in the Japanese market is far from certain. This creates more pressure on iQPS’s international sales team to find sales outside Japan.

- Major upside remains should iQPS sell more than half its operating capacity. This is limited by a ceiling of 19.5 imagery sets per day per satellite, the max iQPS claims possible per inclined orbiting satellite. Selling out max capacity represents 2.5X higher revenue potential upside and 4X higher operating profit upside. (Note iQPS predicates its own projections on selling between 8-11 SAR imagery sets, per satellite, per day.)

Based upon the above, assuming (1) iQPS builds out its entire 36-sat constellation, (2) cost and price metrics don’t significantly change, (3) iQPS underperforms its own business plan by selling 7.5 imagery sets per satellite per day, and (4) a stock price 15x earnings is supported, considerable stock upside remains. Assuming $200,000/year in financing costs per satellite (conservatively high) and $7.5 million in non-operating business costs, 36 satellites yield $155 million yearly profit, an amount justifying a market cap of $2.3 billion. This represents greater than 6X premium to the the current share price.

If iQPS sells 11 SAR imagery sets per satellite, the top of its own business model range, this yields $273 million in yearly profit justifying a $4.1 billion market cap. This should be viewed as the absolute best case for iQPS. Under this case, the maximum justifiable stock price of iQPS assuming no dilution and new revenue segments, is ¥17,675 per share. This represents greater than 18X premium to current share pricing. Everything must go exactly perfectly for iQPS to achieve this (unlikely).

We will closely watch future financial filings to see how iQPS executes and whether evidence suggests sales and profit margins can match iQPS’s models.

Management guidance scorecard

Unlike their American counterparts, iQPS hit its yearly financial forecasts provided at IPO. (Maybe that is why they did not raise so much money? … Punished for providing investors with realistic business models??)

iQPS generally has met its financial metrics. Except for EBITDA, iQPS only forecasts revenue and profit for the end of the current fiscal year. EBITDA growth and satellites to be built and launched are forecasted three years out. iQPS fell short of its launch goals in FY 2024. After falling behind, they revised 2025 launch goals downward.

CEO compensation and performance

iQPS is led by CEO Shunsuke Onishi. Unlike US-listed public companies, Japanese are not required to discloses executive compensation unless it exceeds ¥100M per year ($637k). IQPS does not disclose Shunsuke Onishi’s salary, so his compensation is unknown.

Shunsuke Onishi performance, as measured by shareholder value created, puts him among the top of space stock CEOs. He governed ¥39B yen in shareholder value creation, equivalent to +$270M. On what is likely a $200,000/year salary (or less?), shareholders’ overall return on his salary to date has been impressive for a new space CEO.

iQPS outlook and risk assessment

iQPS, whereas profitable, has a long way to prove its current share price. Consider the following:

- iQPS undoubtably has the lowest operating costs of all players in SAR imagery market. (This alone does not guarantee success. Take note of Satellogic. Also note iQPS’s own satellite engineering.)

- iQPS is positioned to undercut all competitors on price while still remaining profitable.

- iQPS’s first revenue satellite failed in orbit and its projected operating life was cut. iQPS can likely solve the issue by launching future satellites with working thrusters. A second satellite failed shortly thenafter, due to lack of redundancy engineered into the design. iQPS seriously needs to fix its engineering issues.

- International sales remains the wildcard. U.S. satellite manufacturers and sat-imagery companies all employ prior-DOD personnel in sales and business development positions. Familiarity with U.S. government procurement is an asset for obtaining U.S. government business. And the U.S. government is the largest customer for both optical and SAR imagery. iQPS will experience difficulty recruiting ex-USG personnel into sales roles with $42k average salary. iQPS still must find way to crack the U.S. market to sell out imagery from a 12 satellite constellation.

- Throughout FY 2024, iQPS has been selling imagery from a limited number (1-2) of satellites and lists only the Japanese government as customer. Investors have no certainty iQPS will sell out imagery from ten or more satellites, much less the full 36. Satellogic, also operating outside the United States with lower operating costs, (in)famously launched its optical satellite constellation but failed to find enough customers. Shareholders do not want to see iQPS repeating this.

- iQPS announcing significant revenue sourced outside of Japan will give investors confidence in international competitive and strength of their sales team. This is needed to justify financing and launching 36 satellites. So far, iQPS is putting off foreign revenue until 2026. So this uncertainty and risk will linger.

- But even if iQPS fails to secure overseas sales (a huge failure of iQPS management if that happens), iQPS having already demonstrated profitability solely from Japanese government sales likely has low risk of going under. They could likely maintain profitability from a scaled-down business operating just a few satellites. Current stock prices would likely not be supported depending upon where Japanese government SAR demand tops out. But at least iQPS would not go bankrupt.

iQPS currently caters to those with the same risk tolerance of climbing unroped.

What to look from iQPS going forward

With iQPS’s upcoming quarterly filings, look for the following:

- iQPS overcoming the engineering issues related to the failures of two of its first revenue satellites.

- iQPS winning sales sourced outside of Japan.

- Information suggesting the level where Japanese government SAR demand saturates.

- SAR imagery sets sold per satellite per day. As iQPS launches more satellites, if demand persists this should remain above 8, the low-end used by iQPS in its financial models.

- Whether or not iQPS’s individual imagery pricing remains stable.

Recent News

-

iQPS negative business trend continues; revises business forecast downward and announces new stock to raise capital

iQPS (TYO: 5595), once the mighty darling of Japan’s new space industry, again announces negative news to shareholders. After two commercial SAR satellites failed in-orbit…

-

iQPS misses post-Trump space stock run; plagued by two 2024 on-orbit satellite failures

QPS-SAR-6 fell out of orbit on November 17th, spending just 17 months of its 5 year design life in orbit. QPS-SAR-6 suffered failure in July…

-

ImageSat International’s flagship EROS-C3 satellite experiences in orbit anomaly

ImageSat International’s (TLV: ISI) 30 cm ultra-sharp resolution EROS-C3 earth surveillance satellite suffered two anomalies in orbit. Built by Israel Aerospace Industries (IAI), EROS-C3 launched…

-

iQPS first quarter 2025 earnings show 45% quarter-on-quarter revenue decline

iQPS (TYO: 5595) posted first quarter 2025 earnings (for the fiscal quarter ending August 31, 2024) on Friday. Whereas iQPS reported record ¥631 million revenue the…

-

After two failed satellites, iQPS revises guidance upwards

iQPS posted a note updating financial forecasts for both the current 1H and full fiscal year. QPS-SAR-5 failing in orbit caused iQPS to record an extraordinary…

-

iQPS satellite QPS-SAR8working, for now

iQPS announced that QPS-SAR 8, which launched on SpaceX’s Transporter-11 on August 17th, is working. This is welcomed new, of course, since QPS-SAR 5 and…