| Market Cap: $285.2M TTM revenue: $10.1M YOY return: +94.81% |

CEO: Emiliano Kargieman Cumulative pay: $1.5M Shareholder value created: -$575.7M |

Forecast effort: F Forecast accuracy: F |

|

Justin Verlander in the World Series. Anthony Bennett in the NBA. Bode Miller in 2006. Satellogic as a public company. All a little similar. Good opportunity, wasted.

With likely the lowest manufacturing cost in the entire space industry, Satellogic touted the lowest satellite optical imagery acquisition cost among its public piers. Satellogic excelled at raising money, offering a plan for a constellation of 200 (sometimes 300) high resolution imagery satellites. Satellogic upgraded its optical resolution to 70 cm, bettering Blacksly. Prospects were good. But customers and revenues never materialized. Satellogic management completely failed to hit its business plan. And all that money raised — already gone. On a lifeline, Satellogic obtained financing from a cyptro company and is launching a Hail Mary by relocating from BVI/Uruguay to the United States. Satellogic prays U.S. government contracts can save the company. However Satellogic’s constellation size is contracting and there is no money to replace old satellites. Satellogic wrote in SEC filings suggesting it may be switching business to hardware sales. It is difficult to see a coherent strategy. Does anyone think Satellogic’s management and board finally know what they are doing?

2 Minute Version

- Satellogic, registered in the British Virgin Islands and headquartered in Montevideo, Uruguay, is led by CEO and co-founder Emiliano Kargieman. His resume lists 5 years at the University of Buenos Aires, but no degree (“-“).

- Former Treasury Secretary Steven Mnuchin notably invested $150 million in Satellogic in January 2022, through his private equity firm Liberty Strategic Capital. Most of this money is now lost.

- Satellogic went public on the Nasdaq. Sales have since been pitiful. The stock is down about 90%.

- Satellogic entered the market with 99cm native optical resolution satellites and recently upgraded to 70cm. This beats Blacksky’s current Block-2 offering (1-meter) while maintaining similar form factor. (Satellogic does not complete in the 3U 3-5 meter resolution satellite class, i.e. Planet Labs “Doves.”)

- Satellogic has excelled at in-house manufacturing in its Uruguay factory. Satellite claims a cost less than $1 million to build and launch each satellite. (This is roughly 7x less than Blacksky spends on comparably spec’ed satellites.) Mnuchin himself commented at the time of investment that Satellogic’s low manufacturing costs offered ability to sell satellite imagery at favorable economics. Where he went wrong was apparently the misassumption that a large market exists for raw data imagery.

- Satellogic failed to convert low manufacturing costs into profits. With double the number of 1-meter resolution satellites in orbit as Blacksky, Satellogic generated 1/10th the revenue. Now Satellogic’s satellites are falling faster than they can afford to replenish them.

- Management once planned constructing a new satellite factory in the Netherlands. (Why?! You already have the lowest manufacturing costs in the industry!) In early 2022 Satellogic took delivery of a brand new manufacturing facility. After failing to sell imagery for the satellites it already had, it became apparent no business case existed to build more in the new factory. So by end of 2022 Satellogic scuttled plans for its new factory.

- Satellogic repeatedly failed to meet its own financial targets and guidance management offered to shareholders. Sales execution has been, and remains, awful.

- Satellogic’s pre-IPO business model called for 2023 revenue of $132 million. Actual achieved revenue: $10.1 million. (Still, other space SPACs missed their 2023 projections by even worse.)

- And approximately 40% of Satellogic’s current revenue is not from its core business of selling satellite imagery! In FY 2023 satellite sales comprised 40% of revenue. Whereas trying to capitalize on its manufacturing cost advantage is undoubtably positive, only $6 million in imagery sales two years out from IPO is testament to this company’s failure.

- Is Satellogic now switching directions? An April 15th business update advised 2024 revenue is largely dependent on Satellogic closing additional satellite manufacturing deals. At least for the short term, Satellogic’s revenue appears contingent on manufacturing. Clearly, because almost no one buys its satellite imagery.

- Having already executed multiple layoff rounds, there seems little room for more cost cutting. Satellogic simply needs revenue.

- CEO Emiliano Kargieman was quoted in a 2023 SEC filing saying, “we don’t expect to be raising additional financing.” One can only feel said for any investors who took Kargieman him at his word. In April 2024 Satellogic running out of cash announced a $30 Million Strategic investment from Tether.

- Satellogic satellites in orbit have limited lifetimes and numbers are dropping. Cash is needed to replenish the constellation, which Satellogic does not have.

- Management started a business with great cost metrics, a strong pitch, a business model, but apparently no real sales plan. The “if you build it, they will come” sales strategy did not work. After spending all its money, launching the largest optical imaging constellation of its kind, no plausible strategy exists for turning things around.

Examining Financial Disclosures

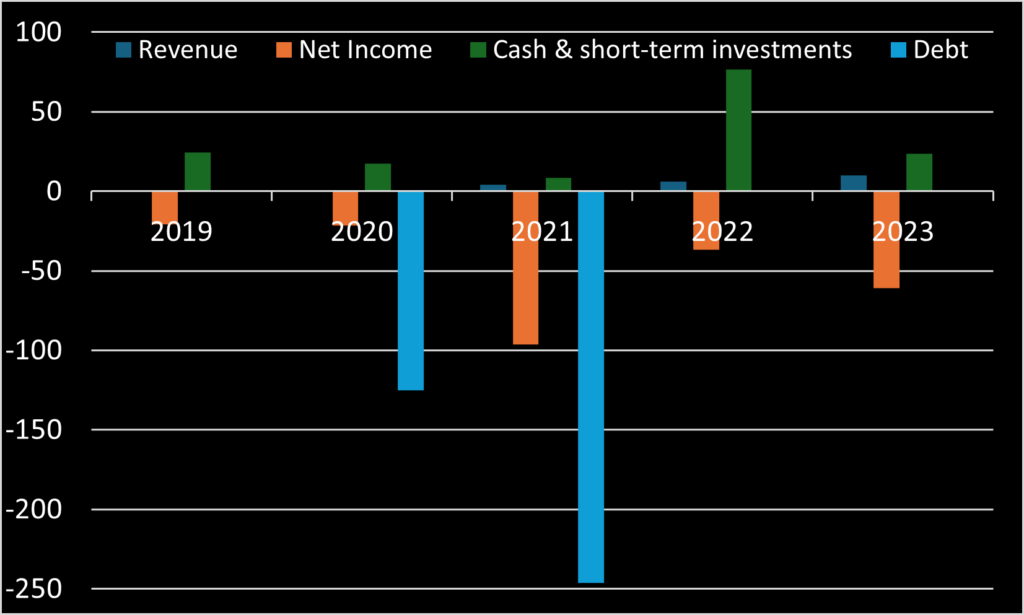

Satellogic prior to IPO funded operations with debt. Its SPAC deal raised $262 million and converted existing debt into shares. Satellogic in 2022 stood with zero debt and cash to fund operations. Its slide deck courting investors into its public offering offered a “Strong Financial Model” with 200% net revenue CAGR between 2021 and 2025. Yeah, that did not happen.

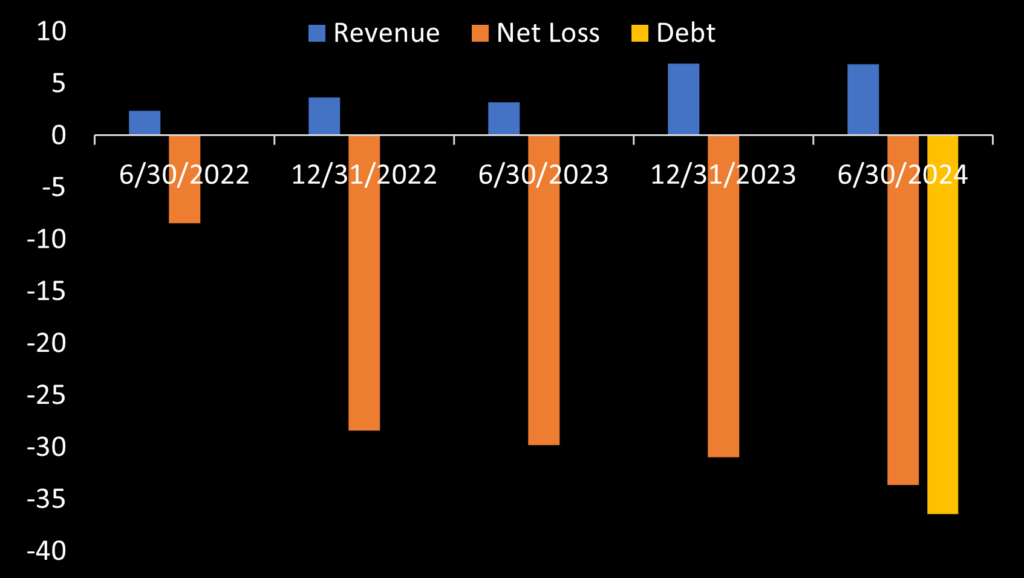

2021 was Satellogic’s first year with revenue, $4.25 million on 22 satellites in orbit. 2022 was $6.01 million on 34 satellites. So that 200% net revenue growth didn’t happen even the first year. 2023 saw $10.07 million revenue posted on 25 satellites (apparently a net 9 decayed). But this is literally a 1/10th of Blacksky’s revenue with approximately twice as many comparable or better satellites. Unbelievably bad. And even with layoffs, the cash burn does not stop. On brighter note, Satellogic reported no debt as of December 31, 2022 and 2023. However, out of cash and no path to profitability yet apparent, debt or dilution (or both) seems to be Satellogic’s future.

The most recent reported revenue, 1H 2023, showed no breakout. The $30m debt from Tether is secured by basically all company assets, including IP.

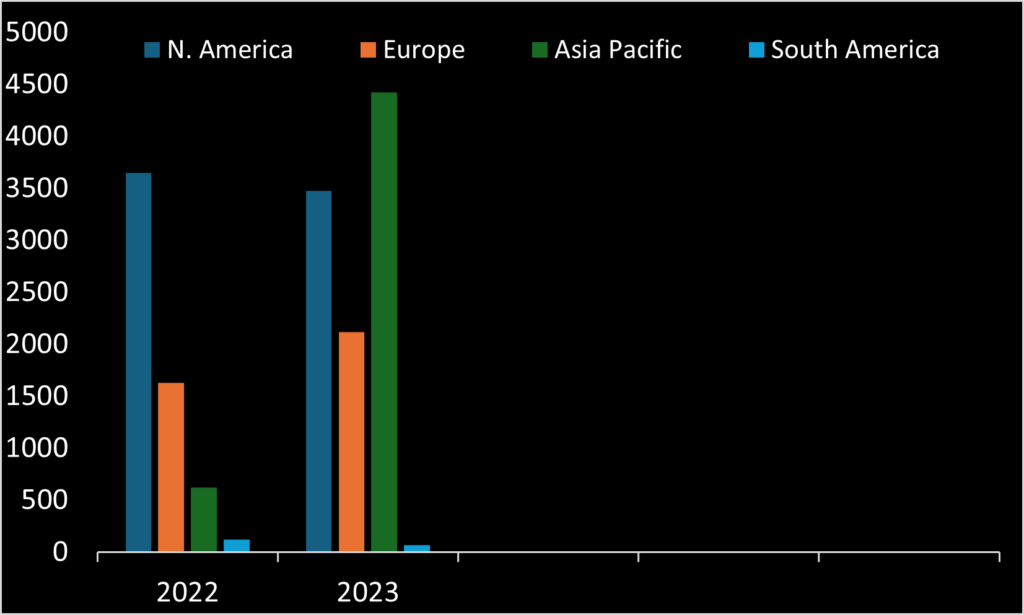

Satellogic’s geographic revenue distribution demonstrates two things. 1. Satellogic does not cash in on U.S. government contracts. 2. No homefield advantage exists in South America. (Planet notably sells imagery to the government of Brazil used to fight illegal mining and deforestation. Planet’s CEO likes to highlight this to demonstrate his company’s positive impact on the actual planet.) Satellogic has not found any significant South American sales. Satellogic’s North American revenue also declined year-on-year. The world’s largest satellite imagery customer, the NRO, per policy procures optical imagery only from U.S. entitles. While this locked Satellogic out of NRO contracts, Satellogic could compete for DOD or other U.S. government contracts, which they enjoyed no significant success.

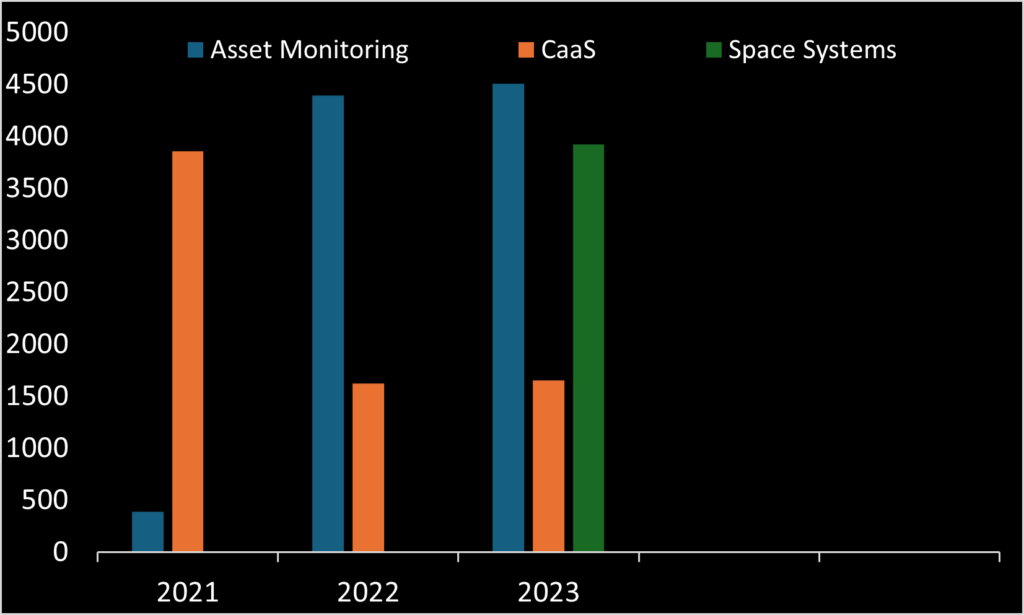

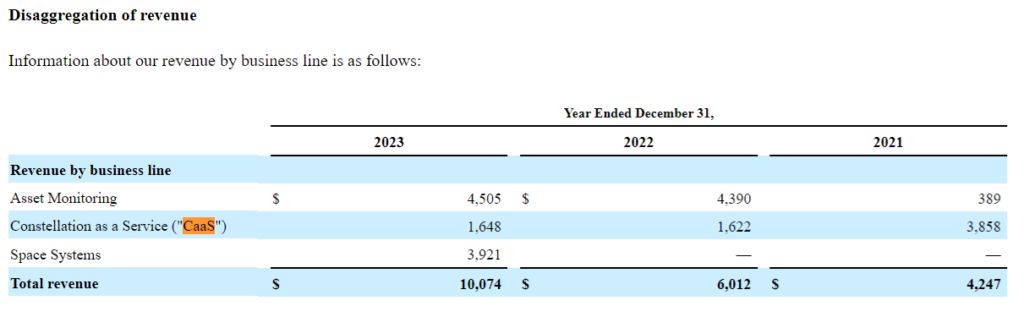

Main observation: no consistency. No sustained growth in Asset Monitoring. Constellation as a Service (CaaS), basically the same as Asset Monitoring but on larger scales, was Satellogic’s early revenue driver. But it appears it large customer(s) dwindled. And then in 2023, “Space Systems” – sales of satellite hardware – popped out of nowhere. As stated above, management is banking on this as leading revenue source in 2024.

But here is the kicker. There seems to be an error in the revenue accounting Satellogic reported to the SEC for 2023. (🚩🚩) Satellogic as a foreign registered company only files financial reports with the SEC semiannually versus quarterly. Sure, assembling a filing is no light lift. But if you are doing at half as frequently, you literally have twice as much time per report to make sure everything is right.

Page 61 of Satellogic’s 2023 annual report claimed $4.7 million of 2023 revenue was from Asset Monitoring and $3.7 million from Space Systems. Then the table on page F-17 claimed $4.51 million of 2023 revenue from Asset Monitoring and $3.92 million from Space Systems. The differences are too large to attribute to rounding. Both sets of revenue total $10 million. It’s hard to determine what happened.

To speculate, at best it seems Satellogic calculated revenue disaggregation, and then later recalculated with different category attributions resulting in different numbers, but only updated one section of the report forgetting the other. At worse, Satellogic decided to fudge numbers, but failed to correctly fudge both places. Fudging seems unlikely, because if Satellogic management wanted to cheat, might as well cheat with higher revenues than the measly $10 million reported. But who really who knows. Satellogic’s financial team, IR team, and Board at the very least appear to be inattentive and uncareful in preparing and approving financial reports for accounting errors to be filed with the SEC.

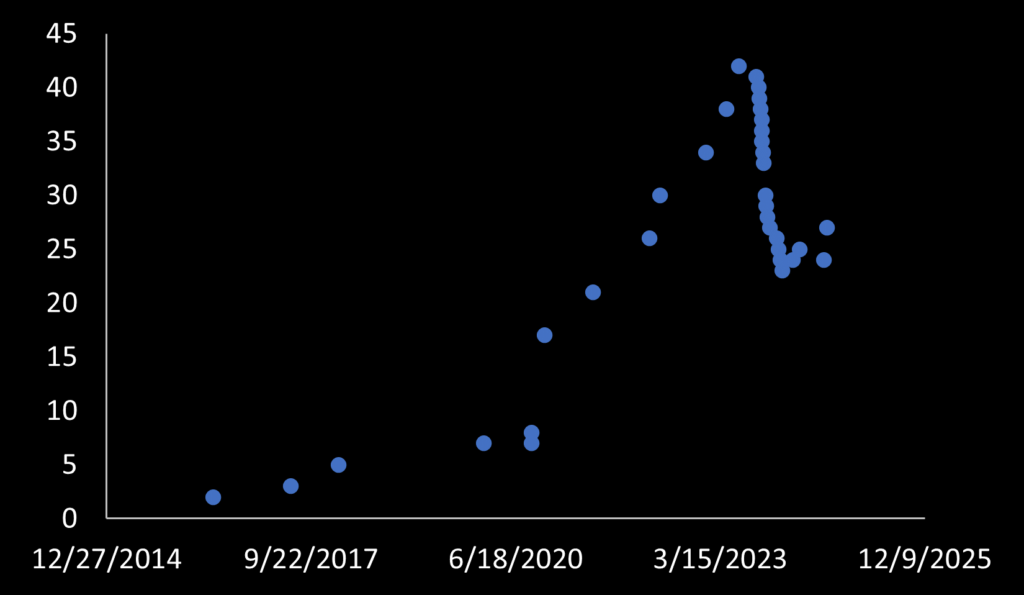

Satellogic’s plan called for up to 300 satellites in orbit by 2025 providing capability to reimage the entire earth daily. Launched with fuel to maintain orbit for 3 years, Satellogic satellites have limited lifetimes. Recent satellites have deorbited after about three years. Satellogic’s satellites in orbit peaked in June 2023, with a constellation size of 42, At a cost of $1 million to build and launch, Satellogic needs about $25 million over the next ~4 years to maintain current numbers. However, low Asset Monitoring and CaaS sales levels likely do not justify so many satellites. So the number of satellites may continue to decline, especially if Satellogic really switches business focus from imagery sales to manufacturing. If satellites numbers diminish more, this may signal Satellogic abandon making satellite imagery profitable.

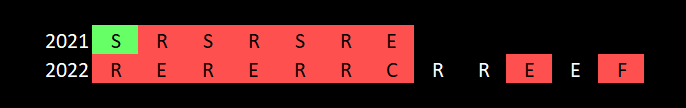

Management guidance scorecard

Prior to IPO, CFO Rick Dunn told stock analysts the following about Satellogic’s proposed financial model:

We’ve been appropriately conservative in our model with only 11% of our near-term pipeline reflected in revenue on a probability weighted basis. As such, we believe there’s considerable upside potential in the near term. In 2025, we’ll be growing revenue at over 100% and we expect to continue experiencing strong growth well into the future.

With respect to EBITDA, we’ll break even by 2022 and that’s when will see the operating leverage of our business really kick into high gear as we rapidly scale up and achieve 60% EBITDA margins by 2025 thanks to unit economics that are unmatched and unachievable by our competitors. This operating leverage is sustainable well into the future.

Satellogic Inc. Analyst Day held on November 18, 2021.

EBITDA did not break even in 2022. The “only 11%” of pipeline reflected in its revenue model, that did not materialize. In fact Satellogic has repeatedly adjusted future revenue and EBITDA numbers downward, yet still missed heating them.

And these have been huge misses. For example, Satellogic management on August 12, 2021 provided investors a model calling for $132 million revenue in 2023. On March 14, 2022 this was downwardly revised to $83 million. Then on December 15, 2022 revised down again to $30-50 million. All said an done 2023 ended with $10 million in revenue. Missed every management number, and badly.

After December 2022, Satellogic management stopped guidance. (🚩) Management apparently lacks confidence in its own knowledge of its business to make forecasts anymore. Satellogic CFO Rick Dunn reconfirmed no guidance on April 15, 2024: “We have no current plans to publish guidance in the near term.”

CEO compensation and performance

CEO Emiliano Kargieman’s compensation at Satellogic has been relatively modest. If I were him, I would be extremely pleased earning approximately half a million a year serving investors plate after plate of failure yearly. Kargieman has owned 13,582,642 shares of Satellogic stock. To think he once was worth $130 million when Satellogic went public is mind boggling.

| Compensation | |

|---|---|

| 2021 | €442,130 |

| 2022 | $471,576 |

| 2023 | $488,023 |

However, among all space CEOs, Kargieman is among the most likeable. In interviews he exhibits insightfulness and articulate knowledge of his place in the space industry. Other CEOs seem to fall back on a prepped recitation of taglines, but not Kargieman. Kargieman is also a proud father passing his love of satellites to his daughter who reportedly also wants to make satellites like her father one day. He comes across as down-to-earth and approachable. And smooth. It is no wonder he and his team excelled at raising investor money. Kargieman has every financial incentive to make Satellogic profitable and re-grow the value of Satellogic stock. If Satellogic stock price rises, so does his net worth. Having a formal background in number theory, Kargieman should understand this concept well.

Despite offering competitive imagery with lowest cost economics, Satellogic’s sales never materialized. Satellogic’s product has been raw imagery. Kargieman apparently envisioned customers would buy imagery and perform data analysis themselves. Planet and Blacksky approached differently – each selling satellite imagery analytics as the product. Kargieman articulated this in March 2022, “we don’t expect to be the company doing the analytics.” He left this to Satellogic’s partners. This regretful decision doomed the company. And Kargieman went on to oversee the loss of approximately three-quarters billion in shareholder value.

Early SEC filings disclose that Satellogic’s management team collectively was paid $2,274,000 in 2019 and $3,694,028 in 2020. This suggests with his pre- and post-IPO compensation, if his Satellogic business venture fails, Kargieman still walks away receiving a millions in total compensation. Not a bad deal.

Satellogic outlook and risk assessment

Satellogic seems to need a miracle to reach profitability.

- Satellogic is relocating to the United States in 2024 to become eligible for NRO contracts. Blacksky netted $72 million over the first two years from its NRO contract. If NRO can win a contract and assuming the award size is similar to Blacksky, this still does not seem to be enough to turn Satellogic profitable. Satellogic posted $61 million loss in 2023. $36 million in NRO imagery sales would undoubtably help, but Satellogic still needs $25 million in other revenue to break even (assuming no further expenses).

- I think Satellogic has been failing at (and this is just my speculation) delivering satellite data to customers in a form customers want. A customer does not want to buy images of freight ships and manually count the containers on each ship. A customer is often more interested in the analysis of imagery, not raw imagery itself. Planet advertises itself as a data analysis and AI company more than an imagery company likely for this reason. Satellogic mastered satellite manufacturing in Uruguay giving it an economic advantage. But I suspected they lack behind competitors in computer AI and imagery analysis capabilities, which hampers sales.

- The fact Steven Mnuchin did not make further investment in Satellogic (and nor did other traditional financial intuitions) should be telling. Mnuchin sits on the Board and invested $150 million in Satellogic already. He should have better view than anyone on Satellogic’s future prospects. Safe to infer he opted against investing more money in Satellogic based on what he saw. Likely not wanting to to throw good money after bad.

- Current management has a complete inability to forecast future results. They have failed to demonstrate any confidence in their ability to sell satellite imagery data. Management then stopped providing guidance to investors. And Satellogic filed a 2023 annual SEC report with revenue accounting errors leaving investors to wonder if numbers were fudged. Even if the explanation is innocuous, management’s inattentiveness to its own financials allowing such a situation to arise speaks to their competency.

- Satellogic at $1 per share trades at a 9x price-to-sales premium than Blacksky and 5x premium to Planet. And they are out of cash.

- Even if Satellogic nabs a NRO contract equal in size to Blacksky after moving to the US, they still at $1/share will be trading 2-3x higher on a price-to-sales basis compared to Blacksky.

- I would never buy this stock right now. But since Satellogic has proven ability to make satellites inexpensively in Uruguay, I am curious if they can find significant buyers of its hardware. This is worth watching in the future.

Satellogic caters to those with the same risk tolerance for Russian roulette. I would never do it.

What to look from Satellogic going forward

With Satellogic in the future, look for the following:

- Satellogic reissuing yearly revenue and EBITDA guidance again.

- Does Satellogic nab any significant NRO/U.S. government business after relocating to the United States?

- Will Satellogic replenish its satellite constellation or do they appear content to writing-off operation of so many satellites.

- Further growth in Space Systems, which would indicate customer demand for Satellogic’s satellite hardware.

- Indication of how much dilution will be upcoming due to cash needs.

Recent News

-

CEO Luis Gomes rediscusses AAC Clyde’s plan for 2025

AAC Clyde (STO: AAC) CEO Luis Gomes again addressed investors driving sustainable profitable growth as the core company focus. Since the dilutive rights issue, Gomes…

-

Satellogic posts new investor presentation; more capital needed?

Satellogic (NASDAQ: SATL) updated their website with new investor slides dated November 18th. Does this signal that another convertible debt offering or other financing event…

-

Global satellite earth imagery market as seen through public company financials

Five satellite earth observation companies trade publicly: Planet Labs (NYSE: PL), Blacksky (NYSE: BKSY), Satellogic (NASDAQ: SATL), Satrec (KOSDAQ: 099320), and ImageSat (TLV: ISI). Yes,…

-

After two failed satellites, iQPS revises guidance upwards

iQPS posted a note updating financial forecasts for both the current 1H and full fiscal year. QPS-SAR-5 failing in orbit caused iQPS to record an extraordinary…

-

SeekingAlpha: Satellogic stock a “strong sell” with 64% downside

The latest Seeking Alpha article by Dhierin Bechai rates Satellogic stock a strong sell. No disagreement. Calculating a price-to-book ratio of 1.88, Bechai presents case…

-

BKSY price continues downward after reverse-split; comparison with SATL

Blacksky announced an 1 for 8 reverse split on September 4th. At the time, the motive was perplexing. Investors apparently interpreted it as Blacksky management…