| Market Cap: $1.6B TTM revenue: $228.5M YOY return: +137.55% |

CEO: Will Marshall Cumulative pay: $18.9M Shareholder value created: -$1.1B |

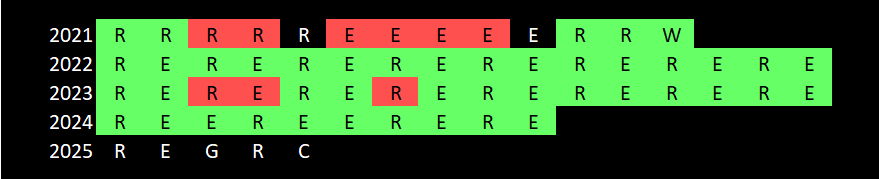

Forecast effort: C Forecast accuracy: A |

|

After building its first satellite in a garage in Cupertino, Planet Labs operates the world’s largest commercial satellite imagery constellation. This story is easy to root for. Planet went public on prospect of sustainable high double digit revenue growth. During its first year trading, Planet largely met its targets. Have you heard a Shinkansen screeching to a halt as it looses momentum pulling into Tokyo station? Then you can relate to Planet’s high revenue growth rate loosing momentum. Revenue growth sharply declined and management implemented layoffs to ease cash burn. Planet currently forecasts having enough cash to reach cashflow positive in FY 2027 without requiring additional capital. Will Planet pull this off? Or will they require more money or be forever unprofitable?

2 Minute Version

- Planet Labs manufactures in-house and operates approximately 180 “Dove” satellites offering three to five meter resolution. Planet additionally operates 21 “SkySats” with 50 cm resolution.

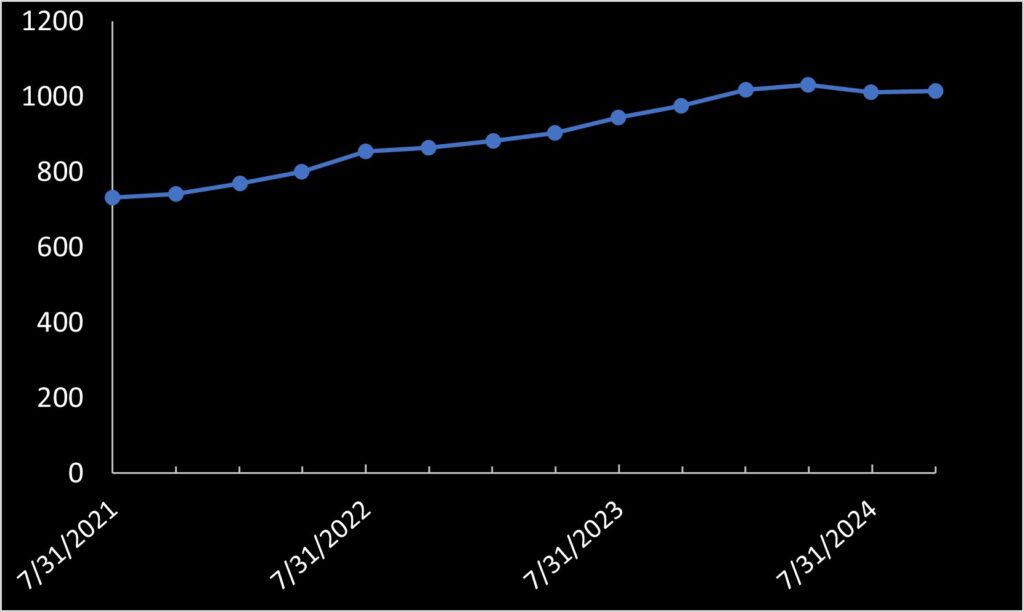

- Planet boasts a broad customer base (973) and highest reported revenues ($244.4M in FY2025) in satellite earth surveillance sector (over 2x that of BlackSky).

- Planet will replace its SkySats with “Pelicans” offering 30 cm resolution, the first of which launched in November 2023. Planet also in August 2024 launched its first hyperspectral “Tanager” satellite (approximately 2 years behind schedule).

- 45.7% YoY revenue growth in FY 2023 (ending Jan 31, 2024) retracted to 15.4% growth YoY in FY 2024 and 10.7% in FY 2025.

- FY 2024 domestic-sourced revenue grew 0.97%, compared to 74.6% growth in FY 2023 (original analysis).

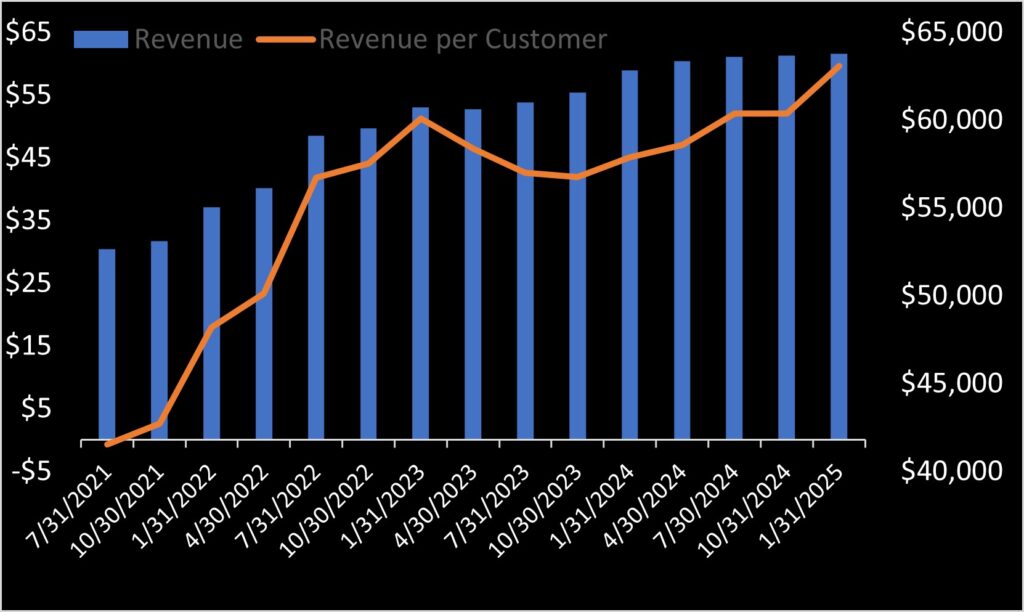

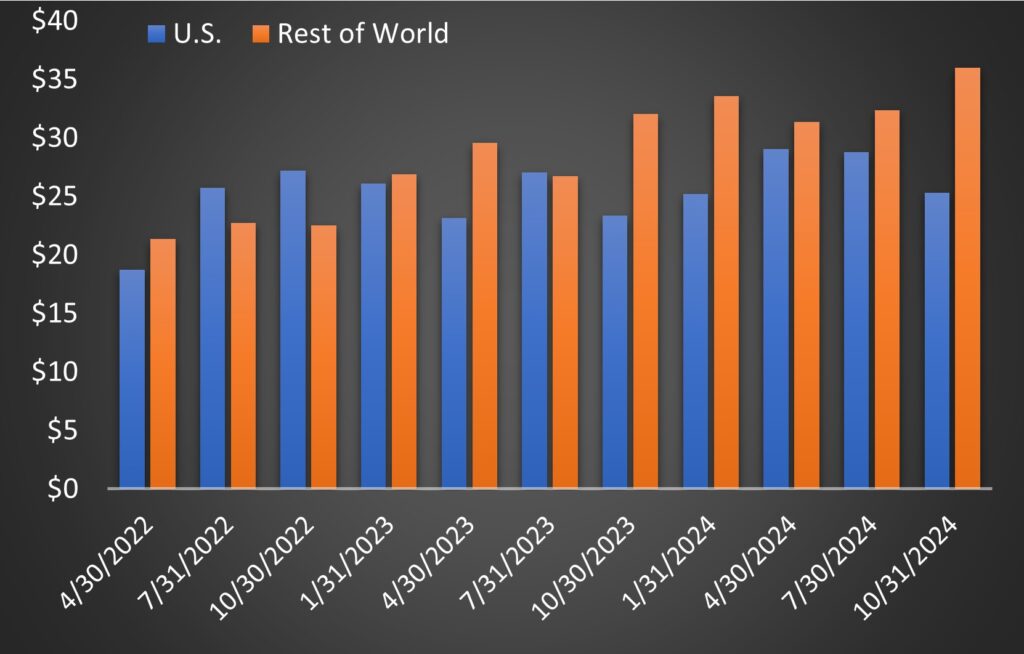

- Revenue-per-customer peaking in 4Q 2023 but has since in 4Q 2025 reached all-time high (original analysis).

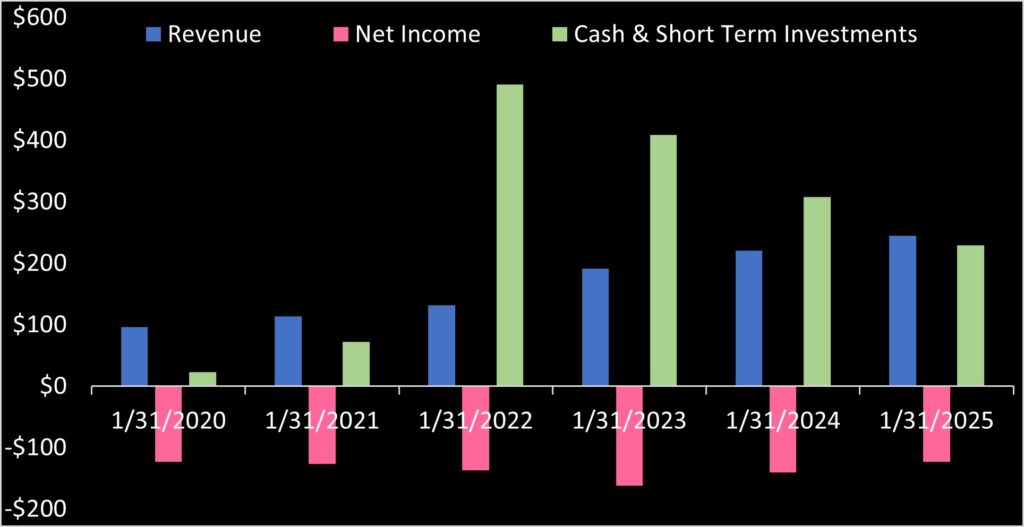

- Two fiscal years ago Planet laid off 117 employees and finished the year with $140.5 million loss and $298.9 million in cash and short term investments. Last year in June Planet let 180 more employees go and finished with $123.2 million loss and $222.1 million in cash and short term investments. Losses are shirking, but not that fast.

- To be profitable, Planet must either cut more costs, increase sales or margins, or even better, all of the above. The top range of Planet’s revenue growth forecasts, combined with current margins and cost structure, may just be enough to reach breakeven in by end of 2026.

- Since its founding in 2010, the earth imagery market has become much more crowded; Planet now faces competition from multiple contenders including Blacksky, ICEYE, Alba Orbital, Umbra, Capella Space, Satellogic, Satrev, and others.

- Satellites launched by well-managed (i.e. not Satellogic) firms located in countries with lower labor costs (i.e. Spacety and Chang Guang in China, and Hancom in Korea) will challenge Planet’s international sales channels in the future. International sales is currently Planet’s only growing market and comprises majority of revenue (original analysis).

- Even accounting for the large pile of cash on hand, without huge business changes, long term prospects of Planet appear grim and risky.

Examining Financial Disclosures

Planet entered market with a ton of cash, claiming raised $590 million from its SPAC deal. The initial business plan on which its SPAC consummated called for consecutive years of high revenue growth providing a “Clear Path to Profitability” with forecasted net positive EBITDA and positive adjusted free cash flow reached in FY 2025 (the year ending January 31, 2025, i.e. this year). That path no longer looks so clear, with revenue growth stunted and reoccurring looses eating away cash reserves.

2022 revenue jumped 45.7% to $191.3 million in 2023, but then only 15.4% to $220.7 million in FY 2024. Revenue growth slowed to just 10.7% in FY25. However, for the past five years Planet consistently has lost $120-160 million per year, specifically most recently losing $123.2 million in the fiscal year ending January 2025. As a positive, and rare among its peers, Planet has essentially no debt. But with $222.1 million left, Planet Labs has burnt through over half its IPO proceeds and appears little closer to profitability. Will Planet decrease its cash burn in time?🤔They are trying, reducing costs through their well-publicized layoffs.

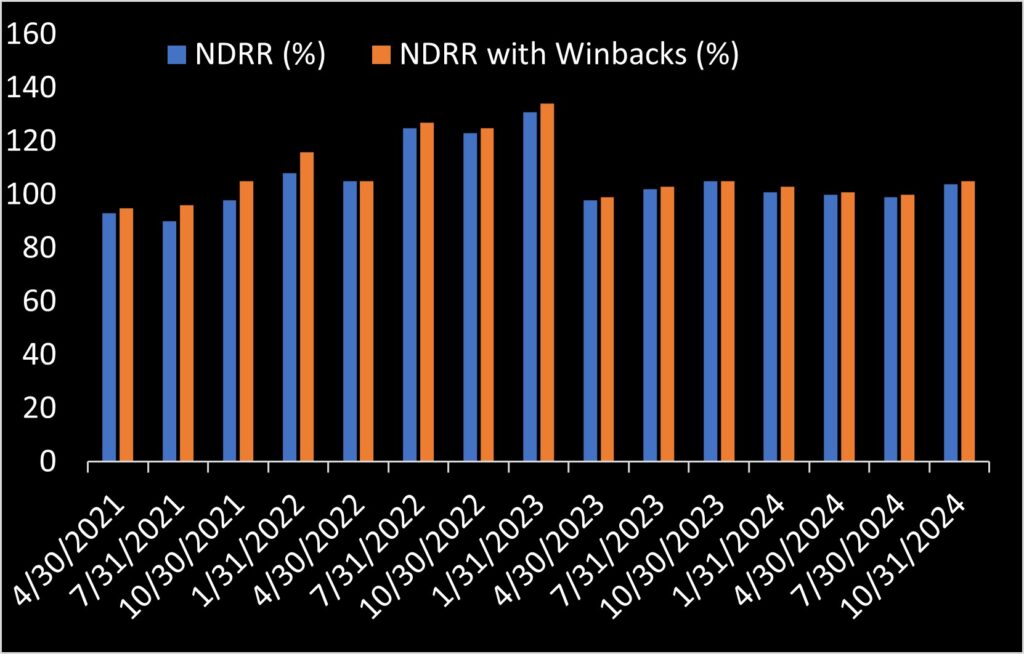

Planet has used two related internal metrics to measure customer growth. One is Net Dollar Retention Rate (NDRR) – basically measuring how much contracted customers ordered from Planet vs how much they were contracted to order at year’s start. The other is NDRR plus winbacks – a measure of NDRR plus inactive customers becoming active again. For both, the higher the percent above 100, the more customers are increasing spend on Planet’s products.

By Planet’s on metrics, FY 2023 (ending Jan 31, 2023) was a banner year, with customers contributing more spend on Planet’s products that originally contracted by approximately +25%. No wonder that year boasted +45.7% growth. But last year (FY 2024) was a different story – Planet’s worst on record since going public with active customers buying just 1% more than contracted at year’s end. FY 2025 (ending January 2025) looks more of the same.

What happened?

While not entirely clear, Planet’s SEC filings offer hints. I suspect Planet now faces stiffer competition than before and is slashing prices to remain competitive. Planet’s imaging offering is not unique – small satellites with a cameras pointed downward. My mom and I could likely design and manufacture our own, launch a constellation and start selling data. Investors should be grateful to Planet for the amount of information they make available in their SEC filings, as they consistently share customer numbers. Dividing Planet’s number of customers (at quarter’s end) by quarterly revenue provides a rough approximate of average revenue per customer. Measuring this by quarter, Planet peaked in Nov 2022-Jan 2023 and has been down ever since. Either customers are ordering less, or Planet cut its prices, or both.

The two above charts reveal why Planet’s growth stunted in 2023: Planet’s large double digit growth in 2021-2022 was driven more by customer spend increasing than by Planet singing up new accounts. So at the end of 2022 when customers began spending less on Planet’s services, revenue growth stunted.

Revenue-per-customer was roughly flat over a two years period requiring Planet must win even more customers to sustain growth. However, in late FY25 Planet turned this around. In light of declining total customers, revenue-per-customer stands at an all-time high.

Planet is pushing differentiation through software and AI tools. This seems Planet’s only option. Selling raw imagery failed for Satellogic. Software and AI extract usable information from image sets providing customers with analytics or alerts. For Planet, this likely comes at high cost: HQed in San Francisco with mean software engineer salary of $210,000, Planet likely pays >2x more than domestic competitors. And likely 4-5x more than competitors in Japan and Korea. (Planet also markets the advantage of having the largest historical earth imagery library dating back to 2009, but it is unclear how much unique revenue derives from historic imagery. I guess not much.)

| FY | US-sourced revenue | Foreign-sourced revenue |

|---|---|---|

| 2021 | $61.4 | $51.7 |

| 2022 | $56.0 | $75.2 |

| 2023 | $97.8 | $93.5 |

| 2024 | $98.7 | $122.0 |

What will become relevant later is the revenue source. Planet’s fraction of total revenue attributed to outside of the United States has grown faster and overtaken domestic-revenue. In FY 2024, foreign revenue comprised 55% of Planet’s total revenue. This number grew to 59% by Q3 2025. The majority of Planet’s growth thus stems from securing foreign sales. This is surely good short term. But it exposes Planet to long term risk when upcoming cheap foreign competition comes online. These competitors cannot sell to the U.S. government but likely later will outcompete Planet in foreign markets.

Management guidance scorecard

Prior to IPO in 2021, Will Marshall, Planet Labs co-founder and CEO, predicted over 40% yearly revenue growth (CNBC video here) for the next 5 years. Needless to say, didn’t happen.

After going public, Planet for a period consistently each quarter provided guidance forecasting revenue and EBITDA for the following quarter and end-of-year. In 2023 Planet management in two quarters provided investors overly rosy guidance that Planet failed to deliver. Then earlier this year in 2024 Planet management stopped giving end-of-year revenue guidance. (🚩) This should be concerning for all the obvious reasons – management appears to lack confidence even in their own assessment of current year revenue.

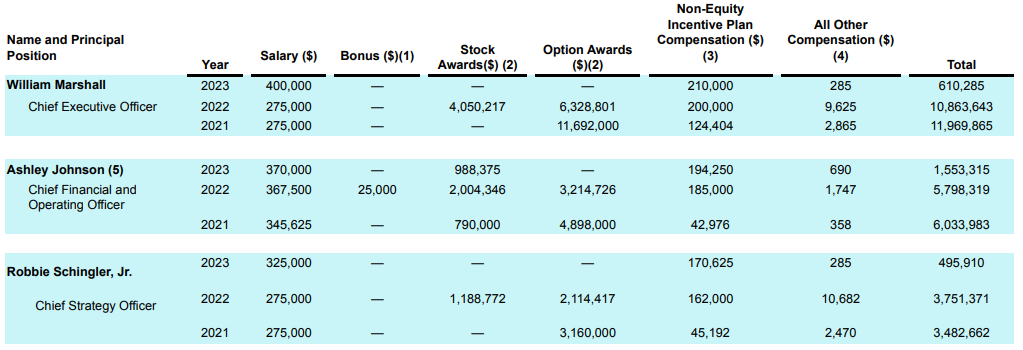

CEO compensation

CEO Will Marshall, CFO Ashley Johnson, and Chief Strategy Officer Robbie Schingler, Jr. made it rain in 2021 and 2022. In 2021, when Planet went public on those business forecasts it failed to meet, these three collectively received $21 million in total compensation. Commensurate with actual company performance, compensation pulled back to a more “modest” half mil to $1.5M each in 2023. But in 2024, CEO Will Marshall earned 10X more than the prior year, receiving $6,250,741 in pay. This was largely from a $5.75M stock award, but Planet also gave CEO Will Marshall a 25% base salary raise.

No doubt CEO Marshall and other Planet executives want to re-live their 2021 and 2022 pay. With all the stock and stock options they have received, they have every financial incentive to turn things around at Planet. So far, no dice. Just a lot of pay.

Also, as a shareholder, be careful. If you read Planet Lab’s SEC filings, you will see this:

Shares of our Class B common stock have 20 votes per share, while shares our Class A common stock have one vote per share. William Marshall and Robert Schingler, Jr. (the “Planet Founders”) hold all of the issued and outstanding shares of our Class B common stock. Accordingly, the Planet Founders hold over approximately 62% of the voting power of our capital stock.

If shareholders are not fond of CEO Will Marshall or CSO Robbie Schingler leading the company, tough break. These two control the majority of votes. This provision sunsets 10 years following Planet’s IPO when Class B shares convert to Class A. So don’t have high hopes for appointment of new executives and leadership change, even if Planet Lab’s future looks dark. This company will sink or swim at the helm of Will Marshall and Robbie Schingler, Jr.

Planet Labs outlook and risk assessment

Planet’s profitability prosects are tough and will get tougher. I recommend the following be considered before investing:

- Planet’s business of offering satellite imagery is hardily unique. With launch costs going down and projected to decease another 10x thanks to Elon Musk’s Space-X, anyone wanting to launch a 100 3U CubeSat constellation will likely need less than $500,000 to cover launch costs, The barriers to entry are shrinking considerably. Before, to start a earth surveillance satellite business like Planet, access to US levels of capital was needed. Won’t be anymore.

- Competitors from foreign markets (Asian?) with much lower operating costs will offer imagery providing extreme price pressure to Planet. In Japan Axelspace has started launching its constellation with 9 satellites up and plans for 50; its average salary for engineers is reported as 7M yen per year (about $45,000). In Korea Hancom InSpace launched its first, just ordered two more, also has plans for 50 total and its average salary is 53.9M Won (or $39,200). And Chang Guang in China already has launched 72 satellites. I don’t know enough to know if any of these specific companies will be the future, but it does seem that Planet will be extremely hard pressed to compete when for price of hiring five engineers its competitors can employee 20-25!

- Planet’s US government source revenue is likely more insulated for foreign competition, since the contracts are awarded only to US-based companies. (However note that Satellogic moved from BVI to Delaware just to be eligible for US government satellite surveillance contracts.) However, recall that Planet’s largest driver drive of revenue growth has been rest-of-world? That will be at risk.

- SpaceX’s Starship becoming fully reusable, launch costs coming down more, and Planet’s competitors surpassing them by number of satellites in orbit will take time. So it is possible Planet enjoys some short- or mid-term success before getting squeezed.

- Long term, Planet’s San Francisco rent and labor costs are just be too high to be competitive. Sure, they have laid off some workers but they require a much more competitive cost structure. Imagery costs are going down, not up. Once launching earth imagery small sats becomes commoditized (which it will), Planet without conducting major cost-cutting or business restructuring seemingly won’t have a chance to profitably offer competitive imagery services.

Planet Labs caters to those with the same risk tolerance as snake handling preachers in the South. However there they say if you really believe, no harm will come.

What to look from Planet going forward

With Planet’s next upcoming quarterly report, look for the following:

- Planet issuing yearly revenue guidance again.

- Revenue per customer growth again, like exhibited in 2021-2022. (Inflation apparently drove all prices up in the United States – except the cost of Planet’s services which apparently went down.)

- Increase in U.S. sales vs rest-of-the-world which would be taken as indicator of stronger U.S. government sales. Or even better, more detailed disclosures by Planet indicating U.S. government revenue is growing.

- Lower cash burn rate and an actual strategy to make this sustainable long term. If Planet cannot make this happen, they will need more money in 2026 which will either cause them to take on debt or conduct a dilutive equity raise.

Recent News

-

Planets Labs 2025 year end reporting

Planet Labs (NYSE: PL) released 2025 forth quarter financials (for fiscal year ending January 31, 2025) showing annual revenue grew 10.7% YoY. Planet added guidance…

-

Planet Labs 2025 Q3 report shows foreign revenue uptick, but no revenue-per-customer growth

Planet Labs (NYSE: PL) released its Q3 financial results for 2025, which were largely in line with projections. The company operates on a calendar year…

-

Global satellite earth imagery market as seen through public company financials

Five satellite earth observation companies trade publicly: Planet Labs (NYSE: PL), Blacksky (NYSE: BKSY), Satellogic (NASDAQ: SATL), Satrec (KOSDAQ: 099320), and ImageSat (TLV: ISI). Yes,…

-

Sidus Space releases new investor presentation

Likely connected with the pending public offering, Sidus Space (NASDAQ: SIDU) posted a new investor presentation. Three things immediately stand out: Sidus’s new larger satellite…

-

US & Israel use Blacksky and Maxar satellite imagery for Hamas War, not so much Planet Labs or Satrec

More fantastic reporting by Intelligence Online: shortage of Israeli homegrown SAR and optical satellites has provided opportunity for Blacksky and Maxar. Israel’s ImageSat (TLV: ISI)…

-

Planet Lab’s Tanager-1 is working; what does this mean for Sidus Space?

First light for Tanager-1: As the state-of-the-art imaging spectrometer prepares for its first observations of methane and CO2, these images indicate what the instrument can…