| Market Cap: ₩519.6B TTM revenue: ₩133.2B YOY return: +134.62% |

CEO: Ee-Eul Kim Cumulative pay: ₩2B (est) Shareholder value created: ₩280.3B |

Forecast effort: F Forecast accuracy: – |

|

Satrec Initiative is an Old Space surveillance satellite manufacturer based in South Korea. Satrec manufactures high resolution, high swath width satellites. Satrec historically built and marketed optical (and SAR) satellites along with satellite buses and internal components. Satrec has also long sold optical imagery and related data analysis, but this business line has not shown growth. Currently Satrec is selling imagery licenses from satellites owned by others. But this may change after Satrec launches its 30 cm resolution satellite constellation. Once a global player, Satrec now survives on South Korean government-sourced revenue after suffering a steady decline in overseas sales.

Satrec has spent three years hording ~$100 million in cash. Management appears afraid to invest in their own business. Offering multiple satellite components with strong heritage, can Satrec reposition itself as a global player like it once was? Or conversely will its revenue become further confined to South Korean government expenditures?

2 Minute Version

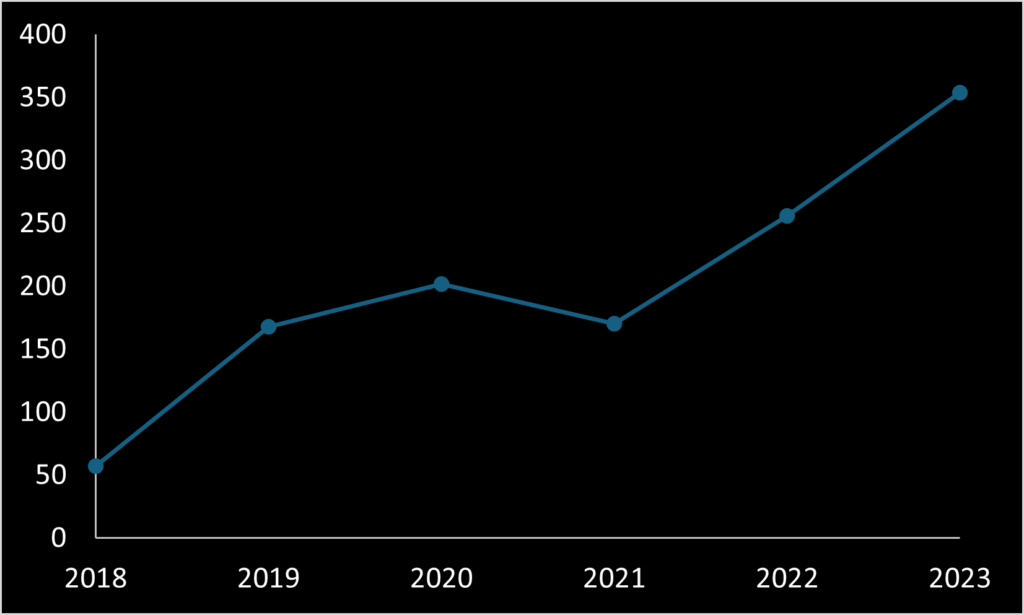

- Founded in 1999 and trading publicly since June 2008, Satrec is now riding the South Korean space growth wave. Satrec’s revenues expanded 3-fold from 2018 to 2023.

- Satrec currently plans to launch a constellation of 700 kg SpaceEye-T imaging satellites offering 30 cm commercial resolution.

- Satrec per its 2023 Annual Report views its competitors as Maxar, IAI, and Airbus. Satrec acknowledges small satellite start-ups entering the market, but does not name any as competitors. Satrec’s historically sourced revenue from selling surveillance satellites to foreign governments. Now many governments instead of procuring satellites procure imagery from firms like Blacksky, Planet Labs, Satellogic, Airbus, Maxar, etc. Thus the unnamed startups in Satrec’s Annual Report are likely responsible for Satrec’s foreign-based revenue decline.

- Satrec benefits from advantageous labor and operating costs in Daejeon, South Korea. Satrec itself claims, “Our company has not only technological competitiveness but also price competitiveness.”

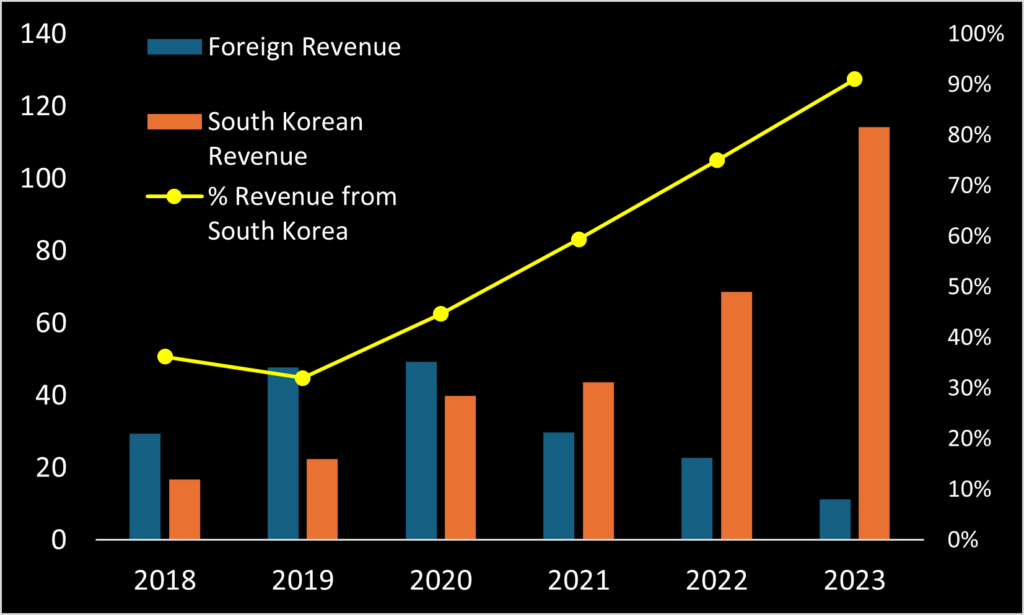

- As recently as 2019, foreign revenue comprised 2/3rds of Satrec’s revenue. In 2023, foreign sales dopped to less than 10%. (original research) In 2024, this decline looks like it will further continue.

- Satrec’s foreign revenue was in large part from sales of satellites to foreign governments. Recent governments still buying satellites instead of imagery, have bought from Satrec’s competitors. (Argentina from ISI, and Indonesia from Blacksky.)

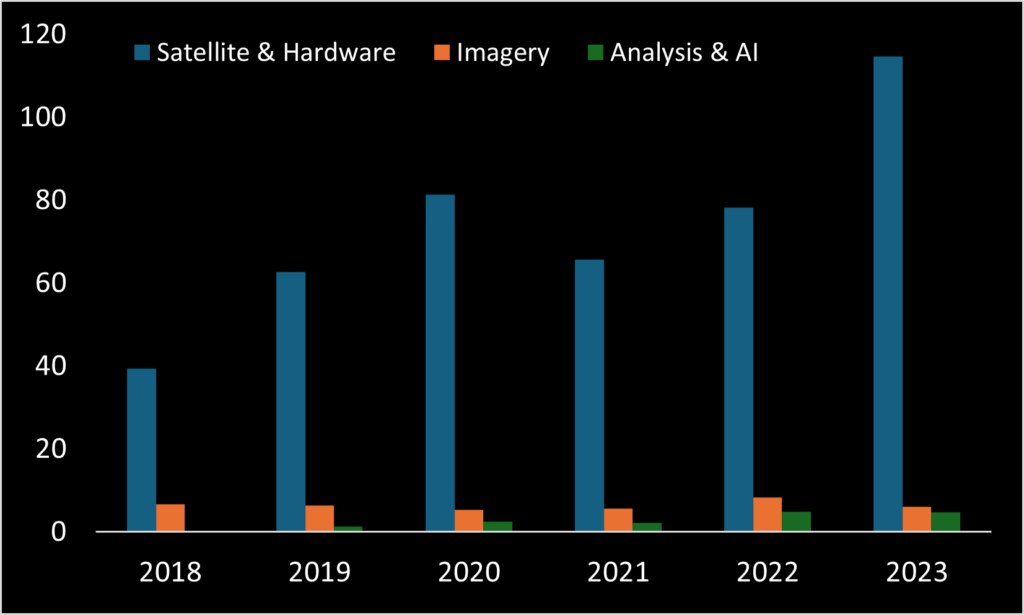

- Domestic hardware sales ballooned approximately 7X since 2018, fueling Satrec’s current revenue growth and profitability. This also has been cushioning the blow from lost foreign revenue. (original research)

- Satrec’s imagery and data analytics sales grossly lag competitors. Image and analysis revenue increased from ₩6.7B in 2018 to just ₩10.7B in 2023. (original research)

- Significant upside remains should Satrec break back into the global market. Recent trends indicate management has severely failed here. If Satrec has technological and price competitiveness as they claim (which they likely do), Satrec management has failed utilize this edge outside of Korea. And there is little evidence suggesting a turnaround is coming.

- With domestic sales now comprising >90% of revenue, until Satrec management and global sales team learn to conduct international business again, investment in Satrec has become a bet on South Korea continuing to dump money into its own space industry. (Which does happen to be rapidly expanding, by the way.)

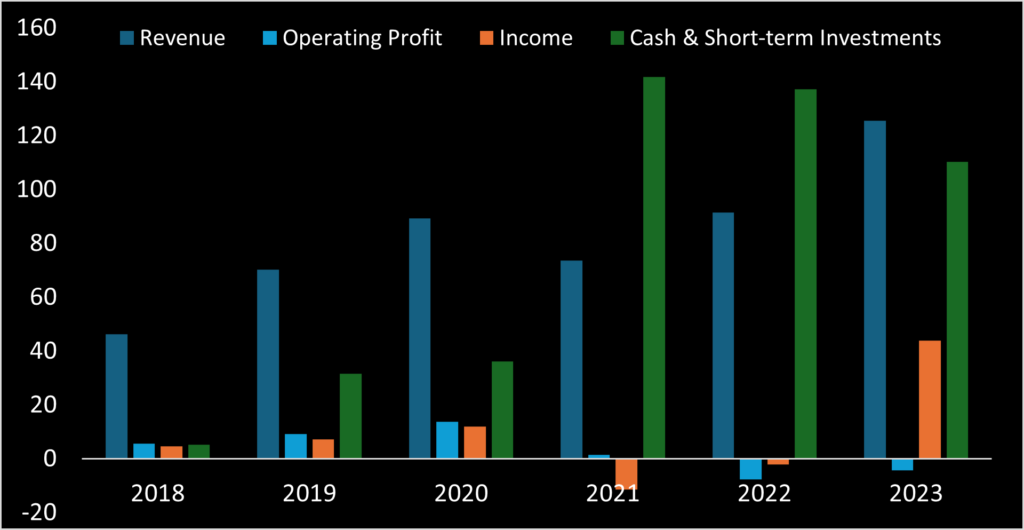

Examining Financial Disclosures

Satrec operated profitably up until 2020 and even paid yearly dividends. Sales dipped in 2021 but immediately rebounded the next year. The cash influx in 2021 was from Hanwha Aerospace investing ₩109B, through which it took a 30% ownership stake. Satrec still sits on much of this cash, but claims it will fund its SpaceEye-T constellation. As of September 2024 Satrec still had ₩110B (about $80M) in usable cash and short term investments. Other space companies would die for this amount of capital. Not Satrec, they just keep hording it.

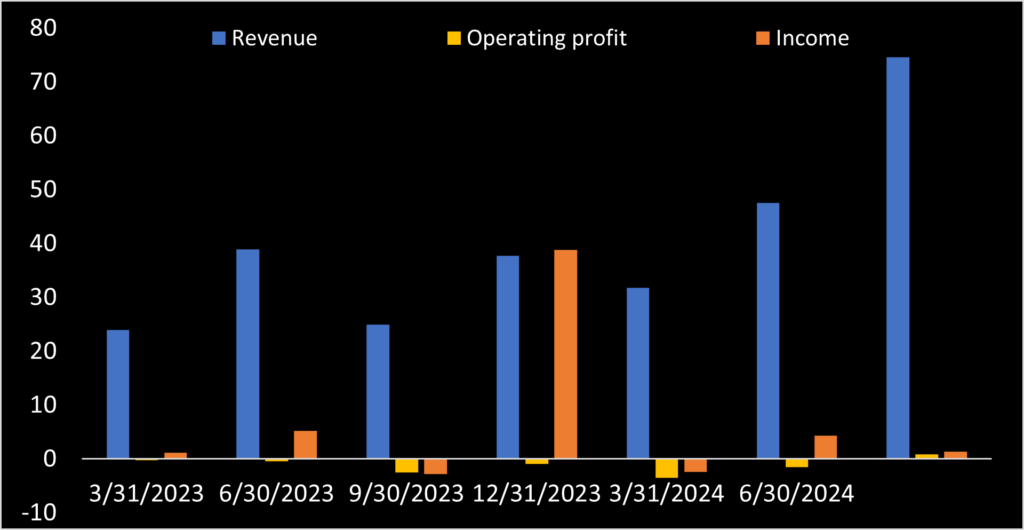

Satrec posted record revenue in 2023, ₩125.4B (approximately $91M). Be careful: the corresponding ₩43.9B profit was not result of operating profit, but instead arose from a corporate tax profit of ₩35.4B and ₩12B earned from investing the aforementioned cash. Satrec otherwise in 2023 had a ₩4.3B (about $3.1M) operating loss. Nonetheless, revenue gains, growth trajectory, and positive EBITDA (₩14.4B in 2023) are positive and investors have reacted favorably.

Quarterly data shows similarly. Huge income surge was seen in 4Q 2023 from that corporate tax profit. And 2024 Q3 broke revenue records for Satrec.

Satrec’s revenue by region shows huge shift. Satrec once was a significant global player, earning the majority of revenue from overseas. A 2021 Korean new article stated 65% of revenue was from sales to United Arab Emirates, Turkey, Singapore, and Malaysia. This is no longer the case. Satrec’s global sales lines are drying up. In 2023, 91% of revenue was domestic. Satrec purports an operating cost advantage and competitive pricing from being based in Korea, but customers outside Korea either don’t agree or don’t want Satrec’s product.

Satrec categorizes revenue from three business lines: satellite/hardware sales, raw imagery sales, and imagery/AI analysis. Satellite/hardware sales have been the driver of Satrec’s business over the past six years. Imagery sales are actually down over the same period. (₩6.6B in 2019 to ₩6B in 2023.) Modest growth was seen in imagery analysis and AI sales, ₩0.1B in 2018 to ₩4.7B in 2023. However this remains immaterial to Satrec’s total revenue. Finally, Satrec in its 2023 annual report sates sales are primarily to governments: “Major customers in the satellite business include domestic and foreign government agencies, government-funded research institutes, and universities.” Thus, combined with domestic/foreign sales data, we can infer that Satrec’s revenue is primarily driven by sales to the Korean government and Korean government-funded research institutes (i.e. KAIST and KARI).

Satrec sells imagery through subsidiary SIIS Co., LTD. SIIS sells imagery taken by KOMPSAT satellites, which are owned by KARI, a South Korean government funded research institute. Currently SIIS markets imagery from KOMPSAT-2, 3, and 3A and radar images from KOMPSAT-5. This will change after SpaceEye-T launchs, which SIIS will operate and sell its 30 cm resolution imagery. SpaceEye-T’s cost was previously reported as $100M. Satrec/SIIS really must shift into gear if they are to recuperate these costs. Current imagery and data analysis sales are ₩10.7B ($7.7M) yearly.

Satrec reports backlog in its financial filings, but it’s unclear how firm the commitments comprising backlog are. Presently the backlog is three-times current yearly revenue. Assuming the backlog is firm, future revenue growth looks nearly assured. And the assumption backlog is firm appears reasonable, since by its own declaration Satrec’s main customers are governments (primary South Korea).

Finally, we believe Satrec actually posses significant operating cost advantage. Jeon Bong-ki, Satrec Managing Director, stated low labor costs allow Satrec to offer lower prices, and price competitiveness is Satrec’s “greatest weapon.” Consistent with this, Satrec’s 2023 Annual Report disclosed 400 total employees with total average salary of ₩71 million (about $51,350). Assuming a comparative business in the United States pays average compensation of $120,000, this equates to Satrec saving $28M per year. Satrec has failed to translate this cost saving into a competitive advantage. Satrec’s international customers have disappeared and no signs exist they want back.

Management guidance scorecard

Satrec does not appear to provide guidance guidance.

(If you are aware of them doing so and can direct me to it, please let me know.)

CEO Ee-Eul Kim compensation

Ee-Eul Kim serves as Satrec Initiative’s CEO and President. South Korea does not require disclosure of executive compensation if under ₩500M per year (about $360,000). Satrec Initiative’s filings are mum suggesting Ee-Eul Kim’s salary is under this threshold. Satrec’s 2023 annual report states five directors and three executives collectively received ₩2,000M in compensation. From these two data points, we estimate Ee-Eul Kim’s compensation falls between ₩250M and ₩500M ($180,000 to $360,000).

Ee-Eul Kim is the least paid among all CEOs at publicly traded satellite optical imagery firms. Since his appointment to CEO in January 2019, Satrec’s stock price has risen four-fold. Yes, Ee-Eul Kim is responsible Satrec’s decline of international sales. And his apparent strategy to compete with New Space satellite imagery start-ups appears to be “more of the same.” But still he led Satrec into substantial growth and even achieved past probability in 2019 and 2020 (2023 doesn’t count). Shareholder value derived from his compensation is noteworthy, especially compared to his US-listed counterparts who get paid more while their stock value has declined.

Satrec Initiative outlook and risk assessment

Satrec has historically proven ability to operate profitably. Low operating costs and in-house satellite hardware with flight heritage is certainly advantageous. But Satrec appears at risk of falling into the trap of Old Space thinking and losing to New Space start-ups. South Korean government spending is keeping Satrec’s business afloat. Thankfully for them and its shareholder, it does not look like it will dry up anytime soon.

- The Korean government funds the majority of Satrec’s revenue and growth. South Korea plans a two-fold increase in government space expenditures by 2027. Thus continued revenue growth for Satrec is nearly assured.

- South Korean New Space start-ups entering the market will provide competition. Hancom Inspace launched a remote sensing satellite and ordered two more, albeit higher resolution and for different purposes that Satrec’s core market. Nara Space after launching its first optical imaging satellite raised $14.5 million to launch more, albeit higher resolution. Such companies transitioning to larger satellites with sub 1 meter resolution imagery and analysis (like Planet, Blacksky and Satellogic) will pressure Satrec’s sales of imagery satellites.

- Satrec plainly is failing to compete globally, and risks becoming a business dependent on South Korean government procurement and subsidies. Overseas revenue once contributed 2/3rds of total revenue, but now stands at 9% and shrinking. CEO Ee-Eul Kim should pause and reexamine his global business and sales strategy. His international sales manager should be re-assigned to serving green tea to company employees and replaced with someone who can actually drive global sales.

- Satrec’s most similar competitor, Israeli ISI, has contrarily found successes in foreign sales. ISI’s sells 95% of its satellite hardware and imagery to customers outside of Israel. Satrec could be doing the same. Satrec sits on cash, has tons of space heritage and know-how, and posses skilled labor at a cost 50% less than American competitors.

- But Hanwha’s 30% stake in Satrec is a positive, giving confidence a second set of eyes is overseeing business decisions.

- Satrec is likely to survive (and grow) just riding the curtails of South Korean space market expansion. Upside exists should Satrec successfully re-develop global sales channels and use their heritage, industry experience, and cash to shift into new business segments.

Pony riding still contains some risk of death, but generally is an accepted low-risk activity.

What to look from Satrec going forward

- Do Satrec’s foreign sales turn around or does management offer any plan for the same?

- Satrec will launch its first 30-cm SpaceEye-T satellite in 2025 and three more by 2027. They already claim competitive pricing. Does Satrec’s imagery and analysis/AI revenue shoot upward after the first’s launch?

- Satrec has posted impressive backlog growth but are there any signs that this backlog may not translate into revenue due to commitments not being strong?

- Do South Korea and its government research centers begin procuring major satellite hardware from any of the newer Korean space start-ups hinting Satrec’s main revenues may be at risk?

Recent News

-

Global satellite earth imagery market as seen through public company financials

Five satellite earth observation companies trade publicly: Planet Labs (NYSE: PL), Blacksky (NYSE: BKSY), Satellogic (NASDAQ: SATL), Satrec (KOSDAQ: 099320), and ImageSat (TLV: ISI). Yes,…

-

Satrec Initiative third quarter revenue break records; stock trades flat

Korean satellite imagery company Satrec Initiative (KOSDAQ: 099320) on November 12th posted record revenue in Q3 of 75.4b Won ($53.6m). This represents a 57% increase…

-

Satrec Initiative third quarter revenue break records; stock trades flat

Korean satellite imagery company Satrec Initiative (KOSDAQ: 099320) on November 12th posted record revenue in Q3 of 75.4b Won ($53.6m). This represents 57% quarter-on-quarter increase.…

-

Trump win pushes Satrec Initiative stock up 16%

Korean investors sunk money into defense themed stocks upon news of Trump winning the 2024 U.S. President Election. Satrec Initiative (KOSDAQ: 099320) was among the…

-

US & Israel use Blacksky and Maxar satellite imagery for Hamas War, not so much Planet Labs or Satrec

More fantastic reporting by Intelligence Online: shortage of Israeli homegrown SAR and optical satellites has provided opportunity for Blacksky and Maxar. Israel’s ImageSat (TLV: ISI)…