Blacksky’s 2024 2Q financial report was generally positive. EBITDA grew quarter over quarter from $1.37M to $2.145. And the -$15.8M net loss posted in Q1 shrank to -$9.4M. This is what investors want to see if Blacksky is to become profitable.

However, in Blacksky’s 2Q financial was one more line about “Customer C.” Blacksky first disclosed the existence of “Customer C” in its 2023 annual report. Customer C comprised 10% of Blacksky’s revenue 1Q 2024 revenue. In the 2Q report, Customer C’s revenue grew to 17% of total revenue making its Blacksky’s second largest customer. Since commercial revenue made up only 1.9% and 3.8% of revenue in Q1 and Q2, respectively, a commercial customer is ruled out. Simple math yields the following:

- 10% of 1Q 2024 revenue is $2.42M. This is within rounding error of $2.49M, Blacksky’s revenue sourced in Q1 from the Middle East.

- 17% of 2Q 2024 revenue is $4.24M, also within rounding error of $4.15M, Blacksky’s revenue sourced in Q2 from the Middle East. (More precisely, Middle East revenue made up 16.65% of 2Q total revenue, which rounds to 17%, matching the number reported.)

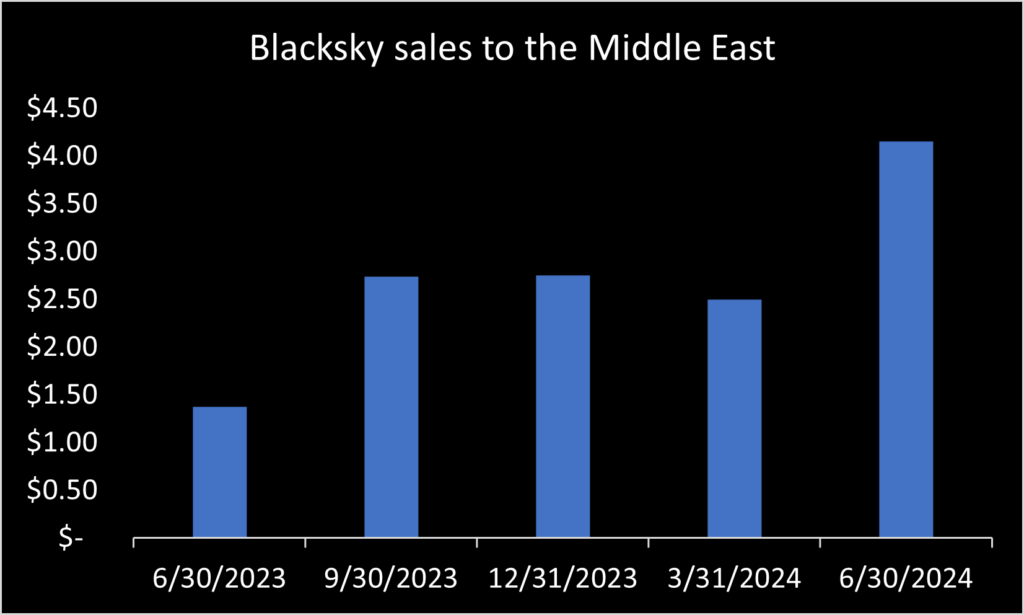

It seems that Customer C is a Middle Eastern government. And sales to this customer are growing. See total sales reported to the Middle East over the past five quarters.

This government customer is almost certainly Israel. And revenue in 2Q 2024 is at an all-time high, likely due to the Hamas-Israel war. This contract may be the $30M contract announced in June 2023 as Customer C revenue began appearing. And between June 2023 and June 2024, the sales have more than tripled. I am sure Blacksky is photographing as much of the Gaza strip as they can on each pass. (Blacksky satellite swath width is 6km; the Gaza strip is between 6 and 12km wide.)

If Customer C is Israel, this is consistent with Intelligence Online’s reporting, covered earlier, claiming Israel is Blacksky’s largest foreign customer. Intelligence Online also stated the Blacksky-Israel contract is valued at $150 million and Blacksky faced financial trouble on this contract. No trouble was revealed in Blacksky’s 2Q financials.

However, one point of interesting analysis is the amount of Blacksky’s current growth due to Customer C. Between 2Q 2023 and 2Q 2024, Blacksky’s quarterly revenue grew by $5.61M. During the same period, Customer C’s revenue grew $2.78M. Thus 50% of Blacksky growth over the past year is from Customer C. If Customer C is indeed Israel some of Blacksky’s revenue growth risk slowing if Israel’s satellite imagery demand decreases when the Hamas war ends. If the war continues, Blacksky likely will continue strong sales to Israel.