| Market Cap: kr246.2M TTM revenue: kr251.8M YOY return: -17.85% |

CEO: Luis Gomes Cumulative pay: kr8.7M Shareholder value created: -kr507.5M |

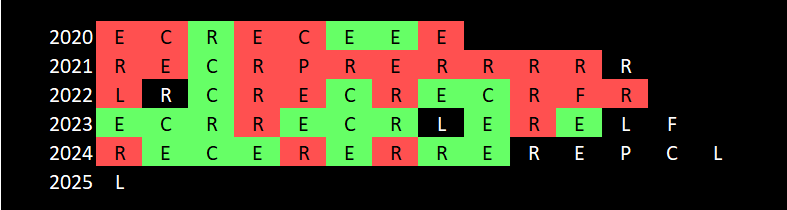

Forecast effort: B Forecast accuracy: D |

|

AAC Clyde is a Swedish headquartered CubeSat manufacturer listed on the Stockholm NASDAQ. With significant operations including a factory in Glasgow, AAC Clyde offers full satellites, individual components, and satellite data services. To say the least, this stock has had an rough ride. It is down nearly 90% since its January 2018 high. Investors have endured over 400% dilution, repeated missed forecasts, excuses, reoccurring losses, and management ignoring pleas and questions from shareholders. In a crowded CubeSat market, AAC Clyde has grown both revenue and backlog significantly over five years. In 2024, AAC Clyde finally hit two straight profitable quarters. Management forecasts sustained profitable growth for 2025 without need of additional financing. AAC Clyde already has become the first public new space company to operate profitably for two consecutive quarters. And with certain large projects visible on the horizon, may very well have likely bottomed out.

2 Minute Version

- AAC Clyde Space’s flight history traces to 2014 when Clyde Space launched of UKube-1 (3U size) into low earth orbit. Four years later in 2018 ÅAC Microtec, maker of satellite parts, bought Clyde Space creating AAC Clyde Space.

- AAC Clyde, now with heritage of 29 satellites, offers customers satellites, components, and earth data acquired from its own constellation.

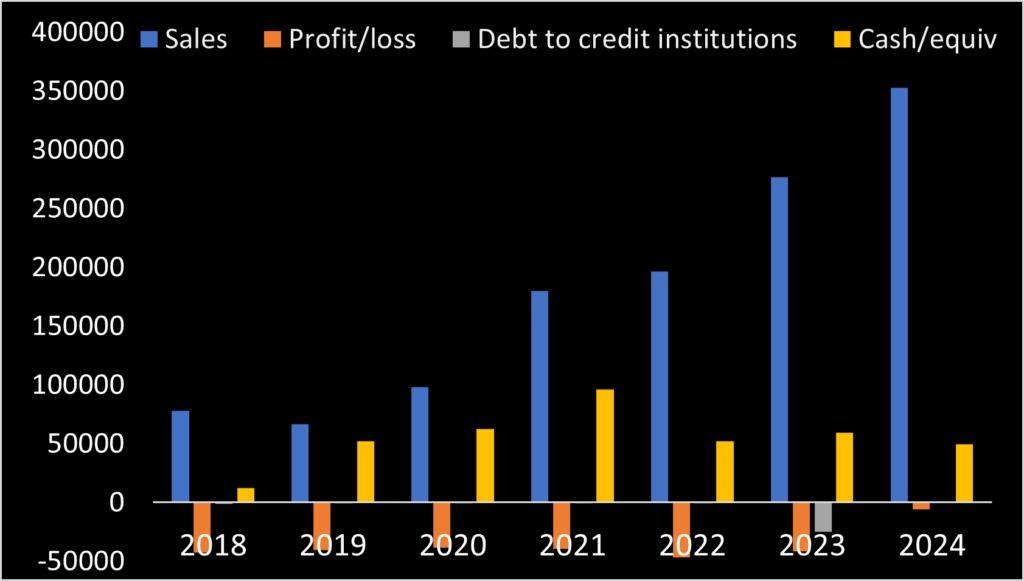

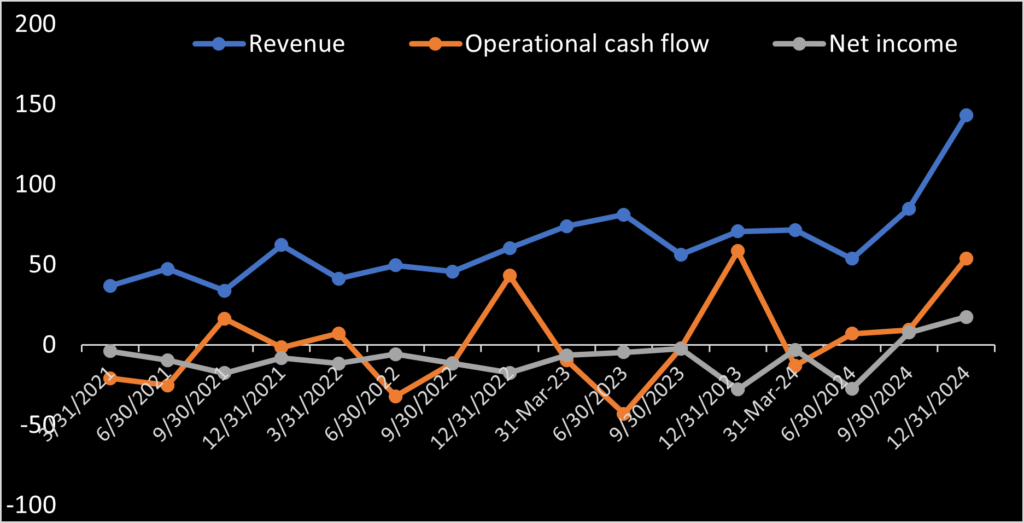

- Since 2019, annual revenue grew from SEK 66.4M to SEK 276.6M ($26.7m) in 2023. However this growth did not translate into profit. Yearly loss has been consistent since 2019, averaging -41M SEK (-$4.0M).

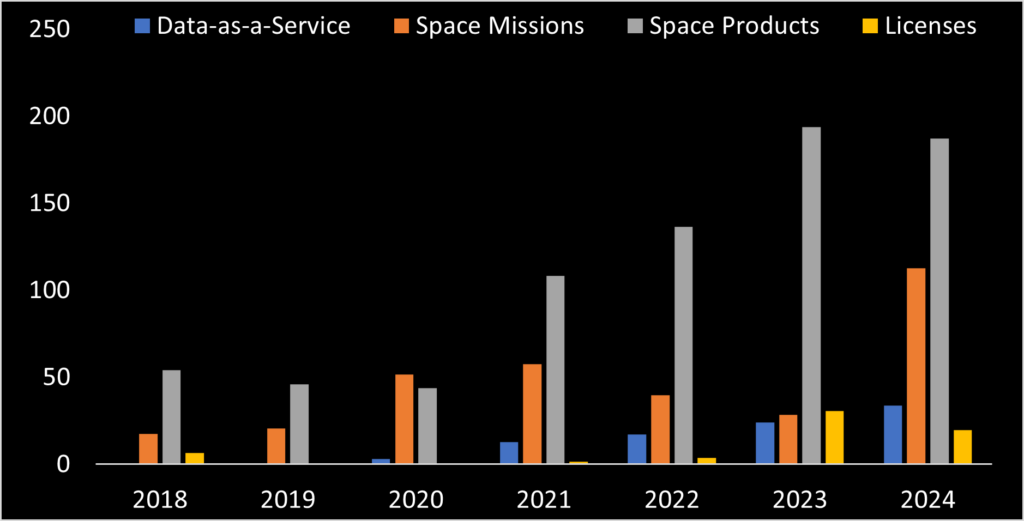

- AAC Clyde reports satellite data-as-a-service as its highest margin segment. AAC Clyde generates data service revenue primarily from selling maritime and now forestry data collected from its own satellites. Such revenue grew from 3.1M SEK in 2020 to 24.0M SEK ($2.3m) in 2023.

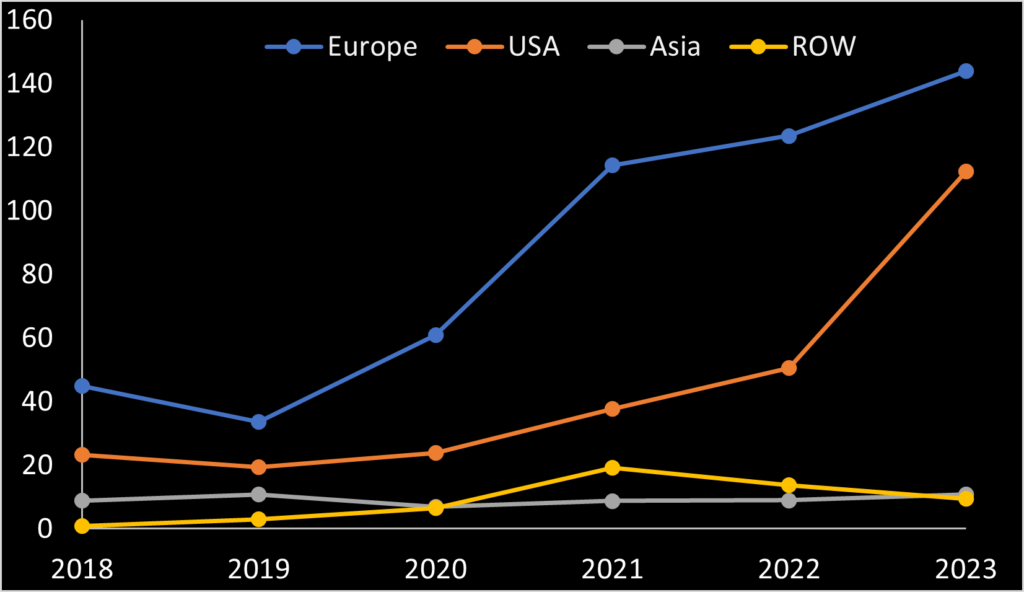

- AAC Clyde has experienced significant U.S. sales growth, surpassing competitor GOMspace in this area. These sales largely fuel AAC Clyde’s overall revenue growth. U.S. revenue totaled SEK 19.4M in 2019 growing to 112.4M SEK ($10.8m) in 2023.

- AAC Clyde recently suffered two failed satellites:

- Kelpie-1 launched in January of 2023 to provide AIS data to ORBCOMM. Payload performance after launch did not meet expectations.

- Kelpie-2 launched in June 2023 before experiencing a faulty antenna.

- AAC Clyde insured and collected claims on both Kelpies. Even though insured, these two failures still should be concerning. Failed deployment prevented AAC Clyde demonstrating high-margin revenue from sale of AIS maritime data to ORBCOMM, as planed. AAC Clyde returning to successful satellite deployments provides considerable revenue upside. Subsequent successful launch and deployment of Ymir-1 suggests AAC Clyde successfuly addressed the antenna issue seen in Kelpie-2.

- In a turnaround, AAC Clyde posted positive SEK 7.6M and SEK 17.3M profit in 2024 Q3 and Q4, respectively. Furthermore, AAC Clyde finished 2024 operating cashflow positive. It appears dilutive financing may become a thing of the past.

- In 2023 and 2024, AAC Clyde posted SEK 30.6M and 19.5M in royalty revenue, respectively. Although not disclosed, we believe for reasons presented below these payments stem from AAC Clyde licensing its power system to York Space. York Space has won multiple SDA contracts, and in August 2024 won another SDA contract for 10 more satellites. Thus significant future upside exists for AAC Clyde collecting more licensing revenue which essentially should be 100% margin.

- Further upside exists in the ESA’s Artic Weather Satellite (AWS) program, for which ESA plans launch of 20 satellites. AAC Clyde subsidiary AAC Omnisys is prime payload contractor for the AWS constellation. AAC Clyde noted this contract could exceed €73m. AAC Clyde provided payload for a test satellite launching in August 2024. Successful demonstration of this satellite could release of the rest of this contract, alone worth approximately twice AAC Clyde’s 2024 total revenue.

- Asia presently competes zero in the CubeSat. AAC Clyde like GOMspace has labor costs likely much lower than American firms with larger market presence (Terran Orbital’s Tyvak and Blue Canyon). So if AAC Clyde sustains profitability, investors likely can enjoy mid- or long-term success without threat of low-cost Asian competition.

Financial Disclosure Examination

AAC Clyde’s growth is actually quite remarkable and likely underappreciated. Revenues have grown more than double that of the greater nanosat market. AAC Clyde posted 43% CAGR sales growth over 2019 and 2023. Bryce Tech tracks and publishes the number of satellites published in each smallsat size class. According to Bryce Tech, the nanosat market – AAC Clyde’s primary market – increased from ~148 satellites in 2019 to 313 in 2024 (21% CAGR). However, AAC Clyde’s revenue growth has not been fully organic. AAC Clyde bought hardware providers Hyperion and Spacequest in 2020, the later contributing approximately 35% in additional revenue that year. But since these acquisitions, revenue growth appears organic over the past three fiscal years.

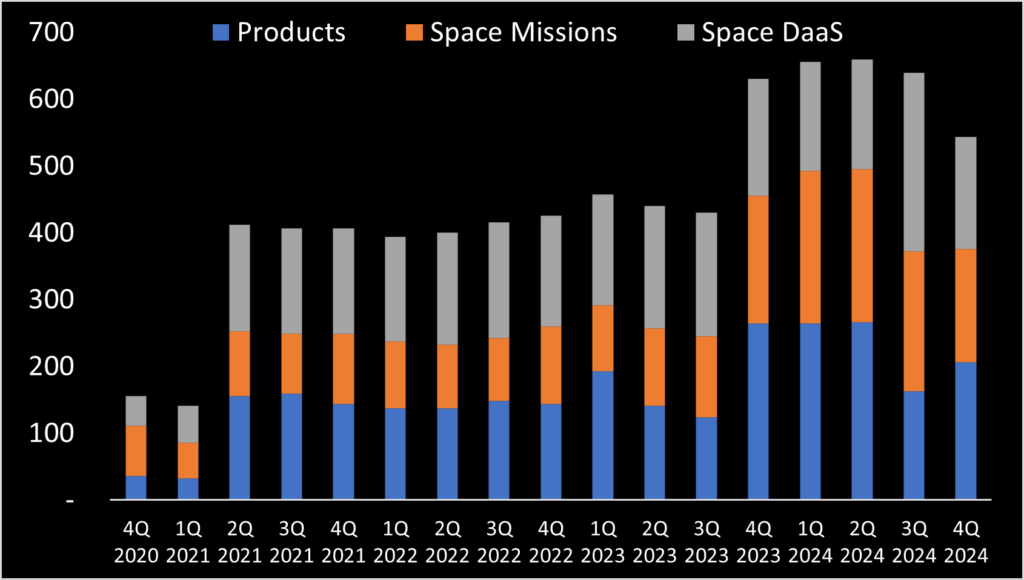

AAC operates in three segments. Space hardware sales fall under “Space Products.” This includes sales of he products made by Hyperion and Spacequest after acquisition. Sales of full satellites are segmented as “Space Missions.” AAC also launches its own satellites and sells acquired data under “Data & Services.” ( AAC Clyde management also sometimes call this Data-as-a-service, or DaaS.) DaaS has highest margins, around 30-40%. Space Products margins are less than half but a still healthy 10-15%. For Space Missions, AAC Clyde aims for 10-20% margins, but AAC’s recent financials indicate this segment has operated at a loss.

By all indications, analysis of segment revenue shows AAC Clyde’s 2020 acquisitions paid off. According to CEO Luis Gomes, satellite hardware and component sales now form the “bedrock” of AAC Clyde’s business. Prior 2020, AAC Clyde satellite sales were driving revenue growth while hardware/components sales were dropping. This trend has reversed. Satellite sales have slumped and hardware sales took off. The reason seems due to many CubeSat operators electing to make CubeSats themselves instead of procuring from manufacturers like AAC Clyde. But it’s like when you built your first computer in high school. Since making a hard drive, sound card, and motherboard was out of the question, you really did not build a computer but rather assembled one. Same for firms (and universities) building CubeSats. They often design and making their own payloads. But most don’t make star trackers, reaction wheels, communication transceivers, solar array systems, batteries, and the range of other components necessary for successful satellite operation. This is why demand for AAC Clyde’s satellite hardware still rises even while demand for full CubeSats declines. (Notice license revenue. This will be relevant to our theory on AAC Clyde below.)

Also encouraging is AAC Clyde’s revenue growth in the United States. The United States invented the CubeSat and the world’s largest CubeSat manufacture is still in California. Sales to Europe have dominated AAC Clyde’s business but AAC Clyde is making inroads into the US market. CEO Luis Gomes described this as his goal for AAC Space. Competitor GOMspace also indicated US sales penetration as its goal, too. But so far AAC Clyde has executed better on US sales growth. So AAC Clyde appears well-positioned to benefit from continued forecasted growth of the US CubeSat market.

Examining data quarterly, 2024 Q2 was disappointing. Revenue was down -25% quarter-on-quarter. Management simultaneously downwardly revised 2024 revenue forecasts from SEK 430-500M to SEK 350M-400M, approximately -19% change. This still represents 35% YoY growth at the midpoint of the range. Operational cash flow has been choppy, but AAC Space achieved positive operational cash flow in 2022 and 2023, and forecasted same for 2024.

AAC Clyde’s backlog has risen steadily. This shows AAC Clyde continues to close deals and provides strong evidence for more future revenue growth. Contract liabilities – prepayments not yet recognized as revenue – are also growing, increasing from SEK 70.3M in 2021 to 122.7M in 2023. As of the end of 3Q 2024, backlog stood at SEK 641M ($59m). Whereas overall growth is positive, investors really want to see growth in the high-margin Data-as-a-Service segment. Unfortunately, DaaS backlog has been flat for three years. Recall Space Missions (sales of full satellites) margins have been negative. CEO Luis Gomes told investors in the Q1 2024 report this was due to “legacy” missions providing negative margins. (Competitor GOMspace similarly also cut a number of legacy projects from its backlog due to unprofitability.) AAC Clyde advised the last legacy mission should be off its books in 4Q 2024. After that investors should look for whether Space Missions segment margins flip positive.

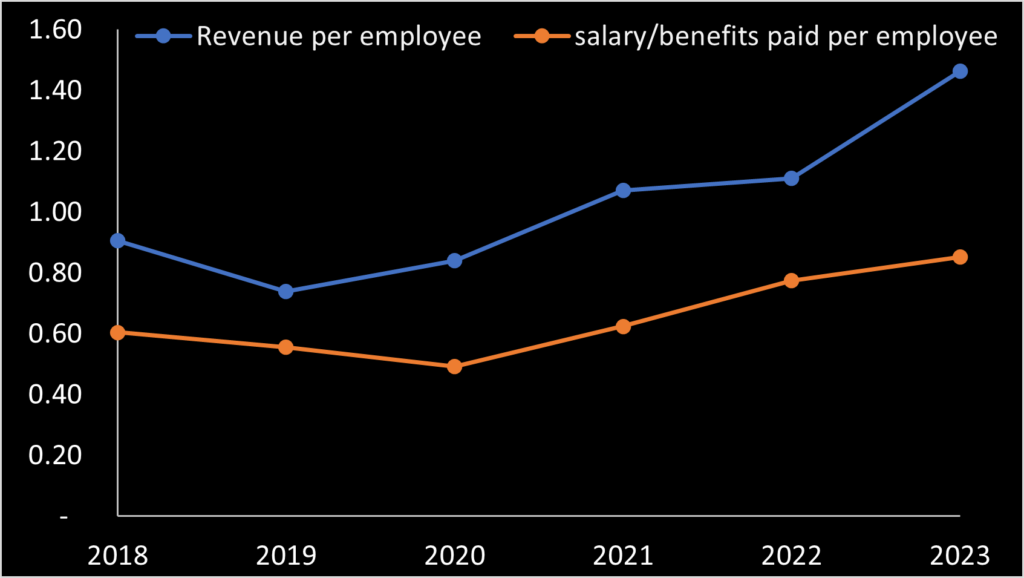

At the end of 2023, AAC Clyde reported 189 employees. In their financials, AAC consistently reports the total salary and benefits paid to employees allowing calculation of salary and benefits per employee. AAC Clyde wages-per-employee grew 73% from 2020 to 2023. At current exchange rate, employee’s fully-loaded salaries averaged ~$82,400. Even after this wage inflation, AAC Clyde likely remains in a competitive position globally. Whereas Nanoavionics in Lithuania certainly has a lower wage cost basis, AAC Clyde should be more competitive than US-based manufacturers. (Blue Canyon or Terran Orbital’s Tyvak.)

In FY23 AAC Clyde finished the year with the largest revenue-per-employee ratio in its history. By this metric, AAC Clyde is now operating approximately twice as efficiently than in 2019. This trend certainly contributes to AAC Clyde’s positive cashflow.

xSPANCION Project and 2023 Rights Issue

AAC Clyde xSPANCION project started in 2020. The project involves manufacture and launch of 10 satellites. The first four support AAC Clyde’s DaaS segment and the following six will launch customer payloads. The UK Space Agency is providing €9.9m, representing over half the project’s total €19.7M cost.

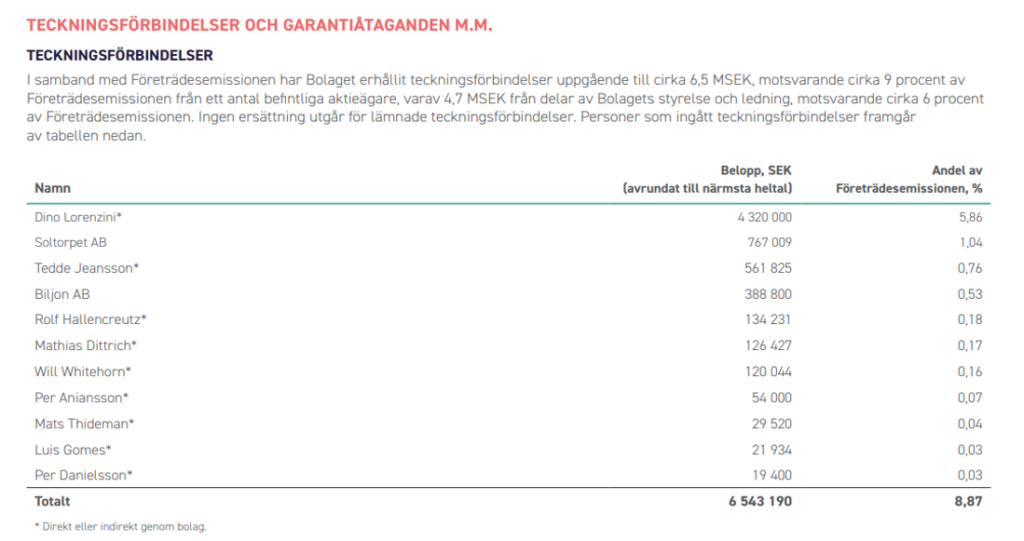

AAC Clyde lacked money to fund its share of xSPANCION. Before market open on June 7, 2023, AAC Clyde announced a dilutive rights issue for this purpose. That day, AAC Clyde Space stock dropped 38%. AAC’s goal was to raise a maximum of SEK 73.7 million before costs. AAC’s prospectus said raised capital would repay about SEK 20 million in loans and fund four XSPANCION DaaS agricultural data satellites. AAC Clyde said remaining funds would go towards the six remaining xSPANCION satellites. AAC Clyde pitched this to investors as a “great opportunity” and claimed the DaaS segment showed net margins of 30-40%.

AAC Clyde CEO Luis Gomes apparently was a big believer in his own project. According to the prospectus, he pledged 21,934 SEK (about $2,100) of his own money to buy new shares.

In July 2023 AAC Clyde announced the subscription ratio for its rights issuance was 45% and it received SEK 47.6M, before costs. Analyst Edison wrote that “take-up of 45% may seem disappointing.” Indeed, investors afterward questioned AAC Clyde about its low subscription rate and if future rights issues could be expected. Clearly investors fear more future dilution. It was not always this rough for AAC Clyde. In 2019, high demand led to an oversubscribed right’s issue. Unfortunately those investors apparently all lost money. Years of AAC Clyde subsequently missing forecasts and an investor base visibly frazzled, no surprise the xSPANCION capital raise was underwhelming.

However one point that raises flags is AAC Clyde representing in its prospectus 10% of proceeds are for 6 xSPANCION satellites. AAC Clyde after the rights issue stated they would sell these 6 satellites to customers. It is understandable why AAC Clyde required capital to build and launch four DaaS satellites. But for satellites sold to others? Examination of contract liabilities in AAC Clyde’s financials shows they receive significant prepayment from customers. Unless they required funds to develop new technologies for these satellites (which was not disclosed to investors), it is difficult to see why AAC Clyde raised money for these 6 satellites. Why were funds needed to sell products? AAC Clyde should just secure the orders like they always do, take prepayment, manufacture, and deliver.(🚩)

xSPANCION, although delayed, continues. AAC Clyde reports “the first four xSPANCION satellites went through preliminary design review (the first major review of the full, detailed satellite design) at the end of 2023. Manufacturing for the first two starts in the spring, in preparation for the launch of the first satellite in either late 2024 or beginning of 2025. These will be the first 16U satellites built by AAC Clyde Space and will introduce a new generation of EPIC VIEW satellites.” Management hit a home run by buying Hyperion and Spacequest. Investors will soon see management was right on xSPANCION too.

Kelpie Satellite Losses

AAC Clyde Space built two Kelpie satellites for AIS data collection from space. Maritime vessels constantly broadcast AIS data identifying current location, movement and other information. AAC Clyde contracted sale of Kelpie AIS data to Orbcomm (revenue segmented under AAC Space’s highest-margin Data-as-a-Service segment). Kelpie-1 launched in January 2023, but upon deployment, the payload failed. AAC Space described it a total loss. Kelpie-2 launched in June 2023, and after deployment its antenna malfunctioned. Again a total loss. AAC Clyde insured both satellites so financially these satellites losses did not impact AAC Clyde financially.

For concerns that the same problems may repeat in future AAC Clyde satellites, AAC Clyde addressed this:

Our CTO lead an extensive review of what went wrong, and several recommendations were issued and implemented by AAC and by the antenna manufacturer. These were implemented for Ymir-1 and for our upcoming satellites based on a similar design and I am happy to report that the antenna on Ymir-1 deployed successfully. (AAC Clyde, March 24, 2024)

However investors wanted to see AAC Clyde demonstrate it high margin revenues with these two satellites. AAC Clyde stated Ymir-1 will deliver AIS data to Orbcomm so AAC Clyde’s financials should hint soon wither DaaS margins remain as forecasted.

AAC Clyde Management – not vested in AAC Clyde Space stock growth

Dr. Dino Lorenzini, former SpaceQuest CEO who joined AAC Clyde after aquation, is the only Board Member holding a substantial amount of AAC Clyde shares. He holds 624,000 shares acquired from the sale worth >$1.5 million making him the only Board member with a financial interest in ACC Clyde’s success. The other five board members combined hold just 51,358 shares. Sans Lorenzini, the Board’s personal financial incentive to manage AAC Clyde in a way that grows shareholder value is practically nil.

Furthermore, Luis Gomes with over five years as CEO holds himself just 13,489 shares (~$70,000). Noone else on the management team owns more than 10,000 shares (except Lorenzini, as mentioned above). The leaders of AAC Clyde plainly have no skin in the game. All they get from AAC Clyde is a pay check. If AAC Clyde takes on debt and they still get that paycheck, fine for them. Based on this structure, it should come as no surprise AAC Clyde share price has been on prolonged decline. Management and the Board is not incentivized to manage the company in a way favorable to shareholder outcome.

All shareholders should be rallying behind Lorenzini. He is the only person in position of leadership at AAC Clyde with a vested interest in the stock’s success. Investors are hoping his influence can push AAC Clyde in the right direction. If he leaves the company or sells his shares, shareholders should be very concerned.

Say what you want about U.S. companies awarding large share-based compensation to executives. It serves a purpose, even though it may be excessive in certain cases. Shareholders of AAC Clyde should consider pressing the Board to re-evaluate executive compensation. Investors would be better off if AAC Clyde paid employees in-part in restricted stock as opposed to straight cash.

It is worth noting there that in August 2024, CEO Gomes stated achieving positive EBITDA in 2024 is his focus. As is maintaining cashflow. He claims he discusses this regularly with the management team and all are in understanding. Whereas investors certainly like hearing this, shareholders would be more at ease knowing that the Board and Management’s financial interest was aligned with their own.

AAC Clyde Space’s communication with shareholders

AAC Clyde CEO Luis Gomes regularly participates in presentations and Q&A with investors. His style is matter-of-fact without exaggeration or embellishment. He answers uncomfortable questions directly and expresses that he shares the same concerns and goals investors have about cashflow and profitability. These presentations are available online. Gomes deserves praise for investor engagement.

However, the same thing does not go for whomever at AAC Clyde Space manages investor relation. Something likely unfamiliar to investors outside of Sweden, the Swedish Companies Act requires public companies to respond to investor questions. AAC Clyde posts on its website written responses to questions it receives from shareholders. Plain reading of the Q&A instills a feeling AAC Clyde has contempt and annoyance with its own investors’ questions. Furthermore, AAC Clyde Space frequently ignores extremely relevant, but uncomfortable, questions from investors. This is a severe red flag. (🚩) It suggests AAC Space may be intentionally keeping negative information from the public. Multiple examples:

Q: How large share of the legacy mission remains? Once the legacy missions are completed, can we expect to see a positive EBITDA also for this segment?

A: We expect to finalize these projects during Q4 2024. (AAC Clyde Space, August 28, 2024)

This question stems from AAC Clyde’s 2024 2Q financial disclosure of SEK 19.1M in Space Mission revenue with SEK -5.1M EBITDA. In the Q1 2024 filing, as mentioned earlier, CEO Luis Gomes stated legacy missions were pushing Space Mission’s EBITDA negative. This shareholder sought information elucidating whether AAC Clyde expects to operate this segment with positive EBITDA after legacy missions complete. Completely reasonable. Any others who looked at AAC Clyde’s 2Q data certainly shared the same question. AAC Clyde Space completely ignored the question. (🚩)

Q: Earlier this year, when asked about guidance for profitability, Gomez answered that guidance for profitability might be provided later this year. Is profitability guidance still on the table for 2024?

A: We have communicated that we target an EBITDA margin of 5-10%. (AAC Clyde Space, August 28, 2024)

The shareholder asking this question appears to reference CEO Gomes in February 2024 telling investors AAC Clyde may provide EBIT forecast later in the year. Of course investors have interest in knowing whether AAC Clyde forecasts its own profitability. This investor simply asked whether AAC Clyde will provide such guidance in 2024 like Gomes previously suggested. The investor is not asking for the guidance – just whether or not AAC Clyde plans to provide it. This question is completely reasonable, especially in light of Gomes’s earlier statements. Instead of addressing the question directly, AAC Clyde blew off its investor’s question. (🚩🚩🚩) AAC Clyde responded sidestepping the question. As much as CEO Gomes appears a straight shooter, this communication by AAC Clyde provides difficulty to reconcile. It suggests CEO Luis Gomes may be toying with investors, tickling their ears with hopes of profitability, while holding back when push comes to shove because he knows issuing positive EBIT forecasts is not reasonable. (🚩)

Q: The royalty income has grown exponentially this year due to licensee starting up production. Do you expect the royalty income to stay on this level? The full cashflow effect is not expected until H1 next year. Can you elaborate on the timing of the cashflow?

A: Payment of the royalties impact cash flow and are made successively. We expect payments to be completed during the first half of 2024. (AAC Clyde Space, December 1, 2023)

As background, in 2023 approximately 11% of AAC Clyde revenue sourced from royalties. Naturally investors are interested if management expects royalties to persist or be a one time deal. This shareholder asked whether AAC Clyde expected royalties to stay at the current level. As eluded to above and addressed again below, I share the same question. AAC again ignored a very relevant question from the investor. (🚩)

CEO Gomes’s interactions with investors demonstrate he recognizes the importance of direct and honest communication. Gomes’s IR Manager who handles investors Q&A required under the Swedish Companies Act apparently does not. If AAC Clyde truly has nothing to hide, Gomes needs to get this under control, because AAC Clyde is providing to many reasons to suspect AAC Clyde may be hiding the ball from shareholders. (If AAC Clyde updates its responses to these and other similarly ignored questions, let me know. I would be happy to report that here correcting the record.)

As update, in October 2024 AAC Clyde announced hiring a new manager responsible for IR communication. Håkan Tribell starts in his role as the Head of Communications for Investor Relations and Public Affairs in January 2025. And AAC Clyde’s November 2024 answers to shareholders did not include any contemptuous responses

Data-as-a-Service revenue

AAC Clyde offers satellites DaaS for three applications: maritime, agriculture, and forestry. Management repeatedly reports DaaS as AAC Clyde’s highest margin revenue segment. Naturally shareholders are looking for strong DaaS segment growth.

AAC Clyde first reported DaaS segment revenue in 2020, posting SEK 3.1M. DaaS revenue now totaled SEK 24.0M in 2023. The trajectory continues: AAC Clyde reported SEK 20.3M so far in the first half of 2024. AAC Clyde recently began reporting EBITDA by segment. Over the six quarters of available data, DaaS EBITDA equals 51% of revenue, confirming the attractive margins.

Maritime – Current DaaS revenue comes from AIS data sales (market described in more detail here). Orbcomm contracted with AAC Clyde to purchase AIS data acquired by satellite. AAC Clyde built and launched two Kelpie satellites for this purpose, but as described above, both failed in orbit. Investors remain awaiting announcement of new plans to replace the capacity of these two satellites. AAC Clyde has been an early proponent of deploying satellites with the next generation AIS system, termed Very High Frequency Data Exchange systemS(VDES). Traditional AIS offers only one-way communication but VDES allows maritime vessels two-way communication through satellites. AAC Clyde with partners Saab and Orbcomm launched Ymir-1, AAC Clyde’s first VDES test satellite, in November 2023. CEO Luis Gomes claims Ymir-1 as the first successful VDES test in space, giving AAC Clyde a unique first mover advantage. Ymir-1 will also collect regular AIS data for Orbcomm. AAC Clyde’s strategic plan of SEK 2.2B in yearly revenue by 2030 is based in part on the success of VDES. They plan launch additional VDES satellites in 2025.

Agriculture – AAC Clyde Space operates three EPICHyper satellites and sells hyperspectral data from these satellites to Canadian company Wyvern Inc. This data is useful in detecting crops damaged by insects and changes in soil conditions, and farmers with this data can increase yields. AAC Clyde announced the four year contract with Wyvern totaled £8.4m and is extendable on a yearly basis. Wyvern with Orbcomm are AAC Clyde’s two largest DaaS customers.

Forestry – AAC Clyde also sell hyperspectral data for forestry application allow identification of diseased patches of trees. CEO Gomes described this quite succinctly in a recent investor presentation. The first customer is the Scottish government and xSPANCION funded satellites will host the payloads. The contract is small, just £612,000. Gomes said other potential customers have expressed interest, but AAC Clyde has not announced further sales.

AAC Clyde and York Space – a bull case for the stock?

Despite red flags present from poor communication, current information presents a possible bull case for this stock. Recall the 2023 licensing revenue in the figure above? AAC Clyde’s 2023 annual report revealed the amount as SEK 30.6 M. Page 48 provides slightly more detail, although not revealing the customer associated with this revenue:

Royalties from a license agreement were recognised for the period 2023 totalling USD 3.045 M (approx. SEK 30.6 M) relating to its power and data handling systems, triggered by the licensee’s start of production. (Page 48 of AAC Clyde 2023 Annual Report)

The phrase “a license agreement” in the singular suggests the source is a single customer. AAC Clyde reporting dollars here further suggests the customer may be from the US. Quarterly reports breakdown further SEK 6.1M of this revenue came in 2Q, SEK 26.2M in 3Q and SEK -1.7M in 4Q 2023. AAC Clyde never names the customer, including in any related press release or other communication.

AAC Clyde states they recognize royalty revenue when the customer begins production using AAC Clyde’s power system. But receipt of payment waits until after satellite manufacturing finishes.

We think this customer is York Space Systems for the following reasons:

- AAC Clyde announced in December 2017 a five year license agreement with York. The license agreement allowed York to manufacture AAC Clyde’s power systems for York’s S-class satellites.

- AAC Clyde’s Q3 2022 quarterly report stated, “AAC Clyde Space received royalties from York Space Systems of USD 0.48 M (approx. SEK 5.4 M) relating to its power systems.” This is about nine months before York-made Space Development Agency (SDA) Tranche-0 satellites launched.

- On February 22, 2024, CEO Gomes identified York Space Systems by name as a customer producing AAC Clyde’s subsystems under license.

Matching the time in 2023 when AAC Clyde recognized its licensing revenue, York reported on August 16, 2023 they were “currently manufacturing” 54 Tranche-1 satellites for the SDA. SDA awarded York Space $382M in February 2022 to make 42 Tranche 1 transport layer satellites. And in October 2022 SDA awarded York an additional $200M for 12 more experimental Tranche 1 satellites. If the $3.045M AAC Clyde recognized in 2023 stems from royalties York paid for manufacturing Tranche 1 satellites, this equates to about $56,000 per satellite.

In August 2020, SDA first awarded York $94 million to manufacture 10 Tranche-0 satellites. These launched on March 30, 2023. Its unclear when York recognized revenue for the power systems used in these satellites. If the $0.48M AAC Clyde recognized in 2022 related to these 10 Tranche-0 satellites, this equates to $48,000 per satellite. Remarkably similar.

York is on a roll winning these SDA satellite contacts. In October 2023, SDA awarded York another contract for 62 more Tranche-2 transport satellites. Then in August 2024 SDA again chose York for 10 additional Tranche-2 satellites. If York manufactures these with AAC Clyde power systems, AAC Clyde stands to collect about $4 million in additional licensing revenue. AAC Clyde announced it updated its agreement with its “existing customer, a US based supplier of space solutions, a license to manufacture its power and data handling systems.” This is certainly York. A week afterward CEO Gomes referenced this license agreement in the context of AAC Clyde future plans for growth.

Yes, $4 million in future licensing revenue from York for Tranche-2 may “only” equate to 15% of 2023’s annual revenue. But licensing revenue is likely 100% margin. This revenue could provide the cashflow necessary for AAC Clyde to reach positive EBIT – just like CEO Gomes eluded to in February 2024.

York has won contracts to make 135 of 474 SDA’s satellites. This makes York the second largest SDA contractor in terms of satellites, second to Northrup Grumman. Should York continue to win more government business with AAC Clyde’s power systems, substantial upside exists for AAC Clyde shareholders.

Management guidance scorecard

AAC Clyde deserves applaud for consistently providing short and long term business plan guidance to shareholders. Historically, AAC has not performed well at meeting the numbers. In its most significant failure, on November 24, 2022 AAC Clyde told investors they were financed for 12 months. Three quarters later they raised money with that rights issue. This dilution still stings.

However, in 2023 AAC Clyde changed pattern, hitting more guidance metrics than missed. In 2023 CEO Luis Gomes issued and reiterated positive EBITDA and operating cash flow for FY 2023. AAC Clyde hit both. CEO Gomes then forecasted increased EBITDA, increased sales, and positive operating cash flow for 2024. AAC Clyde hit these metrics too. And now for 2025, AAC Clyde forecasts profitable growth.

CEO Luis Gomes compensation

| Salary | Variable Remuneration | Other Benefits | Pension Expenses | Total | |

|---|---|---|---|---|---|

| 2019 | SEK 998,000 | SEK 97,000 | SEK 38,000 | SEK 1,133,000 | |

| 2020 | SEK 1,509,000 | SEK 90,000 | SEK 1,599,000 | ||

| 2021 | SEK 1,720,000 | SEK 103,000 | SEK 1,823,000 | ||

| 2022 | SEK 1,879,000 | SEK 47,000 | SEK 29,000 | SEK 113,000 | SEK 2,068,000 |

| 2023 | SEK 1,879,000 | SEK 47,000 | SEK 29,000 | SEK 113,000 | SEK 2,068,000 |

Luis Gomes joined AAC Clyde as CEO in May 2019. His salary seems modest. He holds 13,489 shares, worth about $45,000. AAC Clyde stock has lost 87% of its value under Gomes’s leadership. It really seems like it is now or never from Gomes to start turning things around. Gomes’s shareholders also appear to feel 2024 is now “the moment” for AAC Clyde to turn itself around.

AAC Clyde outlook and risk assessment

AAC Clyde looks like it may be on path to positive free cash flow and profitability, without additional dilution. This remains far from certain, but growth in DaaS very much could provide foundation for yearly positive EBIT. Also:

- AAC Clyde’s largest CubeSat competitors are Nanoavionics, EnduroSat, Spire Global, GOMspace and Terran Orbital’s Tyvak. Nanoavionics and EnduroSat likely have lowest operating costs due to manufacturing in Lithuania and Bulgaria, respectively. (Spire Global is based in the United States but assembles satellites in Glasgow, UK. GOMspace manufactures in Denmark; Tyvak CubeSats are made in the U.S. and Italy.)

- Low cost Asian manufactures currently provide essentially zero competition for CubeSats or individual satellite components. This is changing: Nothing from Japan, but Rapidtek in Taiwan announced development of low cost CubeSats (already manufacturing SmallSat antennas). Nara Space in South Korea began selling 6U-16U CubeSats after launching its first successful satellite. Nara Space’s prices must comedown before any competitors begin to sweat. It takes years to independently develop power, communication, attitude & orbit control, software systems. Thus there is time before cheaper competition becomes threatening.

- The CubeSat market continues growing. First-time SmallSat operators reached all time high of approximately 140 in 2023. This trend is promising, since as mentioned above, these operator regularly source parts from AAC Clyde. AAC Clyde’s Space Systems segment growth demonstrates they are capitalizing on this growth.

- AAC Clyde delivering two quarters of straight profitability in 2024 is what investors have been awaiting or years. Just watching investor Q&A with CEO Luis Gomes shows investors’ frustratation. However, things appear to be on the verge of changing. 2025 full year positive EBIT may be within question.

A bull case definitely exists for ACC Clyde. On the metrics, price-to-sales for example, AAC Clyde stock is significantly comparatively undervalued. Especially with near term profitability potentially likely. Back-to-back technological failures in the Kelpie satellites and AAC Clyde’s history of its IR department evading shareholder questions provides plenty reason for skepticism. But looking at their financials, contract liabilities (prepayments) expanding and repeated quarters of positive operational cashflow, a real chance exists for AAC Clyde to breakout.

What to look from AAC Clyde going forward

In future AAC Clyde investor disclosures, press releases, and CEO presentations, keep an eye out for:

- DaaS backlog growth. This is AAC Clyde’s highest margin segment and backlog has been flat for years. Aside from Wyvern and Orbcomm, there are no other known major customers.

- Success of the VDES project, and specifically the Ymir-1 satellite. Kpler (after acquiring it from Spire) now dominates the AIS maritime data market with its global network hosted on the Iridium Next constellation. AAC Clyde could find footing if its VDES partnership can lead to the replacement of AIS.

- York Space continuing its relationship with AAC Clyde and sustaining its streak of winning U.S. SDA satellite contracts. York’s power and data handling system licensing contributes 100% EBITDA revenue to AAC Clyde.

- AAC Clyde’s Space Missions segment (sales of full satellites) is to-date unprofitable. AAC Clyde hinted this may change in 2025.

- Continued U.S. sales and growth of AAC Clyde’s Space Systems segment. AAC Clyde growth in both the U.S. market and the Space Systems segment has exceeded the growth of the overall CubeSat market.

- Dr. Dino Lorenzini remaining vested in AAC Clyde space. If he leaves or sells shares, shareholders would loose the only person in leadership with a financial interest in AAC Clyde’s stock appreciating.

Recent News

-

AAC Clyde posts second straight profitable quarter(!) but not without concern

On February 20th, AAC Clyde (STO: AAC) released its year-end financial results for 2024, reporting record quarterly revenue and net profit for Q4 2024. The company…

-

CEO Luis Gomes rediscusses AAC Clyde’s plan for 2025

AAC Clyde (STO: AAC) CEO Luis Gomes again addressed investors driving sustainable profitable growth as the core company focus. Since the dilutive rights issue, Gomes…

-

AAC Clyde Space CEO Luis Gomes: 2025 goal is profitable growth

AAC Clyde Space (STO: AAC) CEO Luis Gomes deserves more praise for delivering frank and timely shareholder presentations. After Q2 when supply chain delays from…

-

AAC Clyde stock up 31% on Q3 record revenue and positive EBIT

AAC Clyde Space (STO: AAC) reported third quarter results which certainly pleased its active shareholder base. AAC Clyde in Q2 reported supply chain issues had…

-

GOMSpace’s Indonesia maritime contract closing delayed; stock down 10%

GOMSpace announced its high revenue Indonesia project last year in December. The project is contingent upon government-to-government financing but if it closes, GOMSpace will supply…

-

AAC Clyde Space sells four more Starbuck power systems (€1.025m)

AAC Clyde reports sale of 4 Starbuck power systems, plus services, for €1.025m (approx. SEK 11.6 M). Revenue is expected to be recognized in the…