Blacksky announced the 8 for 1 reverse stock split earlier this month on September 4th. At the time, BKSLY stock traded at $1.10. Accounting for the split, this adjusts to $8.80/share. There was no pending need to reverse split the stock, unless management anticipated downward price pressure (as we speculated was the case here).

Sure enough, that downward price pressure came.

Blacksky announced its second dilutive equity raise. This time $40m. Blacksky’s first dilutive stock offering came in March, raising $29.5m before fees. Management apparently thinks more money is required to keep Blacksky in the black. No surprise to shareholders examining Blacksky’s latest financials.

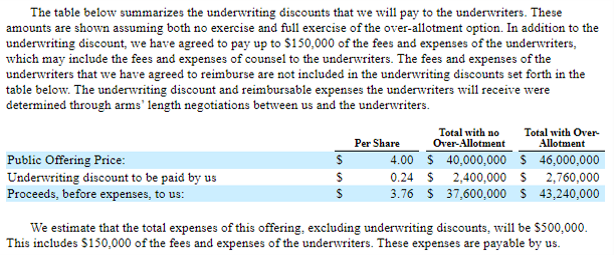

For the first raise, Jefferies LLC acted as sole placement agent for the stock. Blacksky agreed to pay Jefferies 3% commission on sold shares. Times apparently have gotten tougher for Blacksky. For the present $40m stock offering, Blacksky allocated Oppenheimer & Co 6.5 million shares to sell and Lake Street Capital Markets 3.5 million shares. Under the offering terms, each underwriter buys shares from Blacksky at $3.76 per share and resells them to the public at $4.00. Blacksky must further pay up to $150,000 in other fees to the underwriters. So for this second financing, to raise $40m through sale of new shares, Blacksky owes the underwriters $2.91m in fees. This is 7.275%.

So in less than a year, Blacksky’s cost to access capital has increased from 3% to 7.275%!

Blacksky should operate a new business segment – underwriting its own stock sales. More sales seem forthcoming. And with the fees Blacksky now pays its bankers, at least this segment should be profitable if vertically integrated.

With more losses in sight and management presenting no plausible plan to achieve positive cashflow, how much will Blacksky pay for its next stock sale? At this rate, Blacksky may soon approach the fees Sidus Space pays to raise capital, which apparently neared 10.5% for its most recent March 2024 offering.

Since Blacksky announced its reverse stock split, BKSY stock is down 54%. Crazy.