The latest Seeking Alpha article by Dhierin Bechai rates Satellogic stock a strong sell. No disagreement. Calculating a price-to-book ratio of 1.88, Bechai presents case for up to 64% downside. This downslide would give Satellogic a $0.39 share price and corresponding $35.34m market cap.

However, Bechai notes Satellogic has 23 satellites in orbit. Satellogic lists 13 of these Satellites were launched in 2023 and 2024 and should still have a significant life remaining. Satellogic satellites are similar in spec with Blacksky Block-2 satellites. Blacksky pays $3.7m per satellite to LeoStella for each of its satellites, not including payload cost. Blacksky contracted to launch with Rocket Lab, normally two satellites per rocket. Rocket Lab’s average Electron launch cost is about $7.5 million. So Blacksky pays about $7-8m for each satellite similar in spec to Satellogic delivered to orbit.

Someone like Blacksky may want to buy Satellogic just for its satellites in orbit. The 13 satellites launched since 2023, valued at $7m each, discounted by 70% yields approximately $37.8m of value, to Blacksky. This is remarkably close to the $35m figure Bechai separately calculated using price-to-book. But buying Satellogic for its short-lived satellites comes with the Tether debt Satellogic took on earlier this year. Doubt it is worth it.

Satellogic has proven minimal market exists for selling raw imagery from its satellites. They need AI and analytic services (like developed and provided by Blacksky, Planet or ISI). Either could be a buyer. But Blacksky is certainly out, because they don’t have the money. Blacksky itself already is nearing a pattern of repeated dilutive financings to stay alive. Planet Labs, apparent from conducting layoffs, too is managing cash in a way to reach positive cash flow before it runs out of money. Thus it is unclear who if anyone could afford to buy Satellogic now for its satellites, South American factory, and other assets. A better strategy would be to wait for Satellogic’s bankruptcy and try to onboard their customers then after.

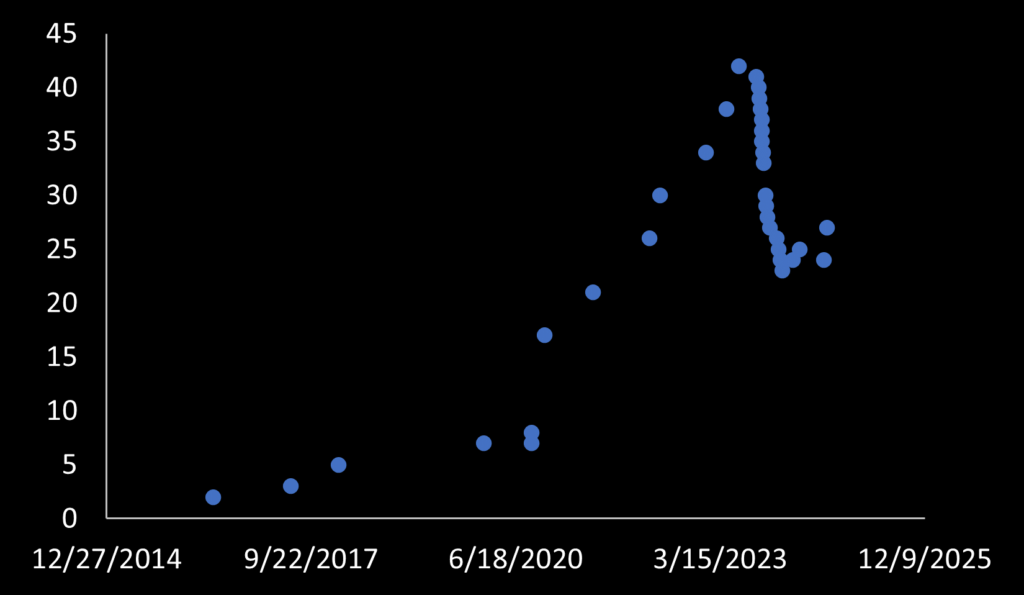

But as Bechai pointed out in his article, and was subject of another Seeking Alpha article earlier this year, Satellogic is running out of satellites. Using the same data Bechai references, constellation size vs time may be plotted.

Satellogic’s early satellites launched into higher orbits. These satellites had lifetimes greater than seven years (but likely at expense of worse spatial resolution). More recent satellites appear launched to lower orbits with higher resolution. But recent satellites have had lifetimes three years or less. Satellogic cannot afford to replace satellites on three year cycles for much longer. Satellogic is already out of money.