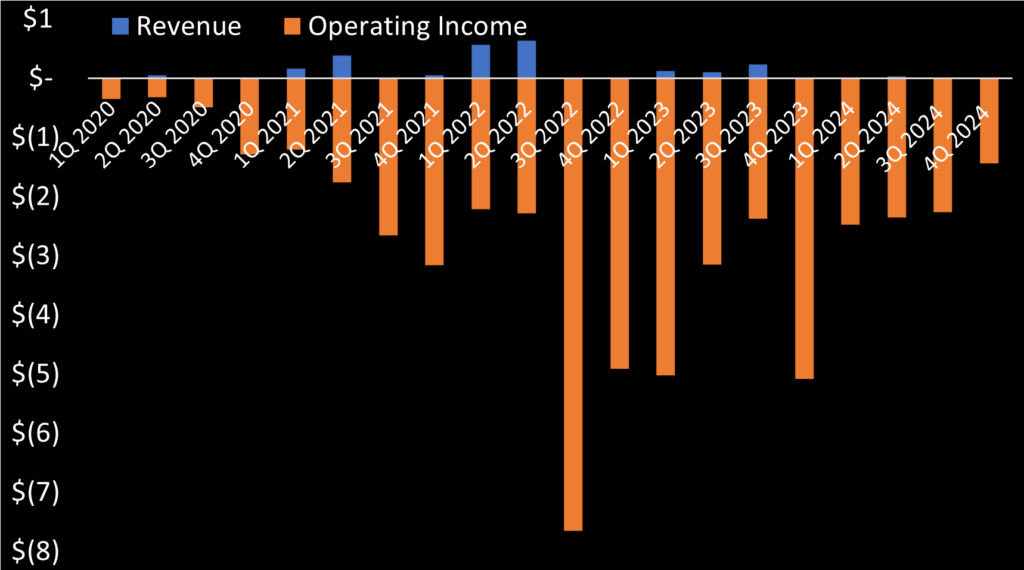

Ascent Solar (NASDAQ: ASTI) released its 2024 annual financials last week. 2024 revenue amounted to just $41,893, the lowest in the last 12 years. And fourth-quarter revenue was $0.00. Annual net income was -$9.1 million. ASTI headcount increased from 18 to 20. Not sure why because they apparently not selling nor manufacturing much.

It was not all negative. ASTI did decrease operating loss to -$8.5 million. And after selling $15.1 million worth of new shares last year, ASTI paid down nearly all of its debt. (One wonders who bought $15 million worth of new shares from ASTI.)

As previously noted, investor slides created by Ascent Solar in March 2024 then indicated 2024 revenue potentially could reach $9 to 13.2 million. ASTI achieved less than 1% of their own projection. Hopefully, anyone who bought ASTI stock based on that representation had significant other wealth and was not impacted by money lost investing on ASTI.

Despite the company’s struggles, CEO Paul Warley’s compensation appears to have increased significantly. In 2024, his salary and bonuses totaled $515,800, up from $484,600 the previous year. He additionally received $263,075 in stock and options awards, a new addition compared to 2023. The capital raised from investors purchasing new ASTI stock apparently funded Paul Warley’s raise

Meanwhile, ASTI’s own annual report states that current revenue and cash flow are insufficient to sustain operations, necessitating further capital raises:

We do not expect that sales revenue and cash flows will be sufficient to support operations and cash requirements for the foreseeable future, and we will depend on raising additional capital to maintain operations.

This aligns with a 96% stock decline in 2024, and suggests that continued stock sales, losses, and minimal revenue could lead to another reverse split and similar losses in 2025.