| Market Cap: $3.6M TTM revenue: $226.1k YOY return: -96.18% |

CEO: Paul Warley Cumulative pay: $201.9k (est) Shareholder value created: -$28.2M |

Forecast effort: F Forecast accuracy: F |

|

Ascent Solar Technologies remaining in business until now is plainly remarkable. ASTI manufactures and markets CIGS solar products. In space, most satellites use either silicon or costly Germanium triple junction cells. ASTI pushes CIGS, a lightweight and radiation resistant thin-film material potentially suitable for space. ASTI started CIGS development over 20 years ago when terrestrial application looked promising. Silicon prices dropped in the late 2000s, causing CIGS to lose competitiveness for terrestrial use. ASTI transitioned to marketing CIGS for HAPS and satellites. So far profitability, or even sales growth, remains unseen.

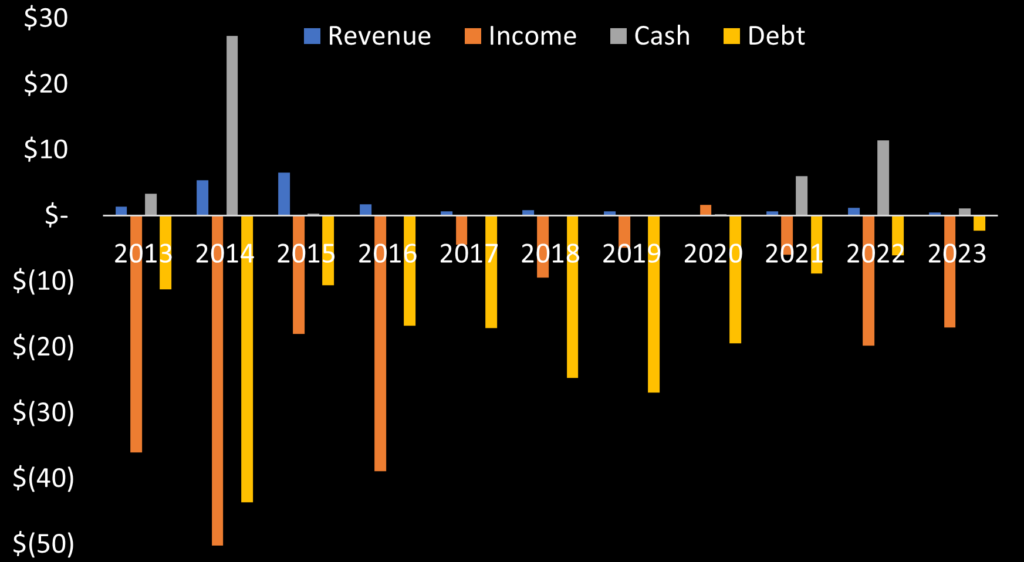

Since 2013, Ascent Solar’s annual revenue averaged $1.7m with losses averaging $18.6m. Death spiral convertible financing and dilutive stock offerings have become norm for ASTI shareholders. And ASTI’s Board decisions have raised serious questions about their ability to responsibly manage the company. For example, when Ascent Solar hired Jeffrey Max as new CEO in September 2022, ASTI’s was averaging just $563k in revenue over the prior five years. Yet the Board offered Max $19.0 million in compensation via stock options. ($3.8m of which vested immediately!) Jeff Max’s did not last a full year as CEO, so not all stock vested. But ASTI still paid Max $5.27m in compensation for working just seven months. Actions like this demonstrate how management has crippled shareholder value.

Ascent Solar’s CIGS solar sheets have flown on the ISS and two satellites. But in all three cases, ASTI was just an auxiliary power source apparently for testing purposes. With future sales not secured, Ascent Solar will likely require more money from investors to keep paying management’s salaries. Further dilution and Ascent Solar stock price decline remain as certain as ever.

2 Minute Version

- ASTI started in 2005 when CIGS panels offered potential for terrestrial solar sales. ASTI and fellow CIGS competitors Nanosolar, Solyndra, MiaSole, and Global Solar all were working on different CIGS products.

- But the price of silicon collapsed. Low-priced silicon panels made the economics of CIGS manufacturing untenable. CIGS manufacturers slowly went out of business. Nanosolar and Solyndra went bankrupt first. MiaSole and Global Solar stuck around but closed their factories in 2020. Only ASTI remains.

- ASTI, riding on the backs of investors sinking money into the company, now markets CIGS solar sheets for space. (ASTI also has one terrestrial product, similar in design to Solyndra’s tubular-based panels. But space comprises its first three of four market segments.)

- A small ASTI CIGS panel flew on the ISS in 2018. Since then two test solar arrays flew on two other satellites (Vigoride-6 and PTD 4).

- SCEYE, maker of HAPS airships, also selected ASTI to furnish ASTI’s lightweight solar for its high-altitude airship.

- ASTI’s financials are awful. Yearly net losses have averaged 20X more than annual revenue for 10 years. Nothing in ASTI’s financials even hints a turnaround may be forthcoming. How Ascent Solar’s placement agents find buyers of newly issued stock is miraculous.

- In August 2024, ASTI announced its cash will run out again in 1Q 2025. Shareholders should brace for another dilutive issuance of new stock or convertible financing event that almost certainly will again cut down ASTI’s stock price.

Ascent Solar’s CIGS space solar panels

Nearly all satellites use solar panels for power generation. Satellites typically use expensive Germanium triple junction solar cells providing efficiencies 30% and greater. For example, Boeing’s Spectrolab offers commercial space solar delivering 32% efficiency. Some LEO satellites, including SpaceX and Amazon, opt for silicon powered satellites at lower cost, but requiring larger arrays to deliver equivalent power.

The efficiency of ASTI’s CIGS solar panels is lower than both Germanium and silicon solar. Ascent claims reaching 17.73% efficiency with CIGS made in the lab. However their commercial Titan space module generates 16.5 Watts with size 336 mm by 289 mm, giving about 12.6% efficiency. So to deliver the same power, a satellite equipped with ASTI CIGS solar requires panels approximately two and a half times larger in area than a equivalent satellite made with Germanium triple junction solar cells.

However, CIGS does present some advantages for space use. CIGS is lighter weight, lower cost, and exhibits better radiation tolerance than Germanium triple junction. Lighter weight means satellites equipped with CIGS could potentially offer lower launch costs. ASTI’s investor presentation represents its CIGs cost is lower than Germanium triple junction, but more than silicon. ASTI CEO Paul Warley summarized the business case for his product as, “Ascent’s products save dollars and kilograms for the missions”

But ASTI’s high radiation tolerance is not that applicable for most LEO customers. Radiation exposure causes solar cell efficiency to decrease over time. To compensate, engineers design satellite with more solar than needed at beginning of mission in order to provide required payload power at end of mission. If the radiation calculated for a particular orbit deteriorates PV performance by 50% over 10 years, double the solar array size must be launched at outset to compensate for expected power loss. For long missions in high radiation orbits (MEO), ASTI’s increased radiation resistance thus offers a marketable advantage.

However, most new-space satellites operate in low-LEO. Here mission lengths are relatively short and so are radiation levels. Thus the benefit of ASTI’s radiation resistant solar panels is not as significant for most LEO satellites. Momentus, for example, flew a test ASTI CIGS array on Vigoride-6. That mission ended on schedule after just 3 months. This is too short a mission to recognize much advantage from a radio-resistant solar array.

Ascent Solar space heritage

ASTI’s CIGS first deployed in space on the International Space Station in 2018. The total size was apparently half an inch by two inches. Despite its tiny size, ASTI reported the array performed better than expected.

ASTI CIGS panels again flew on Momentus’s Vigoride-6 mission in 2023. Pictures of Vigoride-6 show Germanium triple junction solar cells made up its main solar array. Thus this satellite appears to have flown ASTI’s CIGS flexible solar array as an auxiliary payload. Pictures show the CIGS rollout array positioned on top of the satellite.

Most recently, ASTI’s CIGS solar flew on the LISA-T PTD-4 satellite, made by Terran Orbital for NASA. The purpose of the satellite was in-part to test the CIGS panels. Pictures of this satellite again show Gemanium-3J cells providing the main power source and ASTI’s CIGS solar being auxiliary.

🛰 PTD-4 will test a very high-power, low-volume deployable solar array with an integrated antenna called LISA-T. This is a partnership among @NASAAmes, @NASA_Marshall, & @TerranOrbital. pic.twitter.com/CpImpgnVJ4

— NASA's Launch Services Program (@NASA_LSP) August 16, 2024

Recently ASTI announced receiving a commercial order from a “mega constellation manufacturer” related to testing its CIGS panels. Details about the size of the order or whether the customer will test ASTI’s solar panels in space are unknown.

Ascent Solar commercial marketing

Ascent Solar’s product website seems severely lacking. Just two sentences describe each product. No product pictures, no datasheets, and no product specs. Compare to space solar competitors Rocket Lab, Spectrolab, and Azur. These competitors each present extensive information about each product, along with datasheets that satellite engineers reference when designing power systems.

ASTI’s investor presentations show evidence much effort went into drafting them. The same cannot be said for ASTI’s product website.🚩 This may help explain why ASTI’s revenues are so low. Or worse, it may indicate a lack of effort by management to seriously sells its own product due to it not being commercially competitive.

Ascent Solar’s financials

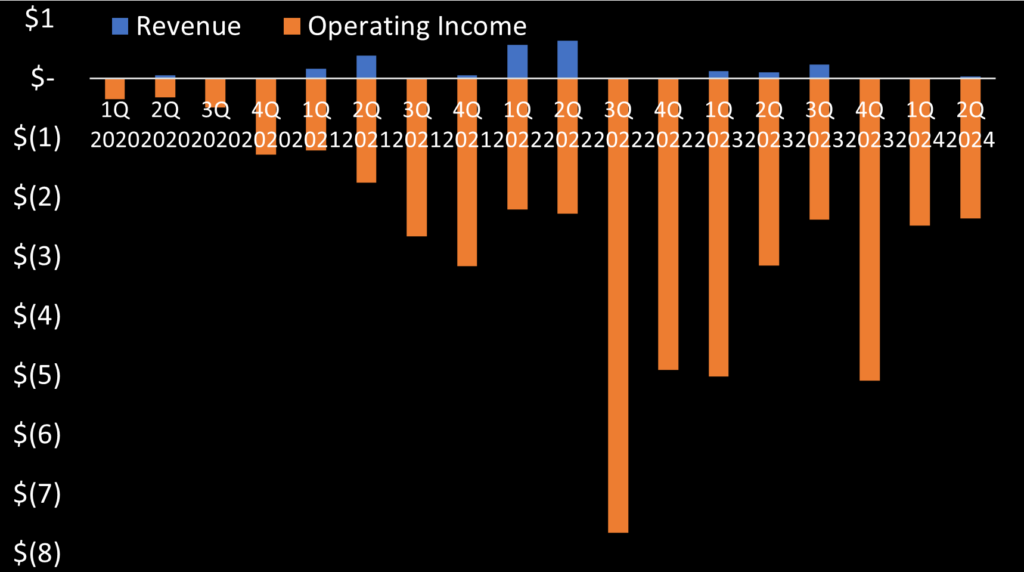

Examination of ASTI’s financial reports reveals a company persistently in poor financial heath, funded by shareholders who loose money buying shares from public offerings. Quarterly revenue and operating income tell the story: revenue is consistently tiny, and sporadic while operating losses dwarf revenue every quarter. No trend exists suggesting revenue is on any sort of track to provide future profitability. In fact the majority of quarters show just negligible revenue.

Examination by year shows the same. ASTI actually posted a $1.6m profit on paper in 2020. Don’t be fooled – revenue that year was just $66k and operating loss was $2.5m. Operating losses grew to $17m and $15.6m in 2022 and 2023, respectively. The only good news is ASTI has paid down a lot of its debt, which in 2019 was nearly $30m.

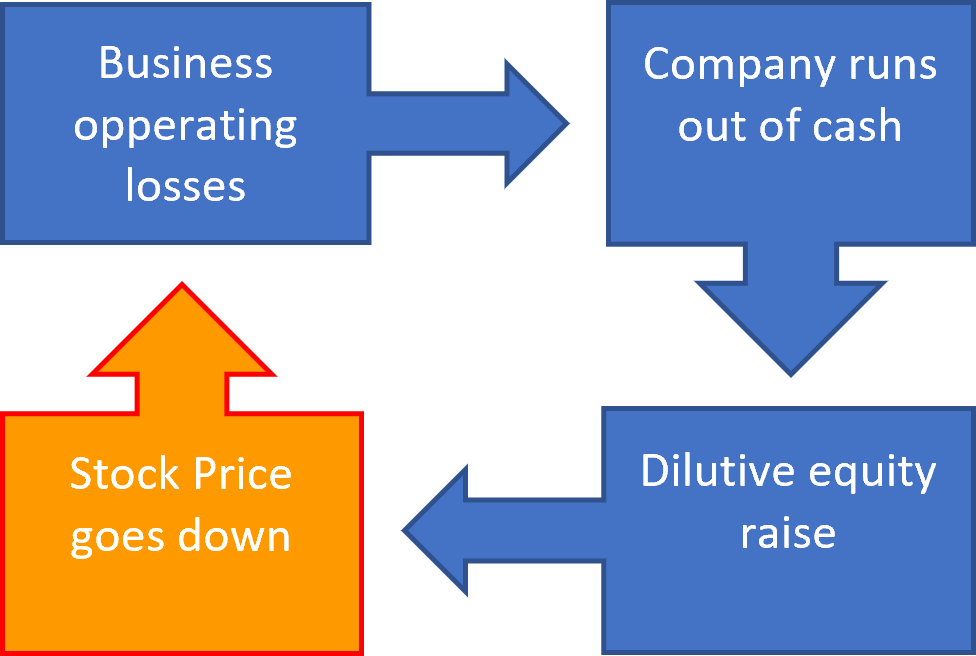

Ascent Space has been stuck in a cycle of business losses leading to financing events that lead to stock price declining. ASTI used death spiral convertible financing to raise capital. When buyers of ASTI’s debt thereby converted debt into shares, the agreed conversation price was under ASTI’s share price. Quick sales resulted in stock price sinking.

Specifically, ASTI’S SEC filings show debtholders of Ascent Solar’s “Widjaja” notes could redeem debt into shares at a discount of at least 20% less than the current share price. The discount was 35% for Ascent Solar’s “GS Capital” note holders. The resulting dilution and the noteholders’ sales of shares post conversation certainly pressured ASTI’s stock price downward.

ASTI finished 2Q 2024 with $5.8m in cash, but reported $2.4m in operating losses on negligible sales. Extrapolating, ASTI is on track to run out of cash in three quarters. In August 2024, Ascent Solar confirmed this, announcing cash levels could fund operations into 1Q 2025. Without revenue, shareholders should ready themselves for another dilative financing event continuing the cycle pushing ASTI’s stock price downward.

Revenue derives from four segments – a) Mega-constellation satellites, b) Space power production, c) Defense contractors, and d) Agri-voltaic. However ASTI does not disclose segmented revenue in SEC financial reports. Opaque reporting makes seeing where ASTI generates revenue almost impossible. In a September 15, 2023 investor presentation filed with the SEC, ASTI reported $80m in revenue “potentially could materialize” by 2025. ASTI management is dreaming. Management’s motive to put such phrasing into an investor presentation is questionable. The same presentation noted $60/watt as ASTI’s space CIGS price. To reach $80m revenue at this price equates to ASTI selling 1.3 MW of space solar panels. Only sales to a mega constellation would generate this level of revenue. Starlink already sources silicon solar for its satellites with higher conversation efficiency and a cost likely 10x less than ASTI’s CIGS arrays. A few other mega constellations are poking around (Amazon, Oneweb, IRIS2, Lightspeed, Rivada). The chance one of these elects a solar array that to-date has only been used on two satellites as an auxiliary, test array is fanciful. (To this point, MDA reportedly just chose mPower silicon panels for the Lightspeed constellation, not ASTI.)

ASTI provided an updated investor presentation in March 2024 lowering its price from $60 to $30-$45 per Watt. ASTI included the same $80m potential revenue figure for 2025. $60 per Watt found now buyers. The lower price may offer greater competitiveness, but to reach $80m revenue now requires sale of 1.8-2.7 MWs by 2025. This is literally supplying two mega-constellations the size of Lightspeed by 2025. ASTI management telling investors that they may potentially furnish this volume of solar panels by 2025 is almost suspect. Whereas it may be true ASTI may “potentially” sell such volume, me and all my nerdy coworkers may also “potentially” marry supermodels.

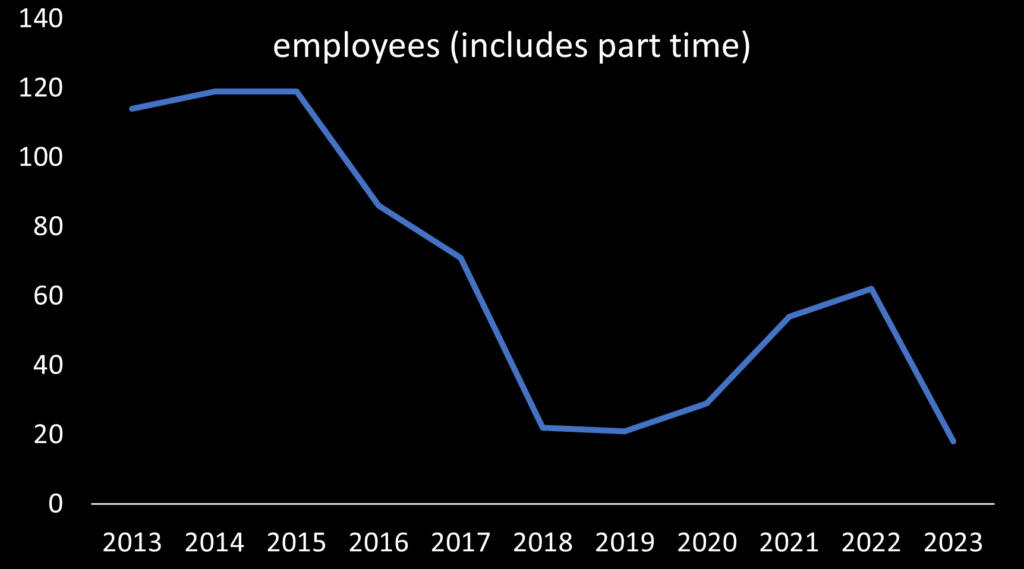

Lastly, if ASTI management actually planned to manufacture and deliver $80m of space solar to customers, one would expect ASTI to be hiring. After all, employees are needed to manufacture megawatt levels of solar panels. ASTI’s employee headcount instead dropped, finishing 2023 with 16 full time employees (and two part-timers). Per their 2023 annual report, at least three of Ascent Solar’s 18 employees are C-suite executives. This leaves 15 non-executive employees as of 2023. ASTI manufacturing and managing megawatt levels of solar deliveries by 2025 with 15 non-executive employees, again, seems preposterous.

Repeat public offerings cause dilution and push ASTI’s stock price down

With their CIGS space solar panel not generating significant commercial customers, ASTI is constantly running out of money. Instead of filing bankruptcy, ASTI keeps going through selling convertible notes or issuing new shares to investors. Both fundraising mechanisms historically have been dilutive for ASTI’s existing shareholders. Examination of ASTI’s stock chart shows such financing events correlate to chunky drops in ASTI’s share price.

ASTI even warns investors in SEC filings that convertible notes and new stock issuance “may cause the trading price of our common stock to fall.” With operating losses expected to continue due to lack of revenue growth, you can safely assume such dilutive financing to continue. But you have to tip your hat to Ascent Solar for being upfront and warning investors about its stock price falling. However, one wonders how many people read these warnings.

For example, in ASTI’s most recent stock placement, Ascent Solar engaged Dawson James Securities Inc. Before announcing this stock placement, on April 8, 2024, ASTI’s stock closed at $0.314. The next day Ascent Solar filed a Registration Statement with the SEC announcing Dawson James was engaged as placement agent for the stock offering. An prospectus dated April 11, 2024 then described the offering price would be $0.14 per share. On April 18, 2024 ASTI closed the stock offering, confirming shares were offered at $0.14. Gross proceeds totaled $5.09m, and Dawson James earned 8% on the stock it placed (except for referrals from Ascent Solar, for which Dawson earned 4%). Ascent also agreed to reimburse Dawson up to $155k for travel, and other expenses, including legal costs. Thus Ascent Solar paid approximately 11% in fees for Dawson James to sell stock totaling $5.09m. The same day, the share price closed at $0.106 per share. During the course of this offering, shareholders lost 66% of their stock value in the week since Ascent Solar announced the stock placement.

In Ascent Solar’s prior investment raise, shareholders observed the same pattern. Ascent Solar stock closed at $6.23 on September 25, 2023. Ascent Solar announced in a prospectus dated September 28th engagement of Dawson James to sell newly ASTI shares. The price was to be $2.88 per share. On October 2nd, Ascent Solar announced the public offering of new stock closed, and confirmed shares sold at $2.88 per share. Gross proceeds were $10m, but Ascent Solar paid Dawson James an 8% fee and up to $155k for other reimbursements. That day, ASTI stock closed at $1.75 per share. During this stock offering, shareholders lost 72% of their stock value in the week after Ascent Solar announced the stock offering.

As mentioned above, Ascent Solar issued a press release in August 2024 announcing its current cash amount will dry up in 1Q 2025. Without revenue, shareholders should brace for another dilative financing event continuing the cycle that pushes ASTI’s stock price further downward.

Management guidance scorecard

Ascent Solar basically provides no regular guidance to investors. Regularly quarterly forecasts given to investors projecting future revenue, cashflow, and profits? Look elsewhere.

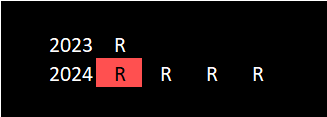

ASTI management in conjunction with two different new stock sales provided investors forecasts in investor presentations. In September 2023, ASTI advertised that 2025 revenue potentially could reach $80m. In March 2024 ASTI management reiterated the $80m potential 2025 revenue number. However in March ASTI additionally projected second, third, and forth quarter 2024 potential revenue of $1-1.2m, $3-5m, and $5-7m, respectively.

ASTI missed the 2024 second quarter $1-$1.2m revenue projection. ASTI similarly looks on track to miss all the forecasts management wrote into their investment presentations.

CEO compensation and performance

Paul Warley has lead Ascent Solar as CEO since April 2023. Before that, since December 2022 he served as CFO. Prior to that, “at Warley & Company LLC, Mr. Warley provided corporate finance consulting services to BD1 Investment Holding LLC,” one of ASTI’s largest stockholders.

Warley received $17,300 in salary and $2.086 million in stock awards in 2022, the year he joined as CFO. In 2023 he received $384,600 in salary and a $100,000 bonus.

Yet Paul Warley’s performance, as measured by value her created for his shareholders, puts him among other space stock CEO losers. ASTI stock traded at $4,880 (adjusted for splits) when Warley took over as CEO. Accounting for the approximate value of new shares at issuance, approximately $28.3m in value has been lost under Warley’s leadership.

ASTI outlook and risk assessment

ASTI is extremely risky. The primary product – CIGS based space solar panels – has not been adopted by satellite manufactures or operators. ASTI has publicized no large sales contracts. The declining number of employees suggests bodies are not needed to run the factory in order to meet customer demand.

ASTI has publicized three instances when its CIGS solar panels deployed in space. The total maximum cumulative wattage deployed thus far from pictures appears to be approximately two or three square meters. Using the spec ASTI publicized for its Titan model space panels, this equates to approximately 260-400 Watts. At $60 per Watt (ASTI’s price in 2023 before lowering to $30-$45 in 2024), this equates to $15,600 to $24,000.

One can easily begin to see why these small sales do not provide enough revenue for ASTI to pay its bills. As has happened repeatedly since its founding, ASTI will all but certainly resort to another dilutive financing round. And these dilutive financings, whether it be convertible debt or new stock issuance, will expectedly push the stock price downward.

Additionally, ASTI just has too many other red flags:

- ASTI states it has four different revenue segments. But ASTI does not disclose to investors segmented revenue. I am certain they have this data internally. One suspects ASTI does not disclose this financial data because it may reveal certain segments (space solar?) are not performing well.

- ASTI does not provide regular projections.

- ASTI issues press releases to announce letters of intent. What is the motivation for this? Why not just wait and announce when you have a firm contract?

Based upon information ASTI has released about it product, an articulable path to profitability is difficult to formulate. Investors should hope Ascent Solar engineers discover a way to break the laws of physics to make solar panels with efficiency exceeding the Shockley–Queisser limit. Until then, this stock nearly certainly looks like it will proceed downward in the future.

What to look from Ascent Solar going forward

Aside from the obvious (increasing portability back to prior levels), looking for the following:

- Any hint of commercial adoption of their product. Short of that, there is only one direction this stock will continue to go: 📉⬇️.

Recent News

-

Ascent Solar: multiple orders for space CIGS solar panels, revenue missing forecast

Ascent Solar (NASDAQ: ASTI) announced separate sales of its space-grade CIGS solar panels. The first order concerned CIGS panels optimized for receiving beamed power. The second…

-

Ascent Solar announces CIGS solar deployment on LISA-T satellite; stock drops 20%

Ascent Solar (NASDAQ: ASTI) announced yesterday on X that the LISA-T satellite deployed its CIGS solar array. Ascent Solar manufactured the solar cells used on this…