Blacksky announced an 1 for 8 reverse split on September 4th. At the time, the motive was perplexing. Investors apparently interpreted it as Blacksky management protecting against future downward stock price pressure. And the stock has retreated dramatically, down 35% in the two weeks since. Blacksky now stands with a market cap of $107.22m, nearly on par with Satellogic at $94.75m.

Both Satellogic and Blacksky are bleeding cash. Both required cash infusions this year. However, Blacksky’s trailing 12 month revenue is $106m. Satellogic’s is $13.7m. Both companies reported flat period-on-period growth in respective most recent semester (SATL) and quarterly (BKSY) filings. However, Satellogic’s spend vs cash balance suggests Satellogic will run out of money again this year. Blacksky apparently can survive into 2025, but carries substantially more debt, roughly $108m versus Satellogic’s $36m. But even with less debt, basically all of Satellogic’s assets are already securing existing debt.

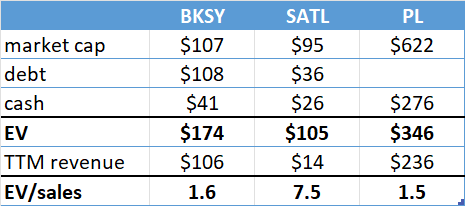

Adding in Planet Labs, the enterprise value to sales ratios of all three American satellite imagery providers is displayed in this table. Blacksky’s EV/sales ratio is becoming comparable with Planet. Satellogic by both EV/sales and price/sales appears extremely overpriced. Not intended to imply that Planet Labs stock is undervalued. It may very well be that all three (PL, BKSY, and SATL) are currently overvalued. But Planet uniquely has enough cash to cover at least a couple years trying to reach positive cashflow. (Or to wait for Blacksky to fold, which would be a gift.)

I doubt KKR or others are likely in the market for either Blacksky or Satellogic. Both’s revenue generating satellites will soon be deorbiting and need replacing. Satellogic manufactures likely the lowest cost <1m resolution imagery satellites worldwide, but lacks data analytic and AI solutions for customers. Blacksky’s satellites cost is likely at least 7x more via its half-owned joint venture factory (Leostella). But Blacksky offers customers meaning data analytics on top of imagery. Neither Satellogic nor Blacksky appear demonstrating a reasonable case towards reaching profitability, but I would bet on Blacksky right now over Satellogic.

Planet has to have discussed internally whether they have enough cash to wait for Blacksky to go under. Satellogic’s revenue is so small that it it bankrupts, this will minimally impact Planet. Even if Planet (or Blacksky) captures 100% of Satellogic’s customers after a Satellogic bankruptcy, this will only add $14m yearly revenue. Thus if Planet is eyeing anyone’s bankrupcy, it would be Satellogic. However Planet can only replace Blacksky’s customers with imagery from SkySats or upcoming Pelicans. (Dove satellites do not offer comparable resolution.)