| Market Cap: $460.5M TTM revenue: $100.3M YOY return: +44.96% |

CEO: Brian E. O’Toole Cumulative pay: $25.5M Shareholder value created: -$802.7M |

Forecast effort: C Forecast accuracy: D |

|

Blacksky operates a constellation of approximately 16 optical imagery satellites selling imagery and associated data analytics predominately to the U.S. government. Benefiting from vertical integration, Blacksky manufactures satellites at fully-owned subsidiary LeoStella. In 2021 Blacksky went public on a business plan modeling three years of approximately 100% YoY revenue growth. One feels bad for any earlier believers. Within a year, Blacksky failed to deliver on its business plan. Blacksky stock expectedly declined, down ~90% since going public. With reoccurring yearly losses, Blacksky already burnt through its SPAC raise. A dilutive private placement in March 2023 raised $29.5 million. Blacksky in April 2024 obtained $20 million more in commercial bank financing. And another $46m stock offering in September 2024 diluted shareholders even more. How much more dilutive financing will be necessary before Blacksky offers a path to positive cash flow? Hard to say, but it certainly appears like a lot.

2 Minute Version

- Blacksky operates approximately 16 optical imagery satellites made by LeoStella, a joint-venture formed with Thales Alenia Space. Blacksky bought out Thales’s share in October 2024 and now fully owns LeoStella.

- Blacksky’s current imagery satellites (“Black 2” or “Gen-2”) offer 85 cm resolution optical imagery. Blacksky caters nearly exclusively to high-resolution hungry government customers. Blacksky flies no 3U size satellites (equivalent to Planet’s Doves).

- In FY 2023, Blacksky sourced 98% of revenue from government customers, 62% of which was the United States.

- Blacksky’s main competitors for U.S. government business are Maxar and Planet Labs.

- Blacksky’s next gen satellites (“Gen-3”) have planned inter-satellite links, 35 cm optical resolution, and 1 meter infrared resolution providing data collection in low-light/night (government interest here) allowing for more competition with Maxar.

- Impressive 92% YoY revenue growth in FY 2022 reduced to 45% in 2023. Now, based on the midpoint of management’s outlook, 2024 growth is forecasted at just 17%.

- U.S. Government sales especially slowed, growing only 10% in 2023, compared to 82% in 2022 (original analysis). In 2024, U.S. Government sales have declined quarter-on-quarter since peak in 4Q 2023.

- More favorably, in 1Q and 2Q 2024 Blacksky reached positive EBIDTA, $1.37m and $2.145m, respectively. Net loss also shrank from -$15.8m in 1Q to -$9.4m in Q2. In Q3 EBITDA remained positive ($0.7m) but net loss increased back to -$12.6m.

- To become profitable, Blacksky must cut costs, increase high margin sales, or both. However since U.S. Government sales already comprise the majority of revenue, Blacksky must either outcompete Planet Labs and Maxar for U.S. government work, or find new commercial or foreign revenue sources.

- International sales channels presently offer Blacksky’s best path to growth and comprised the majority of 2023 revenue growth. However, satellites launched by well-managed (i.e. not Satellogic) firms located in countries with lower labor costs (i.e. Spacety and Chang Guang in China, and Hancom in Korea) will in the future challenge these international sales channels.

- Blacksky found a middle east government customer whose sales expanded 3x since from 2Q 2023 to 2Q 2024. After becoming Blacksky’s largest customer, sales slipped between Q2 and Q3 2024. It was been reported online this customer is Israel.

- As with Planet Labs, the long term financial prospects of Blacksky appear sketchy due to upcoming foreign competitive pressure. But Blacksky appears better insulated than Planet due to a larger portion of US government business (which foreign companies can’t service) comprising revenue.

Examining Financial Disclosures

Blacksky obtained access to about $283 million in capital through its SPAC deal. Its initial business plan presented to SPAC investors called for explosive growth leading to $386 million in revenue and $79 million in operating profit in 2024. This was a dream. Early investors likely feel they were suckers. Blacksky management has been forecasting 2024 revenue to be $102-118 million. Unfortunately profitability remains out of sight.

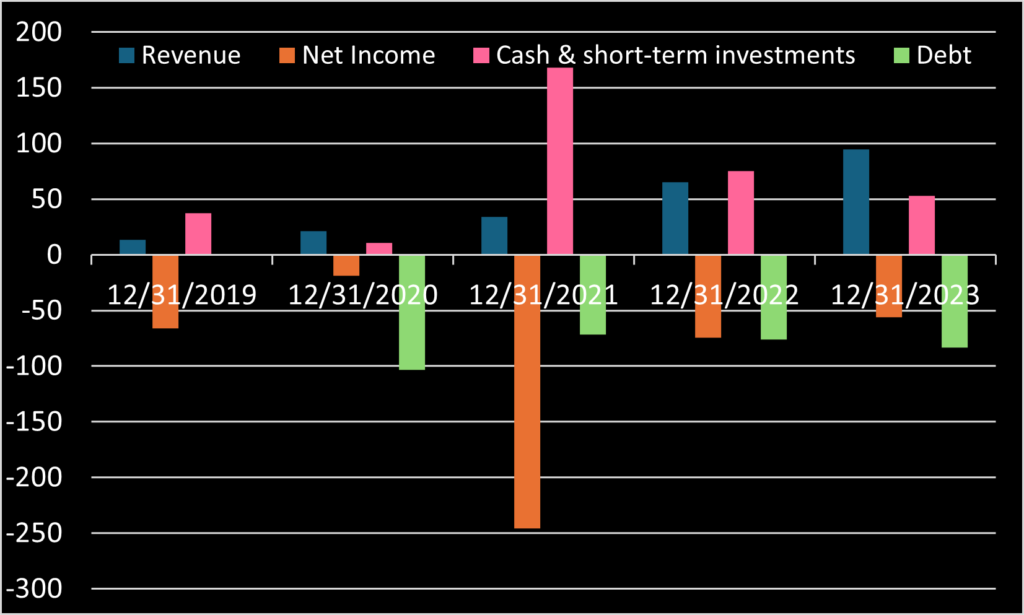

As depicted, Blacksky’s revenue is growing but cash is dwindling and debt is rising. (Note that 2021 income would have been about -$98m not counting for one time loss on issuance of Bridge Notes related to SPAC.) Blacksky finished 2023 with a $55.9m loss and holding $53.1m in cash and short-term investments. Another year of the same would result in Blacksky running out of money. Recognizing this, Blacksky obtained $20m in commercial credit in April 2024 and raised $46m more in September through selling stock. Will this cash be enough for Blacksky to reach sustainable positive cashflow?

Analyst Chris Quilty (Quilty Analytics LLC) asked Blacksky management this same question on the May 8, 2024 earnings call. Unfortunately, management provided a long winded response concluding, “they fully fund us on our path towards our next stage of growth.” What does this mean?!? Will the next growth stage (whatever that is) required external funding beyond this $20 million? This is Blacksky management failing to be clear to investors. Providing long-winded responses that appear to skirt the question makes it appear management is afraid to answer directly. (🚩) And this response proved to be potentially misleading at best: four months later Blacksky sold more stock to raise additional funds.

Blacksky categorizes revenue in four segments. Imagery its leading diver, but recently Engineering/Integration has materially contributed to recent two quarters’ revenue. Blacksky claims this and Professional category revenue are interrelated and expects both “will be primarily from contracts with existing U.S. and international defense and intelligence customers with whom we have contracted to perform development work prior to the implementation of their subscription service contracts.”

Notably Blacksky disclosed in a February 2021 investor presentation that gross margin for Imagery revenue was 90%, 60% for Software & Analytics, and 10% for Engineering. (Professional was not yet a category.) Revenue growth from Engineering is great for topline reporting. But according to Blacksky’s own prior disclosure this has the lightest impact on reaching profitability. Revenue growth for Imagery is more valuable for Blacksky in this regard. Unfortunately, after three straight quarters of growth, Imagery revenue decreased in 2Q 2024. Not a good sign.

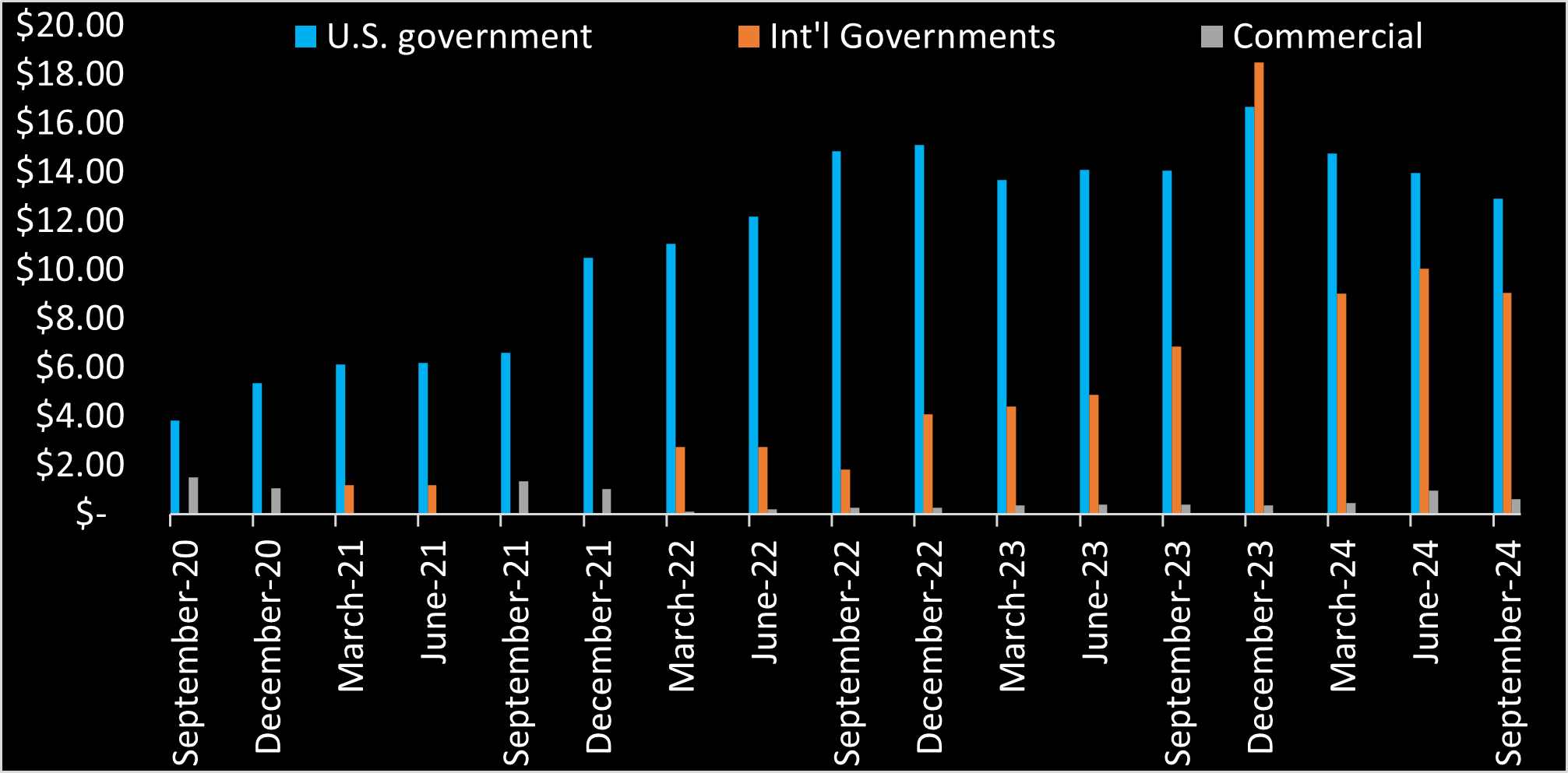

Analyzing Blacksky’s customer sources over time allows three observation to be made: (1) Commercial revenue once comprised 28% of Blacksky’s revenue pre-SPAC. Commercial revenue now stands at 1.9%, having declined both fractionally and nominally. (2) U.S. government-sourced revenue appears saturated since 3Q of 2022 since when there has been essentially no net growth. 2024 U.S. Government revenue is in fact down from 4Q 2023. Planet Labs shows the same trend with its domestic revenue flat for the past two years. (3) Blacksky’s recent growth fuels from increased sales to predominately two international governments (Israel and an Asian government). International sales is also fueling Planet’s current growth, so this may be an industry trend. However, this is a also a vulnerability for US imagery providers. International satellite operators cannot sell to NRO. But when international competitors’ satellite constellations come online, international revenue fueling Blacksky’s current growth will be at risk.

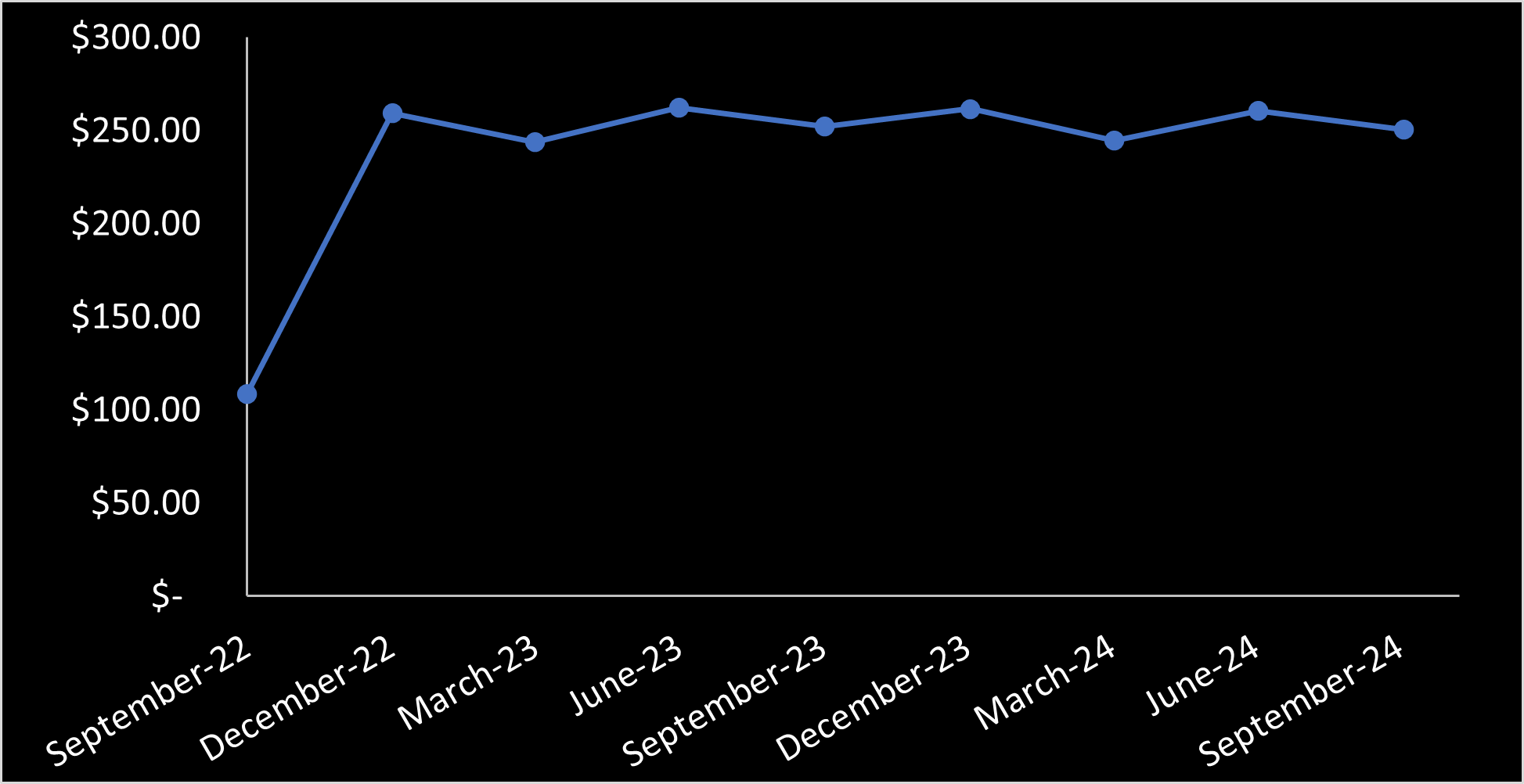

Blacksky defines backlog as future sales expected on received firm orders, not counting unexercised contract options (which are common for U.S. government contracts). Backlog being flat is concerning not just for the obvious reason. Flat backlog suggests new customers are not committing to long term contracts, adding further uncertainty to Blacksky’s ability to maintain growth.

Management guidance scorecard

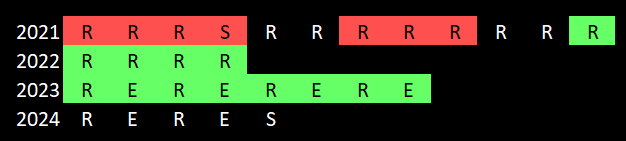

After going public, Blacksky missed basically all pre-SPAC forecasts. Just prior to going public in August 2021, Blacksky management issued revised forecasts. Blacksky went on to miss these too. In November 2021, two months after going public, Blacksky substantially lowered its guidance. With money now secured, the post-SPAC guidance Blacksky issued proved to be more accurate. But when investors woke up to learn Blacksky’s pre-SPAC “base case” was a “space case.” Blacksky’s stock repriced lower accordingly. Within just 6 months of going public, Blacksky stock lost 82% of its SPAC value. On a more brighter note, Blacksky management post-SPAC has provided investors lower guidance that it has been consistently hitting.

CEO Brian O’Toole compensation

| Salary | Bonus and non-equity incentive plan |

Stock and options | Other | Total | |

|---|---|---|---|---|---|

| 2020 | $375,000.00 | $425,750.00 | $8,462.00 | $5,500.00 | $814,712.00 |

| 2021 | $408,125.00 | $810,444.00 | $17,128,801.00 | $9,298.00 | $18,356,668.00 |

| 2022 | $465,000.00 | $646,350.00 | $1,794,114.00 | $1,727.00 | $2,907,191.00 |

| 2023 | $465,000.00 | $510,389.00 | $2,468,618.00 | $3,564.00 | $3,447,572.00 |

CEO Brian O’Toole (with other Blacksky executive management) hauled it in in 2021. This is the same year Blacksky management offered IPO investors those forecasts that proved wildly high.

According to Prospectus Supplement No. 1 to the prospectus data April 7, 2022, Blacksky’s “2021 Executive Bonus Program” awarded Blacksky executives with bonus payments for meeting certain corporate objectives including “the completion of the business combination between the Company and BlackSky Holdings, Inc.” (i.e. going public through the SPAC deal) and “certain related milestones, and “certain public company readiness objectives.” In other words, Blacksky executives received bonus payments based in part for successfully completing the SPAC deal, which was predicated on management’s financial forecasts that Blacksky failed to meet immediately the first year out the door.

After the crash of Blacksky stock, O’Toole’s compensation relaxed to “just” ~$3 million for each 2022 and 2023.

Since going public, Brian O’Toole has collected over $25 million in compensation. During the same period, the net value O’Toole has created for investors is negative. Specifically, shareholders have lost over $1 billion under O’Toole’s leadership as CEO.

Brian O’Toole owns about 2.8 million shares. So incentivize exists for O’Toole to do his job well and maximize the value of his stock. So far, this incentive has not worked out too well.

Blacksky outlook and risk assessment

Blacksky’s path to profitability looks grim. There still is a chance.

- Blacksky is an early adopter of <1.0 commercial satellite imagery. Regardless of missing initial forecasts, they enjoy current growth . And they may enjoy further short- or mid-term growth. But pressure from foreign competitors willl one day come.

- Blacksky’s business of satellite imagery is replicable. With launch costs going down and about to decease another 10x, competitors be able to offer competitive satellite imagery constellations on the cheap. Five or ten years ago starting a earth surveillance satellite business like Blacksky required extensive capital to cover expensive launches. Capital entrance costs are substantially declining.

- Competitors from Asia with lower operating costs will offer imagery at prices pressuring Blacksky. In Japan Axelspace has started launching its constellation with 9 satellites up and plans for 50; its average salary for engineers is reported as 7M yen per year (about $45,000). In Korea, Hancom InSpace launched its first, just ordered two more, also has plans for 50 total; its average salary is 53.9M Won (or $39,200). Unlike Planet with a constellation of 180 “Doves”, Blacksky only offers <1m satellite imagery so they should be more insulated from cheaper, higher resolution imagery from Axelspace (2.5 m) and Hancom inSpace (5 m). However Satrec in Korea plans launch of its first 30-cm SpaceEye-T satellite in 2025 and three more by 2027. They already claim competitive pricing. This is expected to pressure Blacksky.

- As with Planet Labs, Blacksky’s US government sourced revenue should be insulated from foreign competition, since U.S. intelligence and defense agencies award contracts only to US-based companies. (However note Satellogic moved from BVI to Delaware just to be eligible for US government satellite surveillance contracts.) But international governments sales now drive Blacksky’s current revenue growth. Competitors will be going after these customers and will either win it from Blacksky or force prices downward.

- Blacksky like Planet has worryingly high labor and overhead costs. Being only partially vertically integrated by owning half of LeoStella is partly why Blacksky Block-2 satellites cost $3.7m each (without payload). This is about 7x more than Satellogic to make a comparable satellite. As described, other players with lower cost structure are beginning to build and launching earth imagery satellites. Blacksky will require even greater cost-cutting, or else they won’t have much chance to operate profitably unless they win literally *all* U.S. government contract business from Maxar and Planet Labs.

Blacksky stock seems to caters to those with the same risk tolerance as snake handling preachers in the South. According to National Geographic, “Those who believe the word of God will be empowered to safely drink poison and handle venomous snake” — and apparently also buy Blacksky stock.

What to look from Blacksky going forward

With Blacksky’s next upcoming quarterly report, look for the following:

- Blacksky decreasing operating costs and further narrowing its net loss.

- Growth in U.S. government sales again. Blacksky’s current revenue growth stems from increases in sales to foreign governments. This revenue will be at risk in future, but U.S. government sales will be more protected. Blacksky investors long-term needs protected and sustained U.S. government business.

- How much does cash management and losses impact cash balances? If Blacksky cannot stop cash bleed, they will need money again and again. Three financing events already occurred in 2024. It is going to cost money to replace Block-2 satellites with Gen-3. More dilutive events will crush Blacksky stock even more. And it is difficult to think Blacksky will not need more money again in the future.

Recent News

-

Blacksky was 85% of LeoStella’s revenue pre buyout

Blacksky (NYSE: BKSY)’s 2024 annual report highlighted information about LeoStella, underscoring the intense competition in small satellite manufacturing.. In November 2024 Blacksky bought Thales’s 50%…

-

Satellogic saved by Trump’s election win, holds on

Satellogic’s (NASDAQ: SATL) 2024 annual financials shows no breakout. Revenue grew modestly from from $10.7 to $12.6 million. Net loss was $116 million, highest on…

-

Blacksky 2024 annual financials: slower growth, increased debt, more orders

Blacksky (NYSE: BKSY) reported 2024 Q4 and full year financial results. Highlights include: But ultimately low revenue in 4Q disappointed. Blacksky stock dropped 24% as a…

-

CEO Luis Gomes rediscusses AAC Clyde’s plan for 2025

AAC Clyde (STO: AAC) CEO Luis Gomes again addressed investors driving sustainable profitable growth as the core company focus. Since the dilutive rights issue, Gomes…

-

Global satellite earth imagery market as seen through public company financials

Five satellite earth observation companies trade publicly: Planet Labs (NYSE: PL), Blacksky (NYSE: BKSY), Satellogic (NASDAQ: SATL), Satrec (KOSDAQ: 099320), and ImageSat (TLV: ISI). Yes,…

-

Blacksky Q3 revenue drops on weaker U.S. and Israeli gov’t sales; buys out LeoStella

Blacksky (NYSE: BKSY) reported Q3 earnings on November 7th with reported revenue down 9.6% quarter-on-quarter. Blacksky’s two largest customers purchasing less contributed to this decline.…