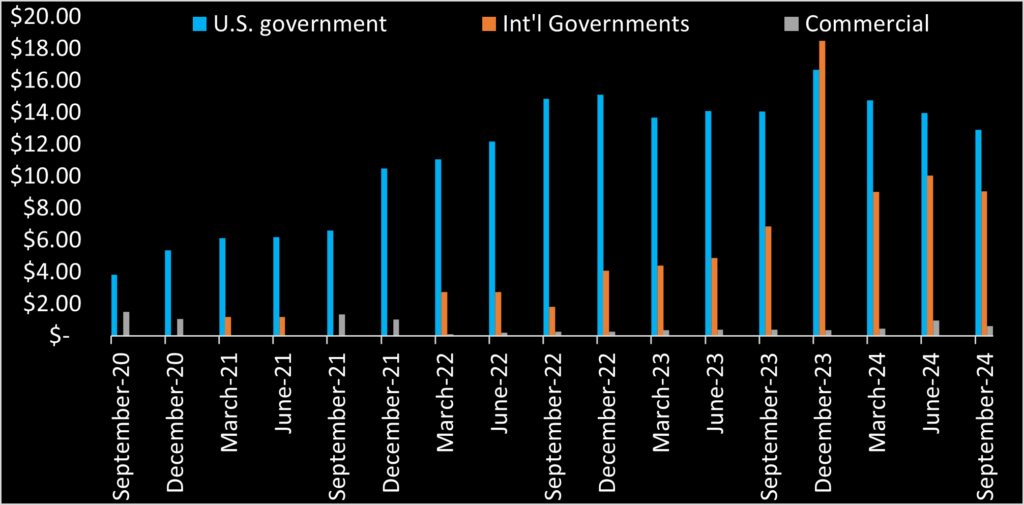

Blacksky (NYSE: BKSY) reported Q3 earnings on November 7th with reported revenue down 9.6% quarter-on-quarter. Blacksky’s two largest customers purchasing less contributed to this decline. Blacksky’s most significant customer, the U.S. government, posted sales 8.0% lower in Q3 than Q2. This marks the third straight quarter of revenue decline from the USG. USG revenue peaked in 4Q 2023 at $16.67m. Blacksky sales to the U.S. government since dropped 23%, now standing at $12.9m.

Additionally, sales to “Customer C” also dropped substantially significantly down quarter-on-quarter. We previously reported that Customer C contributed 50% of Blacksky’s growth over the past year, becoming Blacksky’s second largest customer. We think Customer C is a government in the middle east, likely Israel. We earlier wrote that “some of Blacksky’s revenue growth risk[s] slowing if Israel’s satellite imagery demand decreases when the Hamas war ends.” The Hamas war is not over, but Blacksky’s sales to Israel apparently have already declined 36%, dropping from $4.24m to $2.71m quarter-on-quarter.

Blacksky still has sales incredibly concentrated. In the third quarter, 87% of all revenue sourced from just three government customers: the U.S. government, Customer B (located in Asia), and Customer C (believed to be Israel).

Blacksky reported positive EBITDA which they attribute to cost discipline. Whereas net income was -$12.6m in Q3, Blacksky still had $64.4m in cash and short term investments as of September 30th. The public stock offering earlier in September shored up this cash position. Blacksky as of September 30th apparently held at least a year’s worth of operating cash at current burn rate.

BKSY stock rose 6.3% cumulatively Thursday and Friday following the release of Q3 earnings Thursday morning.

Blacksky buys out satellite manufacturer LeoStella

Blacksky also announced purchase of Thales Alenia Space’s 50% ownership interest in LeoStella. Blacksky has contracted with LeoStella for the manufacture of its Black 2 and Gen-3 satellites. Thales and Blacksky predecessor Spaceflight Industries formed LeoStella as a joint-venture in March 2018. At formation, Blacksky contributed cash and assets worth $7m. Between 2019 and present, Blacksky has paid LeoStella $126.2m towards Black 2 and Gen-3 satellites. LeoStella has struggled gaining significant business aside from Blacksky, so this purchase is not a large surprise. However, Blacksky has not revealed the amount it paid Thales for its share of LeoStella, nor did Blacksky disclose if they paid in cash. How this will effect Blacksky’s cash position thus is unclear.

Thales Alenia Space’s core business has also been struggling, apparently due to cost uncompetitiveness. Telesat famously had contracted with Thales to build the satellites for its Lightspeed constellation. MDA later proposed to build the equivalent if not better satellites for $2 billion less. Telesat cancelled its contract with Thales. Thales announced layoffs earlier this year, citing to weak demand. Thales thus could likely use the money from the sale of its interest of LeoStella.

Thales also was an early equity investor in Blacksky, investing $75m pre-IPO. However, Thales is likely anything but pleased with the performance of this investment. Thales’s BKSY shares held at IPO in October 2021 were valued at $163.6m. Thales should have sold them then and walked away. As of June 30th of 2024, the same shares were worth just $18m. Thales once had grand plans through an entity called Telespazio, S.p.A. to resell Blacksky imagery to certain EU customers. This was apparently a dream, as no large sales ever materialized. For a company watching its core space business struggle, Thales likely would have been better off never partnering with nor investing in Blacksky.

Lastly, whereas Thales has watched its Blacksky investment decline over $145m since IPO, the same cannot be said for Blacksky’s more recent investors. Blacksky in September 2024 sold 11.5 million new shares at price of $4.00. With BKSY stock now trading at $8.05, whomever bought those shares (had they held) would have enjoyed over 100% return in less than two months.