Traditional old space firms manufactured massive, high resolution satellites for governments. Lockheed Martin manufactured for the U.S. Government’s National Reconnaissance Office (NRO). Airbus in France, Satrec Initiative in South Korea, and Imagesat International (ISI) in Israel did the same for their home governments and government customers around the world.

The market changed in 1999 when US-based DigitalGlobe (now part of Maxar) launched 817 kg, 80-cm resolution IKONOS, the first commercial imagery satellite. DigitalGlobe within four years secured a $500 million NRO contract and then sold satellite imagery to Google. DigitalGLobe created an industry. Airbus followed, launching its own commercial satellites. Satrec too announced changing gears, planning launch of its first commercial imagery satellite in 2025.

The above optical recognizance satellites from Maxar and Airbus are state-of-the-art. But they come at trade-off of being huge, costly, and manufactured in small numbers. Due to each company operating just a few satellites, temporal resolution (“revisit time”) is limited by the satellite camera swath width and the frequency which the satellite flies above the target imagery location (dependent on orbit altitude and inclination). Maxar satellites, for example, revisit the same location once each 1-1.7 days. Customers desiring higher temporal frequency created a new market: cheaper, smaller satellites launched at higher numbers offering higher revisit rates at reduced spatial resolution. But the resolution gap is narrowing rapidly.

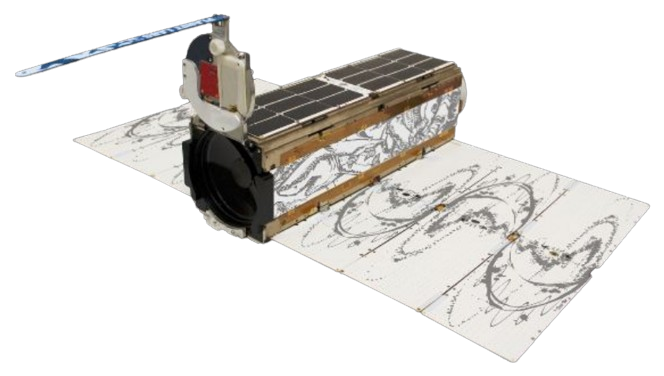

Skybox Imaging, first mover, entered in 2009 with plans for a 24 satellite constellation of 0.75 to 1 meter resolution and 5-7 daily revisits. Skybox launched its first Skysat (built by Maxar no less) in 2013 before Google bought Skybox the next year for $500 million. Skybox Imaging became Terra Bella and continued growing its Skybox constellation. In parallel, Planet Labs started in 2010 and launched its first test satellite three years later. Compared to Skybox, Planet’s satellite was a considerably smaller 3U “Dove” with higher 4.4 meter resolution. Planet continued launching Doves creating the world’s largest imagery satellite constellation.

In 2017, Planet spent $500 million to buy Terra Bella from Google acquiring its then seven Skysat satellites. Planet grew the Skysat constellation to 21 satellites to complement its 3U Doves. Competitors Blacksky, Satellogic and Axelspace successfully entered launching their own constellations.

Current Commercial Optical Satellites

Maxar, Airbus, Satrec Revolution, and ISI still compete with more traditional heavier, high-resolution imaging satellites. Planet, Blacksky, Satellogic, and Axelspace are the new space players operating substantially smaller satellites with lower resolution. However as Planet and Blacksky launch their next generation satellites (Blacksky’s 35 cm Gen-3 and Planet’s 30 cm Pelican), the resolution advantage hold by Maxar, Airbus, Satrec and ISI will end. (Currently U.S. law prohibits U.S. commercial satellite resolution under 30 cm, except images of Israel where the limit is 40 cm.) ISI is the sole old space company offering a small sat competing with the new space companies.

| Satellite | size |

Approx. No. in orbit |

ISLs | Swath Width |

Resolution | |

|---|---|---|---|---|---|---|

| Planet Labs | Dove | 3U | 180 | – | 25-32.5 km |

3 meter |

| Skysat | 110 kg | 21 | – | 5.9 km | 50 cm | |

| Pelican | 160 kg | 1 | Yes | 30 cm | ||

| Blacksky | Block 2 | 56 kg | 16 | – | 6 km | 1 meter |

| Gen-3 | Not yet | 35 cm | ||||

| Satellogic | NewSat | 37 kg | 25 | – | 6.5 km | 99 cm, 70 cm |

| Axelspace | GRUS | 95 kg | 5 | Yes | 55 km | 2.5 meter |

| SatRev | STORK | 3U | 5 | – | 5 meter | |

| Maxar | GeoEye | 2087 kg | 1 | 15.2 km | 46 cm | |

| Worldview | 2800 kg | 3 | 13.1 km | 31, 50 cm | ||

| Worldview Legion | 2800 kg | 2 | Yes | 9 km | 30 cm | |

| Airbus | Pléiades Neo |

920 kg | 2 | Yes | 14 km | 30 cm |

| Satrec Initiative | SpaceEye-T |

700 kg | 14 km | 30 cm | ||

| ISI | Eros |

400 kg | 3 | 12.5 km | 30 cm | |

| Runner |

86 kg | 1 | 5.6 km | 70 cm |

Notice Inter-satellite links (ISLs). Maxar and Airbus’s satellites have long been equipped with ISLs. ISLs enable satellites to communicate with data-relay satellite constellations enabling immediate imagery transmission back to earth. A satellite lacking ISLs generally stores imagery onboard until the satellite passes over a ground station when data is transmitted. The lag time between image capture and when the satellite passes over a ground station can be significant. (Blacksky advertises 90 minutes on average. Satellogic advertises <6 hours.) For many customers, real-time imagery access may not be necessary. But certain government customers desire real time satellite imagery. Both Blacksky and Planet Labs have taken notice. Both spec’d ISLs into their next-gen satellites. Axelspace already deployed ISLs into its satellites.

All companies above except SatRev, Axelspace and Maxar are public. Maxar was public until a $6.4 billion 2023 private equity take-private deal. Axelspace appears on the way, having closed its $44 million Series D in December 2023.

Financial Comparison

Planet, Blacksky, Satrec, Satellogic and ISI are compared below. iQPS providing radar imagery as opposed to optical is also included. Airbus although public, is a large conglomerate for which imagery revenue is immaterial. So comparison here would not be fair.

company

price

YoY change

market cap

CCE

debt

TTM revenue

P/S

TTM earnings

PE

iQPS

¥961

+134.62%

¥36.5B

¥5.9B

¥210M

¥1.7B

22.1

¥-427M

-85.4

Satrec Initative

₩47450

0.00

₩519.6B

₩55.8M

₩0

₩133.2B

3.9

₩133.2B

3.9

Blacksky

$14.96

+44.96%

$460.5M

$35.4M

$85M

$100.3M

4.6

$-55.9M

-8.2

Planet Labs

$5.44

+137.55%

$1.6B

$275.6M

$0

$228.5M

7.1

$-135.4M

-11.9

Satellogic

$3

+94.81%

$285.2M

$23.5M

$36.4M

$10.1M

28.3

$-61M

-4.7

ImageSat

₪13.34

+23.29%

₪816M

₪90.7M

₪116.4M

₪191.6M

4.3

₪6.1M

133.7

The following observations can be made, in order of approximate significance:

- Satellogic’s price-to-sales ratio is incredibly high, especially compared to Blacksky and Planet. Satellogic thus seems to be trading at a significantly overvalued price.

- iQPS appears overvalued. Even though the price has retreated, its price-to-sales is absurd. They would have to grow revenue by 10x next year to equal Planet Labs – not going to happen.

- Planet Labs has a higher price-to-sales than Blacksky, likely do to its excessive cash reserves accounted for by the stock price.

- Satellogic took on debt not reflected here yet, because data is based on Satellogic’s most recent SEC filings, which pre-date the debt agreement.

- Satrec Initiative appears at glance to be a growth stock with lowish PE. But note the recent high earnings are in most part due to a tax benefit and investment returns – not operating profits.

- The fastest growing public optical imagery company is Blacksky.

- None of these companies look that attractive. That is probably why Advent International passed all over and bought Maxar instead.

To be added later: SAR satellite company comparison