GOMspace (STO: GOMX) reported 2024 financials, raised new capital from its largest investor, and previewed 2025 1Q sales progress. In 2024 Q4 GOMspace posted record revenue and positive free cash flow for the third straight quarter. Order backlog also grew for the fourth consecutive quarter. And revenue-per-employee reached an all time high of SEK 1.8 million (~$180,000) suggesting GOMspace operational efficiency is better than ever. In March 2025 the stock surpassed SEK 9.00 per share, before retreating to current levels. All this is without GOMspace’s Indonesian contract closing!

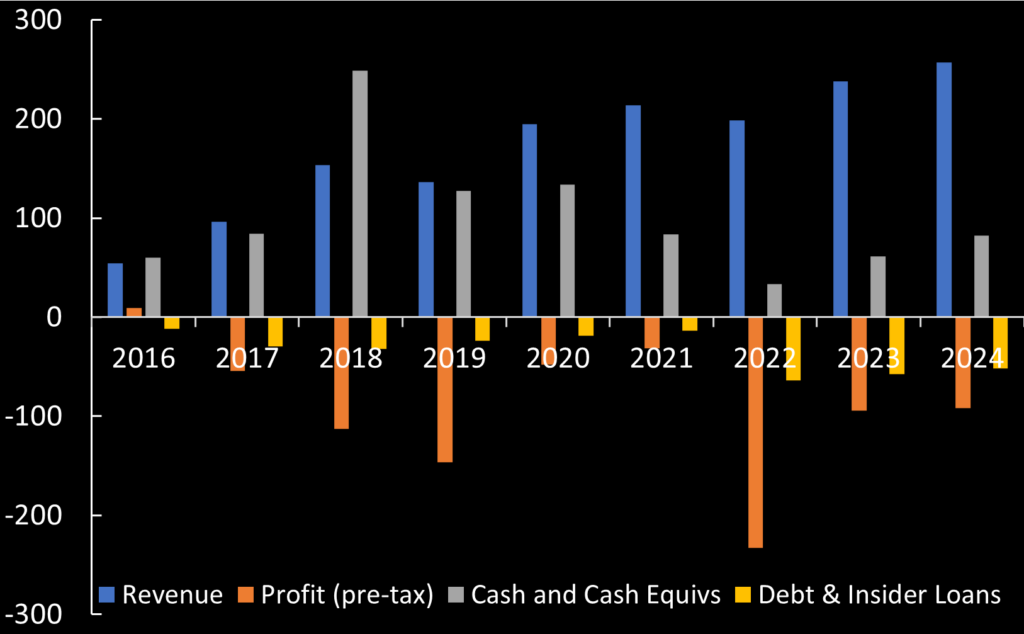

GOMspace operated 2024 at a loss (unlike profitable small sat cousin AAC Clyde), albeit slightly narrowing loss margin versus 2023. And a significant portion of GOMspace’s 2024 loss was not attributable to operations. GOMspace for the first time wrote down slow moving inventory and set aside expenses for a warranty reserve.

GOMspace now forecasts revenue SEK 320-380 million in 2025, with EBITDA margin between -10% and + 20%. This equates to 25% to 48% annual revenue growth. (GOMspace has averaged 9.6% revenue CAGR since 2021.) Gross margin was 29% in 2024. If GOMspace reaches the high end of its revenue forecast (SEK 380 million), maintains 29% margins and its overhead cost structure, the math does not suggest GOMspace will reach profitability in 2025. However under these same assumptions, one additional year of similar growth pushes GOMspace towards operational profitability in 2026.

Indonesia contract still a big unknown

CEO Carsten Drachmann, the best thing to happen to GOMspace, explained in a video interview that GOMspace’s 2025 revenue forecast assumes no revenue from the Indonesia deal. If Indonesia does close, GOMspace stands to receive €59m in revenue over the life of the contract. This equates to approximately 2.5 times 2024 annual revenue. However, 16 months since GOMspace announced the Indonesia deal and it still hasn’t closed. CEO Drachmann alluded to a scenario in which Indonesia does not close until December 2025. Such a delay would become concerning. If sufficient time passes, Indonesia may find it economically beneficial to rebid out the contract and shop for a lower price.

New SEK 196 million ($19.4m) investment from Peter Hargreaves

GOMspace’s largest investor Peter Hargreaves agreed to purchase 27 million newly issued shares at SEK 7.00 per share. GOMspace expects to receive SEK 196 million (~$19.4m) from this sale. Hargreaves first invested in GOMspace in 2022, buying approximately 10 million shares at SEK 9.81 per share. He again purchased (up to) 31 million more shares during the March 2023 rights issue at SEK 1.30 per share. That surely was a good investment now! The fact Hargreaves keeps investing, is likely only positive. In light of the 16.6% dilution from new share issuance, GOMX stock climbed as high as SEK 9.40 following the news. It retreated to SEK 6.34 where it trades at time of writing.

GOMspace’s odd mid-quarterly sales announcement

On March 26th GOMspace strangely announced sales to date totaled SEK 43.5 million across 22 orders. The unusual nature and underlying motive for GOMspace’s mid-quarterly sales announcement on March 26th are difficult to speculate on. Although five days short of a full quarter, the announced revenue lags GOMspace’s revenue posted for each of the past four quarters. And for GOMspace to meet the bottom end of its 2025 guidance, the company needs to post SEK 80 million in quarterly revenue. So GOMspace’s first quarter revenue appears to severely lag.