It seems close to over for Satellogic. Sad. The company presented a competitive satellite manufactured at significantly reduced cost, packaged with an extremely well-presentable and likable CEO. But sales and growth have both consistently lagged behind both Planet and Blacksky. Satellogic’s recently reported 1H 2024 revenue actually retreated 1% from the prior period.

Satellogic told investors in its 2023 annual report that 2024 revenue would largely be dependent on closing opportunities within the Space Systems segment. The numbers are now out and Space Systems revenue sadly dropped from $3.92M to $0.86M. Satellogic warned the Space Systems may be weighted to the second half of 2024. But still this steep drop is not what investors wanted to see.

How Satellogic got here is two-pronged. First, U.S. imagery providers sell to the NRO. But the NRO currently does not buy optical satellite imagery from foreign firms. (SAR imagery though is apparently OK.) Satellogic has tried to get in on this by relocating itself to the United States, but so far no dice. Second, and likely more significantly, Satellogic built its business plan on imagery sales – not data analytics. As recognized as far back as 2018, “customers want useful insights extracted from the data, not raw pixels.”

Instead Satellogic opted for the strategy of not offering customers what they want. CEO Emiliano Kargieman once said:

“We don’t expect to be the company doing the analytics on top of the data to deliver what the end customers want.” (Emiliano Kargieman, Satellogic CEO)

This doomed the company. Even two years ago Satellogic correctly recognized end customers want data analytics. But Satellogic opted not to deliver what customers wanted. Satellogic instead hoped third parties would jump in and provide. And through this decision, Satellogic lost control over its own destiny.

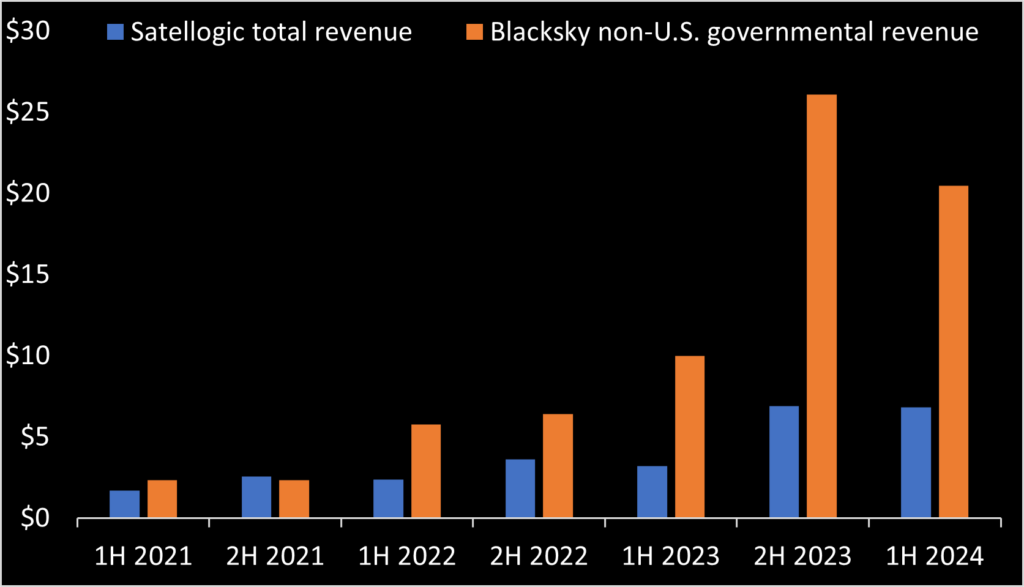

Comparison can be made with Blacksky. Both Satellogic and Blacksky operate satellites with similar specs and capabilities. And both do not compete offering 3U lower resolution satellites imagery. However Blacksky offers raw imagery and data analytics. Since Satellogic cannot compete for NRO revenue, a straight comparison with Blacksky is unfair. But subtracting Blacksky’s U.S. government revenue and then comparing with Satellogic allows contrast between both companies’ sales execution.

Satellogic and Blacksky’s non-U.S. government revenue started out even in 2021. But since 2H 2021, Blacksky grew its non-USG revenue from $2.35M to $20.5M. Satellogic during the same period grew from $2.54M to just $6.83M. There is your difference in sales execution.

Satellogic posted a -$33.6M net loss in 1H 2024. With just $25.6M cash available as of June 30th, at current burn rate, Satellogic will need money again likely before the year ends. Satellogic recognizes this. They warned shareholders in their August 2024 SEC filing.

We have evaluated whether there are any conditions and events, considered in the aggregate, that raise substantial doubt about our ability to continue as a going concern over the next twelve months through August 2025. Since inception, we have incurred significant operating losses and have an accumulated deficit of $317.1 million as of June 30, 2024, with net cash used in operating activities of $23.9 million for the six months ended June 30, 2024. As of June 30, 2024, our existing sources of liquidity included cash and cash equivalents of $25.6 million. We believe that this current level of cash and cash equivalents are not sufficient to fund operations and capital expenditures to reach larger scale revenue generation from our product offerings.

In order for us to proceed and reach larger scale revenue generation, we will need to raise additional funds through the issuance of additional equity, debt or both. Until such time that we can generate revenue sufficient to achieve profitability, we expect to finance our operations through equity or debt financings, which may not be available to us on the timing needed or on terms that we deem to be favorable. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interest of our stockholders may be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of holders of Ordinary Shares. (Satellogic 1H 2024 SEC filing, pg 8)

Its unclear how much longer Satellogic can tread water. The convertible notes sold to Tether in April are secured by substantially all Satellogic’s assets (including all of its intellectual property). It seems dilutive equity financing may be Satellogic’s last last way to raise money. It’s really sad. This company had so much potential with its cost competitive satellites they developed and manufactured in-house. All that seems wasted by comparatively poor business management and execution.