Satellogic (NASDAQ: SATL) updated their website with new investor slides dated November 18th. Does this signal that another convertible debt offering or other financing event is forthcoming? With Satellogic satellites literally dropping out of the sky, shareholders should potentially brace for an upcoming equity raise so Satellogic can afford to replenish it constellation.

As a foreign issuer, Satellogic does not file quarterly financials. According to their most recent semiannual report, on June 30th they held $25.6m in cash. But during the proceeding 6 months they lost $33.6m. At this rate, Satellogic should run out of money again by the end of this year. Their prior cash raise in April from Tether resulted in $30m convertible debt. However, “substantially all of” Satellogic’s assets (including its IP) secures this debt. Thus there does not seem much room left for Satellogic to raise additional capital through secured debt.

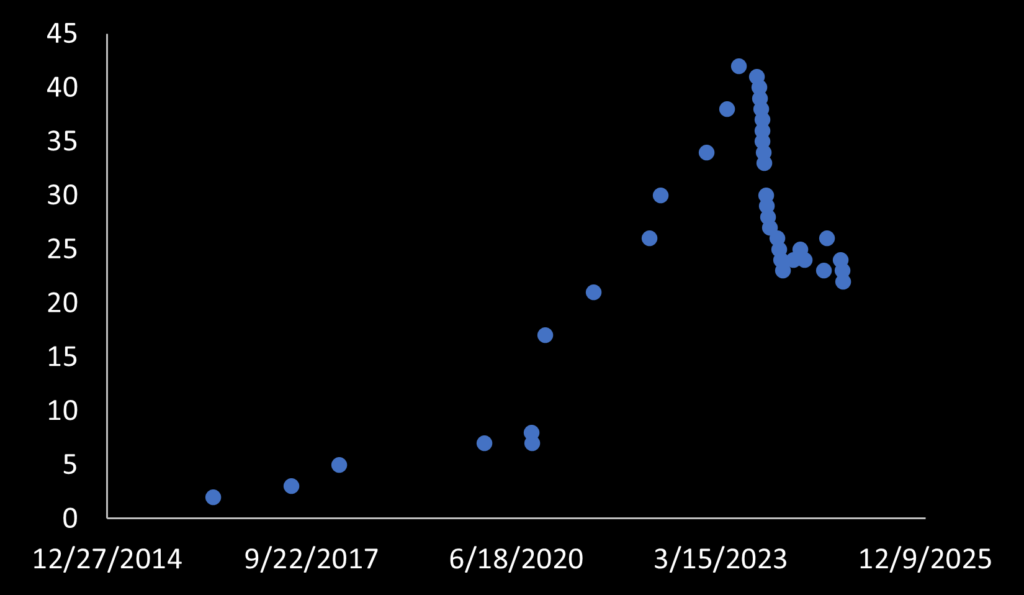

The investor slides present little new. Many are recycled from prior investor presentations. Satellogic includes no updated financials (or even past financials). And keeping with practice in place since end of 2022, Satellogic offers no financial guidance. The investor slides still reference Satellogic expanding it constellation… “While we grow our constellation of satellites …”. Satellogic’s constellation peaked at 42 satellites in June 2022. Four satellites decayed over the past month leaving Satellogic just 22 satellites. Without cash, Satellogic cannot grow its constellation. (And without customers, there is no business case for spending money to grow its constellation.)

Likely before year’s end Satellogic will need money. This year’s layoffs of roughly 40% of its workforce may have slowed the bleed. However, the last financing event from Tether was announced on April 15th when SATL stock closed at $1.45. Per the terms of Tether’s convertible loan, debt converts at a price of $1.20 share. Satellogic’s stock now trades under that – currently around $1.00 per share. Per Satellogic’s prior disclosure, “the conversion price of the Secured Convertible Notes will be adjusted in the event that the Company issues additional equity securities under certain issuances below the applicable conversion and/or exercise price.” Thus if Satellogic issues new shares under $1.20, Tether’s conversion price could ratchet downward creating a scenario in which conversion creates even greater dilution.