| Market Cap: $11.6M TTM revenue: $4.3M YOY return: -99.69% |

CEO: Carol Craig Cumulative pay: $373.9k Shareholder value created: -$134.9M |

Forecast effort: F Forecast accuracy: F |

|

Sidus Space hails from Craig Technologies Aerospace Solutions, LLC, named after founder and CEO, Carol Craig. Craig Technologies Aerospace Solutions changed names to Sidus Space a month before filing IPO paperwork with the SEC. During its IPO, Sidus warned investors its growth could place its business operations at risk. “We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy.” Investors only wish such risk was real. Instead this stock has presented investors a myriad of issues:

- Sidus recognizes material revenue from related-party transactions with the CEO’s other business concern.

- Sidus does not report segmented revenue, leaving investors guessing what amount comes from satellite operations, or even Sidus’s space business in general. Sidus formerly reported specific revenue sources, but unfortunately shifted to becoming less transparent about revenue.

- Sidus paid an investment firms to initiate analyst coverage and issue stock reports on its own stock (which, surprise, surprise, were repeatedly positive).

- Evidence suggests Sidus created SEC filings by copying-and-pasting text used by a biotech firm, without apparently even reading or re-editing for applicability.

Reoccurring losses, declining revenues, said dilutive financing, and nose diving stock prices have led investors still hanging on to rest hope Sidus’s satellite constellation. After over a year delay, Sidus launched its first satellite, Lizziesat, in March 2024. Opaque reporting and carefully-worded statements by Sidus management gives little assurance Lizziesat will be profitable. However if customer demand exists for the payloads launching on Lizziesats, a turnaround could happen. After closely examining the Lizziesat payloads, I am not holding my breath.

2 Minute Version

- Sidus Space calls itself a “space-as-a-service” company focused on commercial satellite design, manufacture, launch, and data collection. The main business pitch centers around generating revenue from selling payload space and data collected by Lizziesat satellites. However historically, Sidus revenue appears to source in large part from ocean technology and space hardware sales.

- Sidus Space does not provide investors financial guidance or projections. (🚩) Sidus stopped fielding questions from investors or research analysts at the end of quarterly earning calls. (🚩)

- Sidus Space has a complex web of related party transactions with Craig Technical Consulting, Inc. (CTC), an entity owned by Sidus CEO Carol Craig. These transactions include loans, revenue, a professional service agreement, and office space lease. The purpose and justification for these related-party transactions is often unclear. (🚩)

- Sidus burnt quickly through its IPO proceeds and investors have since experienced repeated dilutive financing events. For example, see here, here, and here. With no visible path to positive cash flow, more dilution looks nearly certain.

- Public information indicates Sidus Space has generated revenue from a vast range of endeavors, including supplying pallets for the HH60 Sea Hawk helicopter, providing design services for NOAA’s National Data Buoy Center, engaging in work categorized as “Machine Shops; Turned Product; and Screw, Nut, and Bolt Manufacturing” for NASA, and manufacturing components for Teledyne Marine, an underwater technology company.

- Although never stated publicly, its appears Craig Technologies Aerospace Solutions, LLC may have changed its name to Sidus Space in order to benefit from marketing itself as a space company. Craig Technologies, after nine years with the same name, changed to Sidus Space in August 2021. A month later Sidus filed paperwork with the SEC to go public. Apparently investors were initially excited about Sidus Space. The stock jumped 144% after its IPO. But ever since it has been on a long slide downward.

- Sidus Space certainty engages in some space-related business. But significant revenue also comes from work unrelated to space. How much revenue comes from where is not clear because Sidus Space does not provide investors with clear segmented reporting of revenue. (🚩)

Examining Financial Disclosures

Sidus Space raised $15 million from its December 2021 IPO. At the time, CEO Carol Craig controlled 94.2% of the voting power through CTC which owned all Class B common stock. But after Sidus burnt through its IPO proceeds, subsequent investment rounds diluted Craig’s ownership to 20%.

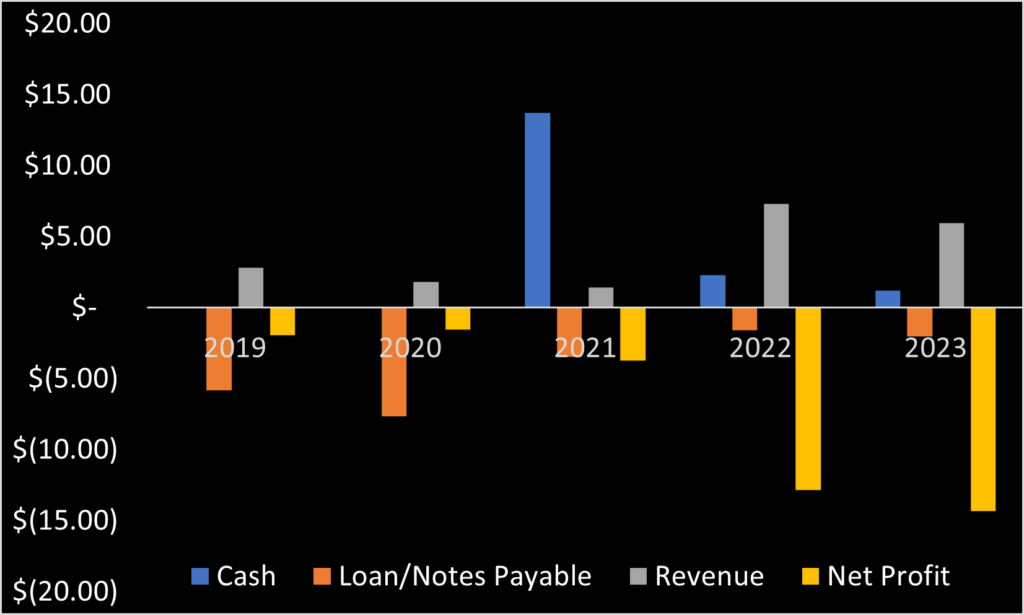

The $15 million IPO cash haul is visible in the above chart, on the books at the end of 2021. Sidus has since been treading water with repeated cash raises. Revenue peaked in 2022, and in 2023 net losses exceeded yearly revenue by 2x. 2024 has already seen two more financing events. More dilutive financing looks necessary unless Sidus increases revenue or cuts costs to reach positive cash flow. Cutting costs does not appear part of its plan: Sidus increased headcount from 37 full time employees in 2021 to 72 in 2023. Apparently Sidus is banking on either increasing revenue or engaging in dilutive financing as a regular business course.

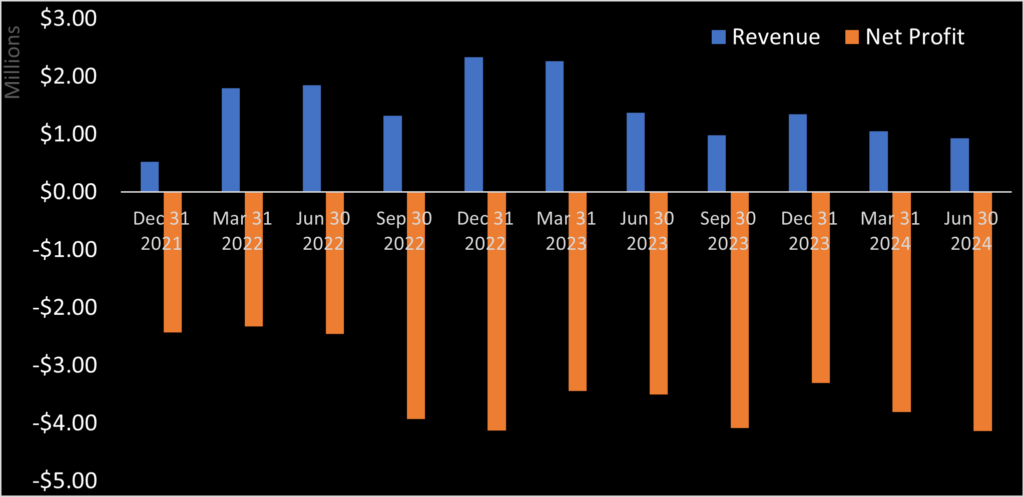

Quarterly revenue peaked in forth quarter 2022. Recently reported second quarter 2024 revenue is approximately 60% off this high. Since 3Q 2022, losses have averaged between $3 and $4 million a quarter. No surprise during this same period, Sidus Space stock has crashed about 98%. Don’t be the person who thinks a stock that has gone this much can’t keep going down more. This stock can.

Related party transactions

When examining Sidus Space SEC filings, you notice a lot of related party transactions. A material portion of revenue regularly comes from related party transactions. Sidus’s 2023 annual report describes these transactions as “contracts entered into by Craig Technical Consulting, Inc, a principal stockholder, and subcontracted to the Company.” CTC is owned by CEO Carol Craig. It is unclear why customers contract with CTC instead of directly with Sidus. What service, if any, CTC performs on these contracts is also unclear. Whether CTC fairly compensates Sidus is also something that should be asked, as Craig has a stronger financial interest in making CTC money than Sidus. Craig addressed this relationship in an interview, but failed to give any current details beyond there being a partnership between the two companies.

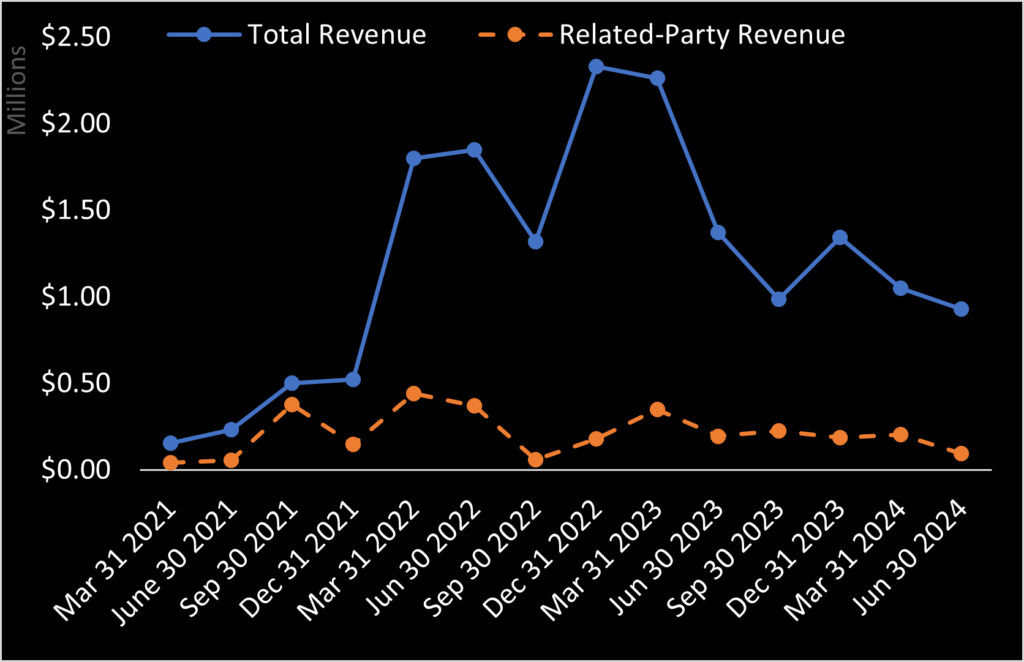

Related party revenue comprised over 40% of total revenue in 2021, the year Sidus went public that December. After going public, related party revenue curtailed but remains. 15% ($1.0 of $7.3 million) of 2022 revenue and 15% ($952k of $6.0 million) of 2023 revenue was related party.

On August 20, 2024 Sidus Space announced “Craig Technologies” subcontracted a $2 million project to Sidus to supply Fleet Interactive Display Equipment (FIDE) Pre-production Unit Main panels to Bechtel for a U.S. Navy program. Craig Technologies describes itself as founded and managed by Carol Craig. So it appears Sidus Space will continue posting more related party revenue sent from Carol Craig.

Revenue sources

Sidus Space recognizes revenue from a wide range business endeavors, some related to the space field and others not. In its S-1 filed with the SEC before going public, Sidus identified the sources of some revenue recognized during 2019 to 3Q 2021. Teledyne Marine was the second largest identified customer, accounting for 11% of revenue over this period. NASA, ISS, and lunar related revenue totaled 14%. Revenue from manufacturing for L3Harris’s Space Division accounted for 12%, and revenue from MTI Wireless 5%. Sidus did not identify the source of the other 57% of revenue during this period. But online databases identify during this period Sidus Space was paid for supplying HH60 pallets, which apparently may reference the HH60 Sea Hawk helicopter.

Post-IPO, Sidus Space stopped identifying major contributions to revenue in SEC filings. And Sidus also does not provide segmented reporting of revenue. Sidus’s press releases and CEO Craig’s public statements make clear Sidus operates in multiple segments, including: 1. Space manufacturing, 2. oceanic and U.S. Navy-related projects, and 3. satellites. Sidus Space’s presents Lizziesat as “a catalyst to the execution of Sidus Space’s high-margin revenue Data-as-a-Service offering.” But since Sidus does not provide segmented revenue reporting, investors cannot know what portion of revenue is from Lizziesat and if these revenues are growing.

Lizziesat constellation

CEO Carol Craig publicly positions Lizziesat as a “vital element” of Sidus Space’s strategy. Sidus has represented launch of satellites Lizziesat-1 as well as Lizziesats-2 and -3 may lead to “high-margin revenue.” Sidus Space almost certainly has internal revenue plans or targets for each satellite, but they share no such numbers publicly with investors.

The nearest thing Sidus has provided investors are the following statements:

To put it in perspective, each of our satellites are capable of downloading a minimum of 100,000 megabytes of data back to earth each day. This translates in our ability to theoretically generate $14 million in revenue per year per satellite, assuming we sell 100% of this data a single time. Interestingly, we may be able to sell this data multiple times. As you can imagine, this business model has the capacity to scale rapidly and generate meaningful cash flow as we develop a steady cadence of LizzieSats going into orbit. (Bill White, CFO, 2023 Q4 earnings call)

Our LizzieSat satellite with its five year design life is expected to provide a return on investment within months of launch. At a cost of $1.75 million to $2 million per satellite, including sensors, along with our low and fixed overhead, single satellite profitability can be achieved with only a fraction of available data being sold. We believe, however, that there is

a demand for all available data and at full capacity the data collected from each satellite is expected to provide a

5 times revenue return on the cost of the satellite within one year. (Carol Craig, CEO, 2023 Q2 earnings call)

If this is true and Lizziesat-1, 2, and 3 each generate five-times cost in revenue ($8.75-$10 million) within a year of launch, Sidus is on verge to record about $7M in Lizziesat revenue in 2024 and $26-30M in 2025 (based on Lizziesat-2 and 3 both launching in late 2024). This revenue would be in addition to space manufacturing and oceanic revenue and would almost certainly push Sidus to profitability in 2025. Sidus could afford setting funds aside to manufacture five more Lizziesats and still likely be profitable. Management’s statements taken at face value may provide bullishness about Sidus Space’s future build upon Lizziesat.

But just a minute. Before buying into Lizziesat offering “5 times revenue return […] within one year,” let’s see what we can learn about them ourselves.

Lizziesat-1

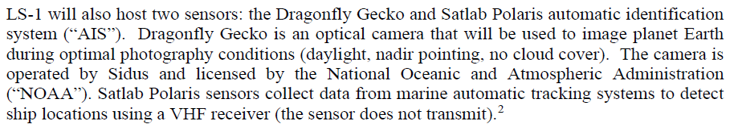

A FCC license is required before a U.S. satellite operator may send or receive radiocommunications with a non-government satellite. In a June 8, 2023 regulatory application filed with the FCC, Sidus Space described Lizziesat-1 and its payloads. Sidus therein disclosed Lizziesat-1 carries two sensors: (1) a Dragonfly Gecko optical camera and (2) a Satlab Polaris AIS receiver.

Dragonfly Gecko – Sidus’s 2023 Q3 quarterly report on page 25 collaborated Lizziesat-1 launches with the Dragonfly Gecko optical camera. This camera offers 39 meter resolution at 500km orbit. The camera is the lowest spec camera in Dragonfly’s lineup. 39m satellite imagery in 2024? The Corona program satellites from the late 1950s and 60s all offered better resolution. What is Sidus Space planning to do with this camera? Blacksky, Planet, and Satellogic all have constellations offering <1 meter resolution. Satellogic even offers up to 50cm resolution tasking for $8/km. Sidus launching Lizziesat-1 with a 39 meter resolution camera suggests they are not serious about selling earth imagery. So don’t hold your breath anticipating Lizziesat-1 to provide $14 million in yearly revenue, as Sidus management claimed may be “theoretically” possible.

Satlab Polaris – Satlab Polaris is a receiver built for intercepting AIS messages sent from shipping vessels. Government customers pay for such data which catalogs the locations and movement of vessels, as well as distress calls an other information. Sidus announced plans to monetize AIS data in March 2023 when CEO Carol Craig stated, “we believe this data will be attractive to prospective customers.” The satellite maritime surveillance field already has multiple large contenders.

- Spire, through acquiring ExactEarth, claims the largest AIS satellite constellation and highest message volume tracked by satellite. ExactEarth hosts 58 AIS sensing payloads on Iridium Next satellites allowing real-time vessel AIS data relay from anywhere on earth. ExactEarth boasts average revisit and latency rates less than a minute.

- French satellite operator Unseenlabs operates a constellation of 11 AIS-receiving satellites, recently raised $92M, and plans to launch 10 more satellites. Unseenlabs also uniquely detects radio frequencies emitted by electronic systems onboard vessels enabling detection of ships illegally sailing without AIS transmission activated to evade surveillance.

- Further proof profitable sales in space maritime surveillance are not guaranteed, Kleos Space recently filed bankruptcy after launching 16 AIS satellites.

- Airbus and Orbcomm (which contracted to buy AIS data from AAC Clyde) also are long established in the maritime surveillance field.

With high dollar Dragonfly Gecko image sales looking impossible, Satlab Polaris remain Lizziesat-1’s best potential revenue-generating sensor. In a way, it appears Sidus launched an 100 kg satellite to generate revenue from a 185 gram payload. But even the prospect of Lizziesat-1 generating large revenues from Polaris seems doubtful.

- Lizziesat-1 launched on Transporter-10 which deployed satellites into SSO orbits between 520 and 600 km. Satellites in 560 km sun synchronous orbits have revisit times of about 40 days. In other words, Lizziesat-1 takes about 40 days to provide global coverage. Spire benefiting from more sensors at higher orbits offers full global coverage with revisit times averaging under 1 minute. Even Unseenlabs offers revisit times of 4-6 hours.

- After Lizziesat collects AIS data, the data is stored onboard and transmitted to earth after Lizziesat passes over a ground station. This can add 30 minutes to an hour latency between collection and data transmission to customer. Thanks to hosting on Iridium Next with intersatellite links, Spire’s average AIS latency is less than a minute. This means Spire customers can acquire AIS data from any ship in the world in under one minute. How many customers are in the market for AIS data with 40 day revisit schedules? Sidus investors will find out.

- For customers seeking to track “dark ships” sailing without AIS transmitters, Unseenlabs developed technology to tracks ships by their unique RF signatures. Lizziesat cannot detect dark ships and only tracks ships with AIS turned on.

Lizziesat-2 and 3

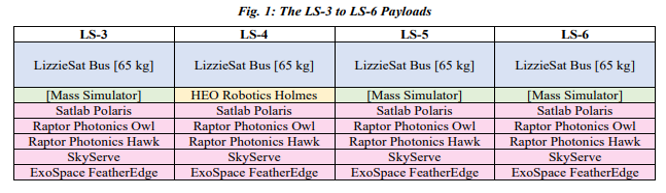

This is a little confusing: Lizziesat-2 and 3 and actually Lizziesat-3 and 4 from Sidus’ June 13, 2023 FCC application. In a May 6, 2024 letter to the FCC, Sidus explained Lizziesat-3 and 4 were being renumbered as Lizziesat-2 and 3. Sidus also informed the FCC both Lizziesat-2 and 3 would launch with HEO Robotics Holmes cameras. Sidus announced the same to investors in April 2024. So Lizziesat-2 and 3 are to launch with the payloads listed for Lizziesat-4 from Sidus’s June 13, 2023 FCC application.

So Sidus’s plan for Lizziesat is becoming a little clearer. Sidus is retaining Satlab Polaris AIS sensors but diched the Dragonfly Gecko. Along with the HEO Robotics Holmes camera, Lizziesat-2 and 3 will each launch with Raptor Photonics Owl 1280 and Hawk 1920 cameras. (As listed in the FCC application above, SkyServe is computing software and ExoSpace FeatherEdge is an image processing device. Neither of these are sensors.)

HEO Robotics takes imagery of other satellites and space debris which it sells to governments and defense agencies. Notably HEO Robotics announced it photographed the Resurs-P1 satellite and detected anomalies before it apparently exploded. HEO also captured photos of the ERS-2 satellite before it reentered earth’s atmosphere. HEO Robotics is apparently paying Sidus to host one of its Holmes cameras on Lizziesat-2. And after the successful launch of Lizziesat-1, HEO contracted with Sidus to host another Holmes camera on Lizziesat-3. These cameras should certainly generate revenue for Sidus. HEO Robotics is an established customer and its contract with Sidus reportedly includes a monthly data service.

Sidus replaces the Dragonfly Gecko on Lizziesat-1 with the Raptor Photonics Owl and Hawk cameras, each installed on both Lizziesat-2 and 3. Sidus Space in a press release described these cameras as “industry leading hyperspectral and multispectral imaging.”

Raptor Photonics Owl 1280 – The Owl 1280 is a visible and short wave infrared (SWIR) sensor, offering Lizziesat sub-5m ground sampling distance. There are fewer SWIR satellite imagery providers than optical. But Maxar’s Worldview-3 offers 3.7 SWIR resolution combined with 30 cm optical resolution. Planet Lab launched Tanager in August 2024 which also offers commercial SWIR imagery. And Blacksky’s Gen-3 satellites reportedly will launch with SWIR imagery capability and ISLs enabling real-time image acquisition. Lizziesat’s Owl 1280 appears based on a 1280 x 1024 InGaAs sensor from SCD. This 1280 x 1024 pixel sensor equates to 1.31 megapixel sized images. Sony offers 5.23 megapixel SWIR sensors, and NIT offers 2.07 megapixel.

GHGsat launched in 2016 with a 0.33 MP SWIR sensor. So the SWIR cameras launching on Lizziesats-2 and 3 appear based on middle/lower-middle of the line SWIR sensors. This does not appear to be “industry leading” technology.

Raptor Photonics Hawk 1920 – The Hawk 1920 is a CMOS night vision camera incorporating the Sony 1944 x 1472, 4.5μm Pregius sensor. This 1944 x 1472 pixel equates to 2.86 megapixels. Sony’s highest rated CMOS sensors offer up to 247 megapixel resolution. So again Sidus appears to be launching Lizziesats-2 and 3 with night vision cameras using middle/lower-middle line CMOS sensors. Even Lizziesat’s camera provider Raptor Photonics sells a CMOS night vision camera (Hawk 4096) based on a Sony 12.3 MP Pregius sensor. For reasons likely known to CEO Carol Craig, Sidus picked a lower spec camera from Raptor Photonics for Lizziesat.

Estimating revenue from the first three Lizziesats

Carol Craig on Sidus Space’s 1Q 2023 earnings call told investors:

To provide some economic parameters, each of our satellites is expected to transmit at a minimum 100,000 megabytes of data per day. As a data point, depending on the sensor 100 megabytes of data can be equated to a single advanced image. We believe that the cost of high value imagery ranges from $12 to $24. (Carol Craig, CEO, 2023 Q1 earnings call)

Whereas this statement may per say be truthful, a naïve investor is at risk of being misled. The numbers Carol Craig presents suggests one Lizziesat is capable of transmitting 1,000 advanced 100MB images daily, each with a market value of $12-$24. This equates to $4.38-$8.76 million in potential yearly revenue, per satellite. The reason this statement potentially is misleading is Lizziesats-1, 2, and 3 do not appear equipped with cameras capable of taking advanced images. Lizziesat-1’s 39 meter resolution, bottom-of-the-line Dragonfly Gecko images don’t produce “high value” imagery. Competitors currently offer images with 100x (!) better resolution. And the sensors comprising the Owl 1280 and Hawk 1920 cameras on Lizziesat-2 and 3 are not leading edge.

Predicting the revenue Sidus Space will book from the first three Lizziesats is important for estimate Sidus stock value. It is safe to assume Dragonfly Gecko imagery sales will be immaterial. Data collected by the Polaris AIS receivers, if sellable, will likely sell discounted to Spire’s pricing since Lizziesat cannot offer customers data in real-time. And longer revisit times suggest Sidus unlikely can sell its AIS data directly to end-users. Sidus’s best chance for AIS data sales may be firms like Orbcomm who can purchase and aggregate data from multiple sources before reselling to customers. This leaves the Raptor Photonics Owl 1280 and Hawk 1920 cameras. The Owl 1280 might actually offer competitive, sellable SWIR imagery. As is well-documented, many satellites equipped with SWIR sensors are used to detect greenhouse gas emissions. How much revenue Sidus generates from its Owl cameras remains to be seen. But the Hawk 1920 CMOS night vision camera seems less promising. Governments and defense ministries certainly have market interest for imagery acquired at night. But radar satellites can supply imager at night, but with 10x better resolution than that from Sidus’s Hawk 1920 camera.

Tying this back to Carol Craig’s 1Q 2023 earnings call statement, none of Sidus’s sensors appear capable of generating 100 MB advanced images. The HEO Robotics Holmes hosted payloads likely will provide the most revenue. The Gecko optical camera, Raptor hyperspectral and multispectral cameras, and Satlab AIS sensors, all installed on a satellite without ISLs, provide slim chance either of these first three Lizziesats will generate $4.38-$8.76 million, $8.75-$10M, or $14 million in yearly revenue (all numbers Sidus management have suggested to date). Based on the payloads, I expect Lizziesat-1 to generate <$1M in yearly revenue and the other two satellite each <$2M.

Sidus Space buys analyst coverage, plays charades on earnings call

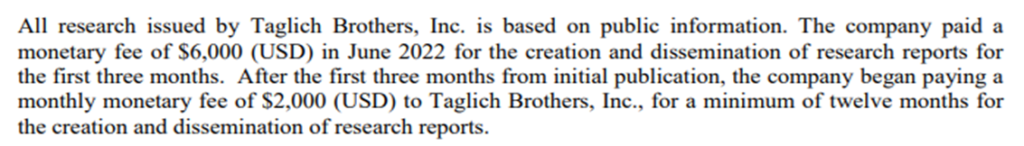

Sidus paid a company called Taglich Brothers $24,000 a year to write research reports about Sidus Space’s stock. Taglich Brothers then published repeated reports featuring positive ratings on Sidus stock. This continued while Sidus stock dropped in value. Taglich Brothers’ initial report dated August 17, 2022 when SIDU traded at $3.42 rated SIDU a “Speculative Buy” with a $7.50 price target (+119% upside). A year later, on August 21, 2023 when SIDU traded at $0.15, Taglich Brothers maintained a “Speculative Buy” rating and offered a $0.65 price target (+333%). Taglich Brothers disclosed:

Sidus’s plan to engage analysts to write about Sidus stock began at least as early May 2022. In an interview then, Carol Craig stated Sidus has discussions with an “analyst” to gain more exposure for Sidus. Although not named in the interview, this likely refers to Taglich Borthers. Nowhere did Carol Craig state in the interview Sidus was planning to pay for analyst coverage of its own stock.

On Sidus’s 2023 first quarter earnings call, CEO Carol Craig took questions from Howard Halpern, Equity Analyst at Taglich Brothers. All softball questions, as you might expect. But take that in: Sidus Space raised money from investors, paid a firm to write analyst reports about its own stock, and then took questions from the firm on an earnings call. All while Carol Craig failed to mention to investors on the call that she was paying Taglich Brothers. This may not be illegal, but it seems shady.

Who at Sidus thought it was a good idea to use company money to buy analyst coverage? Whereas Taglich Brothers may very well write unbiased and independent reports, these optics are horrible. It looks like Sidus is using money to pay for positive reviews to prop up its own stock price. This alone causes me to exercise extreme caution. (🚩)

Laziness: Sidus Space SEC filing language is word-for-word copy-and-paste the same from biotech firm’s

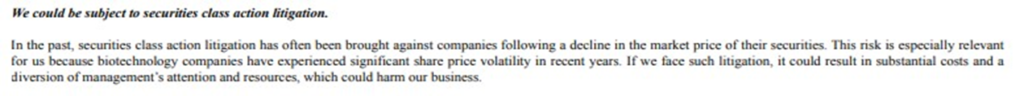

If you read Sidus’s 2023 Annual Report closely, you will find the following peculiar paragraph on page 35:

Why biotechnology companies experiencing share price volatility is “especially relevant” to Sidus Space? Wouldn’t “space companies” experiencing share price volatility be more relevant? A little research shows the answer. Sidus apparently copied it from page 55 of a prospectus Nkarta, Inc. filed with the SEC one year before Sidus went public. And Sidus used this language in its IPO filing, not correcting it for years.

I have no issue with borrowing ideas from others’ filings in order to provide a fulsome disclosure of risks to investors. This should be applauded and there is no reason to reinvent the wheel. But to copy full wholesale without editing for applicability to your own company? That is lazy. And it very well may be indicative of the level of seriousness management takes in its responsibility to file reports intended for investors. (🚩)

Management guidance scorecard

Sidus did not provide a financial model to investors prior to going public. In one sense, you cannot miss your targets if you don’t have any. Sidus Space’s position on offering investors revenue and earnings guidance can be seen from the following question and answer exchange on a recent earnings call:

“And last question is, can you provide any visibility into future revenues and earnings growth expectations?”

“We’re an emerging growth company, and we currently don’t provide guidance.” (Bill White, CFO, 2023 Q4 earnings call)

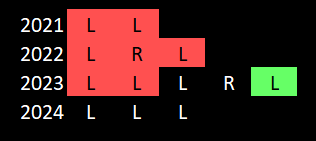

However, Sidus has provided some projections, mostly concerning anticipated launch dates of Lizziesat satellites. Nearly all have been wrong as Lizziesat-1 was delayed over a year. CEO Carol Craig has also provided two identified revenue-related projections. The first in May 2022 when Craig stated she expected Sidus to have significant year of year growth for the foreseeable future. This turned out to be incorrect. The second statement was when Craig said in August 2023 that Lizziesat is expected to provide a return on investment within months of launch. This remains to be seen if true.

Sidus originally projected Lizziesat-1 launching in 4Q 2022. It launched in 1Q 2024. In June 2023, CEO Carol Craig stated Sidus was contracted to launch 9 satellites over the next 18-24 months. We will wait until June 2025 to see if Sidus hits that number. So far, Sidus does not look on track. And this year, Sidus said Lizziesat-1 and 2 are scheduled for 4Q 2024 launch.

Particularly concerning to investors, Sidus management appear pro at dodging financial questions. As seen above, CFO Bill White comfortably sidestepped question of future revenue. CEO Carol Craig has done the same when asked about Sidus reaching positive cash flow. Dodging questions about positive cashflow suggests either Sidus has no plan for this or Craig does not understand accounting well enough to address such questions. And on the very next question in this interview, Craig dodged another question about future Sidus revenue. Sidus almost certainly has its own internal revenue and cash flow projections. Failing to answer these questions or provide related guidance suggests Sidus management expects the public’s reaction to the real numbers would not be positive. (🚩)

CEO compensation and performance

CEO Carol Craig has been active in media appearances. Before Sidus went public, Craig appeared on Fox Business News discussing her company’s ability to mount guns on areal drones. Good Morning America also featured Craig in an inspiring feature about Trailblazing Women. But when one hears Carol Craig presenting her business plan for Sidus Space, it is not that inspiring. An outsider spending just 45 minutes reading Sidus’s public information could present Sidus Space’s business case better than Craig. Instead of shady market analysts, Sidus’s money would have been better spent on engaging in executive communication coaching.

Carol Craig initially waved compensation after Sidus Space went public. She had a change of heart and on September 15, 2021 began accepting compensation, receiving $31,519. Her pay was a modest $125,000 in 2023. This apparently increased in 2023, during which she received salary of $217,425.

Sidus Space outlook and risk assessment

Sidus Space has so many red flags and until management becomes more transparent with investors, should be judged as extremely risky.

- Lizziesat-1 looks like a bust with that Gecko camera. No chance it makes $8.75-$10 million within a year of launch as some may be hoping.

- Sidus’s net losses are 2x greater than revenue. More dilutive financing or debt (if anyone will loan them money) appear forthcoming.

- Sidus Space provides the investing public no formal top or bottom line guidance. This suggests Sidus management knows their internal numbers, if publicized, would not go over well.

- Sidus stopped taking questions for investors during earnings calls. More evidence suggesting they are trying to hide something.

- Sidus does not provide segmented revenue reporting. Before Sidus identified its major revenue sources by name. They have since walked backwards. Investors are at a loss knowing what revenue comes from space manufacturing, oceanic endeavors, or Lizziesat. For those wanting to know if Lizziesat will save the company, Sidus makes this impossible to know with its current reporting.

- Based on what I see, I would never buy this stock. And I would not let my mom buy it either. But the successful launch of Lizziesat-1 should not be understated. Others with more money have failed their first launch. Sidus could potentially snowball a successful launch into more hosted payloads from paying customers. I will be watching for this in the future.

Although academic researchers note an 83% survival chance, Russian roulette is extremely dangerous. I would never do it.

What to look from Sidus Space going forward

With Sidus Space, the primary thing investors should seek from management is transparency. Shareholders wanting Sidus Space stock to increase in value should be looking for:

- Sidus issuing top and bottom line guidance to investors.

- Sidus providing segmented revenue reporting so investors can clearly see whether Lizziesat revenue is material and growing.

- A more fulsome description of related-party transactions and explanation satisfactorily explaining why revenue flows through Craig Technologies instead of directly from the customer.

- Do any new customers sign up to host payloads on Lizziesat after its first successful launch?

- Any indication that Sidus can progress towards positive cashflow and avoid the current pattern of repeated dilutive financing events which will continue to kill the stock price.

Recent News

-

Sidus Space issues more stock when stock pops 290%, stock then re-falls

On no news but a lot of activity on Stocktwits, Sidus Space (NASDAQ: SIDU) was up 290% over just two days in December. Perhaps equally…

-

CEO Luis Gomes rediscusses AAC Clyde’s plan for 2025

AAC Clyde (STO: AAC) CEO Luis Gomes again addressed investors driving sustainable profitable growth as the core company focus. Since the dilutive rights issue, Gomes…

-

AAC Clyde Space CEO Luis Gomes: 2025 goal is profitable growth

AAC Clyde Space (STO: AAC) CEO Luis Gomes deserves more praise for delivering frank and timely shareholder presentations. After Q2 when supply chain delays from…

-

Sidus Space’s third share offering of 2024 sends its stock down 47%

Sidus Space (NASDAQ: SIDU) received a Notice of Effectiveness from the SEC on November 12th and the same day issued a Prospectus concerning sale of…

-

Sidus Space releases new investor presentation

Likely connected with the pending public offering, Sidus Space (NASDAQ: SIDU) posted a new investor presentation. Three things immediately stand out: Sidus’s new larger satellite…

-

Could Sidus Space dish up an 3Q earnings surprise?

Sidus Space (NASDAQ: SIDU) ended the second quarter of 2024 with just $1.44m in cash. Over the first two quarters of 2024, quarterly operating and…