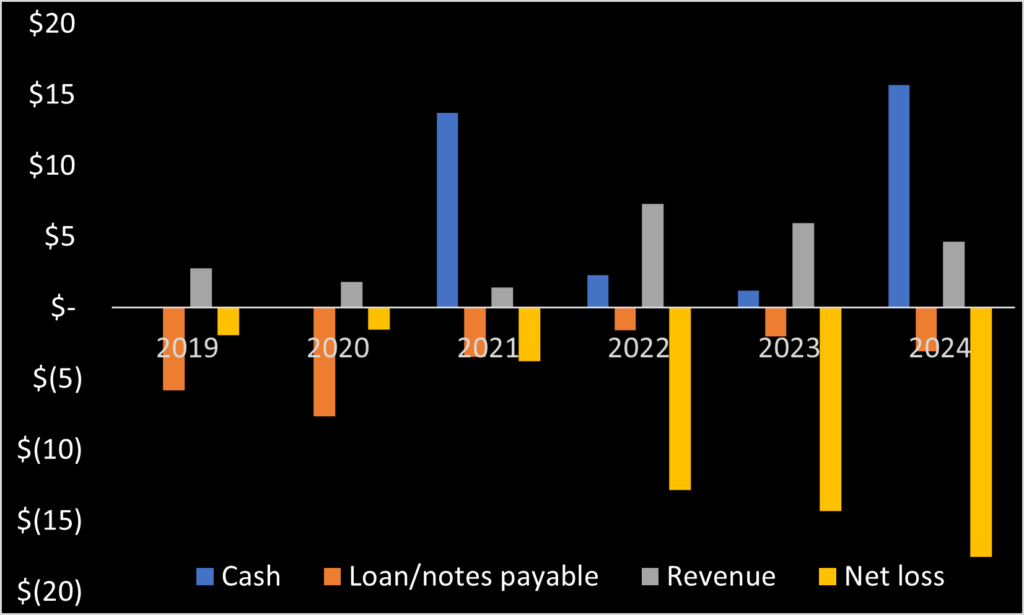

Sidus Space (NASDAQ: SIDU) finished 2024 with two Lizziesat satellites in orbit (Lizziesat-3 launched in March 2025). Sidus management pitched investors these Lizziesats as source of potential significant revenue. However, this has not materialized. 2024 revenue dropped from 2023, a year in which Sidus Space had no satellites in orbit. Sidus posted a net loss of $17.5 million, all time high. The decline in revenue continued for a second straight year: $7.3 million (2022) to $6.0 million (2023) to $4.7 million (2024). On a positive note, Sidus ended 2023 with its highest ever cash on hand. $15.7 million in the bank courtesy of dilutive stock sales. This appears to be nearly sufficient to fund Sidus through the end of 2025. (Sidus spent $15.8 million on operating costs in 2024.)

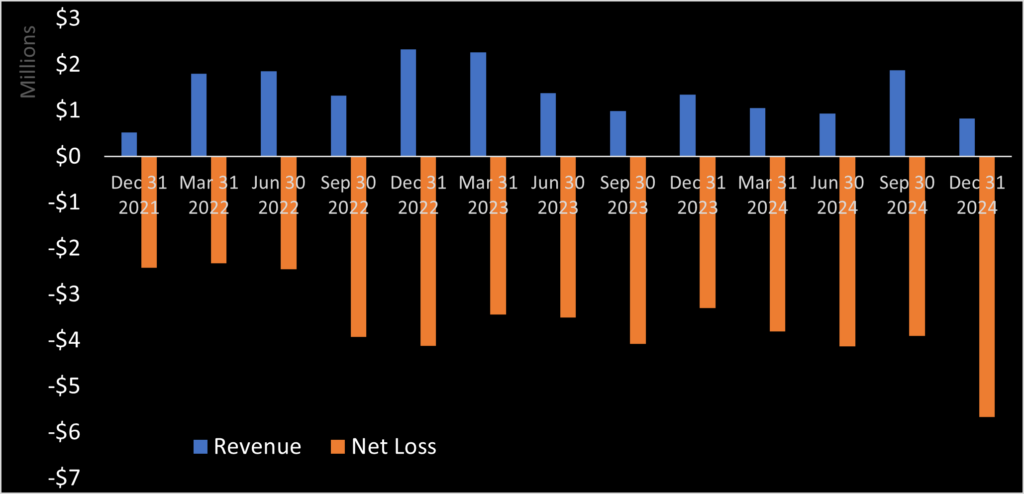

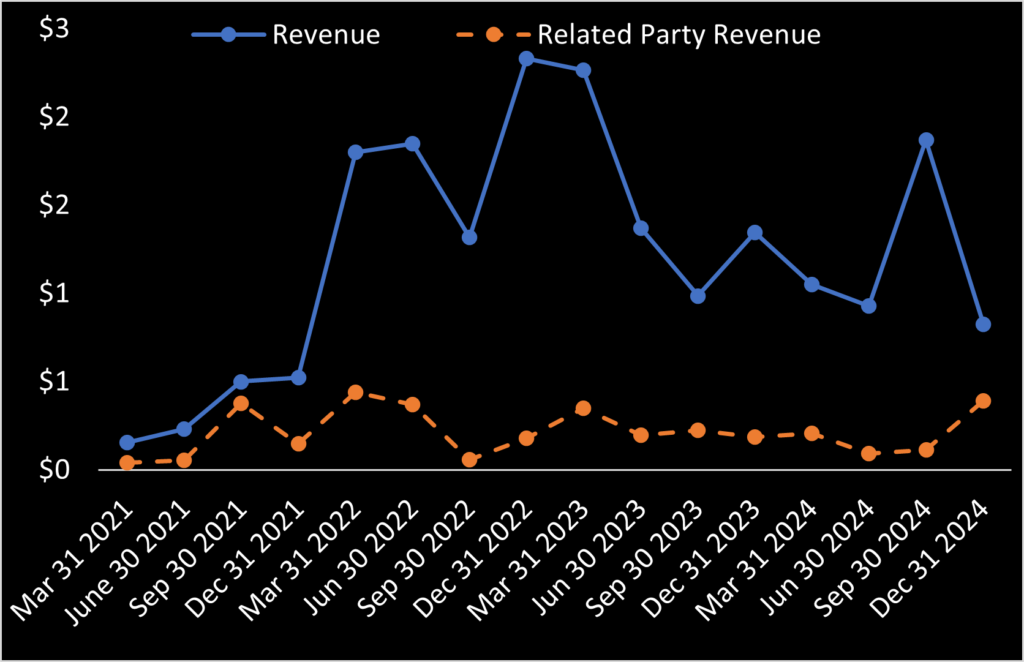

Fourth quarter financial performance was particularly grim. Quarterly revenue dropped to $826,000, the lowest in three years. Quarterly net loss totaled $5.7 million, the highest on record. The increased fourth-quarter loss may be partially attributable to costs associated with the launch of Lizziesat-2 (launched December 21, 2024). However, the data strongly suggests Lizziesat-1 is not generating significant revenue. At least not to the level of $3.65 million per quarter that Sidus management once advertised.

Also concerning, related party revenue spiked in the fourth quarter. 47% was for work Craig Technical Consulting, Inc, a company controlled by CEO Carol Craig, subcontracted to Sidus Space. This leaves $437,000 in non-related party revenue in 4Q 2024. Sidus Space does not provide segmented revenue reporting, thus Lizziesat revenue is unknown. Even if all $437,000 of the non-related party revenue in Q4 2024 is attributed to Lizziesat-1, this is approximately eight times lower than the $3.65 million per quarter Sidus Space previously represented.

CEO Carol Craig’s salary reached all-time high in 2024. Total cash compensation, including bonuses, totalled $559,000. This is more than twice what she earned in 2023. Carol Craig once waived salary from Sidus Space. Now, with cash coming in from investors buying newly issued stock, plenty of extra money apparently is available to pay raises and bonuses to CEO Craig.

Sidus Space stock is down over 99% since its IPO and down 70% year-to-date. It trades just above its all-time low reached in November 2024.