Likely connected with the pending public offering, Sidus Space (NASDAQ: SIDU) posted a new investor presentation. Three things immediately stand out: Sidus’s new larger satellite bus (Lizziesat-XL), Lizziesat mission payload manifest, and revenue guidance.

Sidus lists three satellite platforms on slide 6: Lizziesat, Lizziesat-XL, and Lunar-Lizzie. Lizziesat-1, 2, and 3 are based on the regular Lizziesat bus. Lizziesat-4 (and onward?) will use Lizziesat-XL. Sidus provides no additional information about the increased size or additional payload capacity of Lizziesat-XL vs Lizziesat. But Sidus does state Lizziesat-XL will offer improved comms. And this also appears to be the the introduction of Lunar-Lizzie. Again Sidus here provides no further details on whether they plan Lunar orbiting satellites or something else. (Intuitive Machines, ispace, and Lockheed Martin subsidiary Crescent Space Services all plan to put commercial satellites around the moon).

Sidus lists the payloads manifested on the first five Lizziesats on page 11. This list can be contrasted with Sidus Space’s FCC application describing the same.

- Sidus Space represented in its June 8, 2023 FCC application that Lizziesat-1 hosted two sensors, Dragonfly Gecko and Satlab Polaris. However the latest investor presentation includes two more sensors not found in the FCC filings: “Multi-spectral Ag” and “Multi-spectral Methane.” Ag appears to refer to agriculture, not silver. Public details about these other two sensors on Lizziesat-1 are hard to come by.

- Sidus also represented in a June 13, 2023 FCC application that Lizziesat-2 and 3 each hosted HEO imagers, Satlab Polaris, and Raptor Photonics Owl and Hawk sensors. In the investor presentation, Sidus lists “AIS sensor,” “<10m Visual spectrum sensor,” “Multi-spectral Methane,” and “HEO Holmes Imager.” So for these two satellites there seems to be no discrepancy. (This assumes the Raptor Photonics Hawk corresponds to the “visual spectrum sensor” and the Owl to the “Multi-spectral Methane” sensor.)

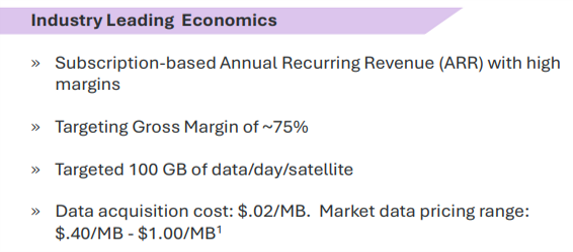

Sidus Space provides investors with the “economics” of their Lizziesat product. They claim targeting 100 GB of data per day per satellite and state the market rate for this data is $0.40 – $1.00 per MB. They don’t do the math but likely want us to. This equates to $14.6m in revenue per satellite per year on the low end. (And $36.5m on the high end.) If Sidus can reach even its low end target, investors should expect $3.65 in quarterly revenue from each satellite. If Sidus hits this number with Lizziesat-1 (or 2 or 3), Shareholders would likely get rich from soaring Sidus stock prices.

However, you may want to exhibit caution before believing Sidus Space’s representations.

So should investors expect the first three Lizziesats to each generate $14.6m in revenue, in line with what Sidus apparently is representing? For Lizziesat-1, Sidus stated satellite commissioning completed on May 14th and that it was “operating effectively as a fully functional satellite“. Lizziesat-1 first full quarter of operation was thus 3Q 2024. Sidus averaged about $1m in revenue over Q1 and Q2. Should shareholders expect Sidus Space to post $4.65m ($1 + $3.65) in revenue for Q3? Highly doubtful.

For one, the Gecko camera is cheap and does not offer commercially competitive resolution. Blacksky Gen-2 and Planet’s SkySat each are not even top of the line but still provide 10x better resolution than Lizziesat. Any sales of images taken from the Gecko camera on Lizziesat-1 should not be material. And AIS data sales from Satlab Polaris are likely south of $500,000 yearly. This equates to approximately $100,000 per quarter likely as a top estimate. This leaves the “Multi-spectral Ag” and “Multi-spectral Methane” sensors for which little is known. The Methane sensor may be the same as the Methane sensor in Lizziesat-2 which appears to be the Raptor Photonics Owl. This sensor is far from top-of-the-line. Planet Labs Tanager offers a much more sensitive and competitive methane detection option. Until Sidus Space releases examples imagery from its Methane sensor demonstrating its high resolution and low noise sensitivity, good reason exists for skepticism.

From what is known, investors should be skeptical that Lizziesat-1 will generate enough revenue to even cover its own cost.